Michal Kratochvil: Budgetbakers CEO Talks Profitability and Pivots

Michal Kratochvil is a StartupYard investor, former head of Accenture Consulting for Central Europe, and currently the CEO of StartupYard Alum and popular personal finance management platform BudgetBakers (SY Batch 5), a role he took up in 2016.

BudgetBakers informed investors this month that they are now cash flow positive and, in fact, that monthly revenues had nearly doubled in just a few months, after 2 years of mostly steady growth. This news came just months after BudgetBakers nearly halved the size of its team, and pivoted to focus developing some the flagship app’s core features (like integrations with banks).

I sat down with Michal to talk about the last 6 months at the company, and what he’s learned from the ups and downs of running a tech startup for over 2 years. Here is what he had to say:

Hi Michal, so you’ve been with BudgetBakers for over 2 years now. What were the surprises? If you could go back to the beginning, what would you do differently?

Michal Kratochvil, CEO at BudgetBakers since 2016

I should say I did everything perfectly, and everything went according to our brilliant plan, right? :laughs: Ok, there are always going to be things you would want to change because you know the outcome, but this is cheating. If you’re asking how I would have changed our general approach, there are a few things I would do differently. I would try and make some of the “surprises” less surprising.

How would you do that?

Let’s be concrete. When I joined BudgetBakers, Founder Jan Muller and I explored many options as to where we could take the company. I spent a few months getting to know all the possibilities, and coming up with plans.

We decided to focus on a couple of core activities. One of them: continuing to develop our B2C product, which was already enjoying a lot of popularity, with tens of thousands of active users (it was then in Version 2, we are now up to Version 6). Today we have added tens of thousands more, and recurring revenues have grown from nearly zero, to tens of thousands of Euros per month.

The other activity was to explore the second pillar of our business, which I believed was going to be our partnerships with financial institutions, particularly banks. There are a lot of opportunities for personal finance management software companies to help banks and their customers. Banks are very much in need of new ideas and new ways to serve their customers, and we have a personal finance product that people choose to pay for. So I think we have a lot to offer, either as a white label, or in some other form of partnership.

Of course, working with a bank is a difficult process, and matching up and actually managing to make a deal at the end of the day is very tough. They have dozens of priorities, you have just a few.

What I think is interesting is that my advice about the former (B2C), and my advice about the latter (B2B) will slightly conflict. I believe now that we had to be more patient when it came to developing our B2C product, particularly in our release schedule, and I believe we should have been less patient in our B2B activities with partners.

Why more patient with the B2C product?

You know, I think it comes down to just human nature. We keep making the same mistakes, because we don’t really change that much as people. We are startup guys. We want action! Get the products out the door.

When I joined the company, I saw that our dependence on platforms like Google Playstore and iOS App store was a vulnerability. You are getting most of your business directly from these places as an app maker.

What I did not expect, which I found out quickly, was that your fortunes can really hinge on these platforms on a day to day basis. When we went from, I think v2.x to v3.0, it was a major shock to me how violent the reaction was from the user base. Instantly, your rating drops from average 4.5 stars, to under 4. Closer to 3. Then slowly, over months, it starts to go back up as you fix some of the things you got wrong, and customers sort of get used to some of the changes.

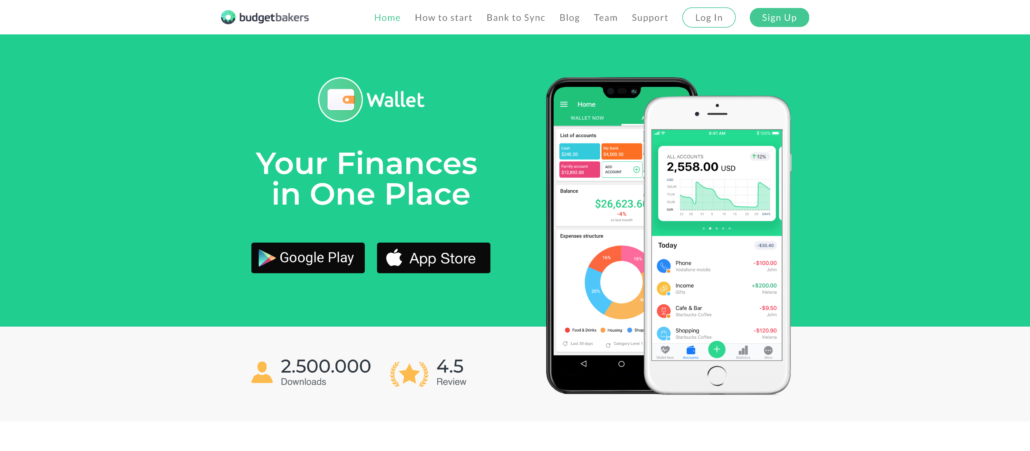

BudgetBakers provides a complete personal finance solution for individuals, families and small business.

Why does this happen?

Please, if I knew why, then it wouldn’t happen. :laughs: I think people just do not like change. When we make major changes to the apps, even when we have to make them and the long-term results will be better for the users, still nobody likes change. You moved that one button, you disrupted my flow in the app, so I’m pissed. One star. That’s what happens.

Not to mention, there are bugs that appear when you make major releases. This also provokes a harsh reaction, especially from your biggest fans.

So how would you try to be better at this?

What I would do differently, which frankly I have still not gotten 100% right, is to make us a bit more patient with the release of a big new version, and try and take the release in smaller steps. Try to create more of a transition in the product from one version to another, and game out more of the steps needed to get from here to there.

You need a bunch of things to work really well in order to push a major release. You need to migrate data and settings, you need to create a path for the users to move from the old UI to the new UI, and still be comfortable with the product.

We do testing, and we try to get everything working, but if I’m being honest, the temptation is always to push too fast, and to get the release out before it is really ready. I am saying this, knowing that we will still want to move too fast in this regard.

Do you think you will ever get the timing exactly right? This is a problem even for huge software companies.

I think it will never be totally right, but it can definitely be better. What you do not want is this sudden shock reaction from your userbase, who are suddenly giving you one-star reviews because of what is really a dumb mistake, or a series of small errors that can be avoided.

As you grow in maturity as a company, you have to get better at this, because your customer base is growing also. It is starting to include people who do not have patience for these kinds of issues. They don’t know the history of the product, and their level of engagement is not as deep. You can become really invested in big changes to the product, and then fail to explain these changes well or to justify them to the users. Then you have problems.

We are no longer in the land of early adopters at BudgetBakers. Our hardcore, long time users, while they are still really important to the way we think about the product, and test the product, are not the average user anymore. They become increasingly the edge case, and this means you need to be casting new hooks and talking to less engaged customers as well.

I would say our power users are 20% of our paying customer base. So the 80% are the silent majority, and these are the people who you need to aware can very quickly change their mind about you. These are also the people who will not tell you what they need. You have to really dig in to understand them. They won’t spell it out for you.

Your 20% might be very vocal about changes, but they will not walk away either. What they tell you is important to them, may be important, or it might not be. The more casual users, who are seeing you in a less personal way, can be less forgiving. If you don’t give what they need, they go elsewhere.

Part of growing your product maturity is to understand that your customers’ actions are more important than their words. If people complain, and yet we can see that they are using the product, maybe even using it more, then we should take this under consideration. Everyone likes to complain about changes.

[Author’s note: at the time of writing, the current rating for BudgetBakers’ flagship app, based on nearly 89,000 reviews, was 4.5 Stars on the Google Play Store]

One of the biggest mistakes you can make is to deprecate a popular feature without a real replacement.

Yes! That is a huge danger. Worse if you really don’t appreciate how important something is until you take it away from your average users. That can be surprising. Every time we do a big change, it does surprise me, even though I know now to expect this.

Just spending a little more time on something and getting beyond “it works, get it out the door now,” is what we have to work on. Just sleep on it, and play with it for a little longer. 3 weeks more of testing. I keep saying this, but every time the temptation is the same, to rush the release. You want those new features to be out in people’s hands, and you want that feedback.

It’s a bit of an addiction, maybe. We can’t stop the cycle. It’s like the binge and the hangover. You load so many things into the big release, and then you deal with the hangover, which is negative feedback, complaints, etc. You feel that all the way down your funnel, for weeks and months.

In Node5 where we work, as you’ve seen yourself, there is a sign about “the better is the enemy of the good.” This is it. We always want to be better, but sometimes you just have to be good.

Mentor, Investor, Startup CEO: Michal Kratochvil talks about life at StartupYard

StartupYard investor, mentor, and CEO of StartupYard alum BudgetBakers, Michal Kratochvil joined the world of startups after a career in corporations as Managing Director of Accenture Consulting in Prague. Michal gives us an idea of how working with startups has changed his view of business in the past few years, and how he became a believer in Acceleration.

Posted by StartupYard on Monday, January 15, 2018

In 2017, Michal spoke on video about his experiences as a StartupYard investor, mentor, and CEO.

So be more patient with your release schedule. What about being less patient with your partners?

Let’s say not “less patient,” because you have to be persistent in this business. Instead, let’s say: “more opportunistic,” or “less confident,” about the likelihood of any one deal working out.

A big danger for any small company, particularly just after raising a seed investment as we did, is that you commit too many of your resources to one deal. You can spend a lot of money and effort working on this one deal, and if it falls through, for whatever reason, this is money that is not coming back.

This can be just bad luck. A deal can fail to happen because somebody changes positions, or gets fired. That happened with us. The deal we hoped would happen just didn’t. It not in our control, nor in theirs. It just didn’t happen.

So if I had this to do again, I would remind myself that you need to be constantly building up your pipeline of opportunities. You can’t stop building a pipeline, because when you stop, you inevitably become increasingly dependant on what others decide to do. Basically, more dependent on chance and luck, because you aren’t making the opportunities actively.

When you are working towards one particular deal, you get focused on the value this deal can provide for the company. However, that deal is worth nothing until it is signed. Until it is signed, you need to be constantly working on alternatives in your pipeline. That is a best-case scenario, which is that you have to tell partners, “sorry, we made another deal.”

You know, going back to someone who you dropped 6 months ago means you start the process all over again. You can’t afford to do that. They can move on in that time. You are basically starting at zero, so you need to be building that pipeline until the moment you make a deal.

Do you have a new appreciation for the role of luck in this process?

Yes, in a way. Of course luck doesn’t matter if you don’t do the work. We did well by really investing in our technology and building up our products from the ground up. We did the work. At the same time, this work in the case of this particular partner, didn’t pay off. It was bad luck.

That being said, this same hard work can pay off in ways you don’t expect at first. When this deal fell through, for example, we had to make a really hard pivot to focusing on growing our B2C product faster, and adding more features that we were very sure would attract more customers.

As a result, we sat around really asking ourselves: what can we do in a matter of days or weeks to increase the sales of this product? That led to some big changes, and as we’ve seen, some dramatic results in the end. Our revenues basically doubled in a few months.

We absolutely could not have done this if we had not been investing well in the development of our backend. We would not have had this resiliency that we had, and the pivot would not have worked without that.

Still, and again, there was an element of luck here as well, in that in the moment we turned away from the B2B business, there was a new opportunity in the B2C space that was just opening up. I’m talking specifically about the ability to connect our user’s accounts directly with their banks, so that they can get a view of their finances without doing any manual data entries. This was the perfect moment to really focus on that functionality, and as a result we made a deal very quickly with a big data provider to connect with two or three times more banks than we had before.

What have been the hardest moments in the transition to a cash-positive operation?

When we had to make this particular pivot, we had built our team with the hope that we would make this B2B deal. When it didn’t happen, we had to change the team. Letting people go and shrinking the team has been very tough on us. No easy way to say it. It is not fun.

I have plenty of experience with this, but quite honestly, it is not something you want to get used to. It is not nice, and it does hurt.

You don’t have to talk about that…

Well, it is fresh, but also there are some things I think we can learn from it. We can do better, always. I want to be clear first of all that I still believe in each individual that we had to let go. This was not about them, but about where we needed to be as a company. That is important to emphasize for me: it was never a mistake to work with any of them. If I could keep them all, I would.

Have you learned something you didn’t know about building a team?

Yes, I always believed that you need to consider several things when hiring someone. First: you need to consider the immediate goals of the company, and the talent you need for those. Then you need to consider the long-term health of the company, and just as importantly, you must always consider the personal development of the people you hire.

I believe strongly in this, that you must invest in people when they join your team, and also in the case that they may choose to leave, or you are forced to let them go. Still, I believe we owe it to people who we hire to see that they land in the right place. I’ve put a lot of effort into making sure that these people have their next steps and are secure. That’s something I believe we promised them from the beginning, and you must keep your promises.

I’ve been managing people for 25 years. There are those managers who keep their promises and commitments, and those who don’t. If you do keep commitments, and if you are focused on the good of your employees during and after their time with you, then you are going to have a better time in life, and an easier time finding people to work with you.

But hiring for a startup is different than hiring for a big company…

Yeah, because the promise is a bit different. You are building this little family, and you’re asking people to be more flexible, and find their role in the company over time, instead of having that pre-defined by an HR department or something.

That means to me that I have asked people to have faith in me and the company, and I have put faith in them as individuals. I could not sleep at night if I did not believe I was doing all I can to help those who have helped us. That is a core commitment that you make to people as a leader. You must follow it through.

Now, as to keeping your promises, I think one thing I would do differently is to work harder not to overpromise on our ability to keep the team the way it is. I believe we did well in this, but there is room to do better. To make clear, also to ourselves, that certain people are being hired for a short period for their skills, and others are being hired for the long-term goals of the company. If you are clear about this with your hires, then you get the right level of commitment going both ways.

I wanted, because this is a startup and we are such a small group, to make everyone a part of the core team. The truth is, not everyone is in a position to be in that relationship with you, and in many cases, it would be better to treat them as more “true freelancers,” rather than to try and force a match with your internal culture. You need to have a clear idea of what kinds of people you will need when you go through a squeeze, and which ones will be the first to leave in that scenario.

You have to make clear the stakes involved with someone when you hire them. Let them know what you need to keep them around, and get a clear idea what they want to get from you as well.

It makes no sense to try and makes someone a part of your work family if they are never going to stay more than a few months. However it is also a waste to treat someone as a contractor for years, and not show some commitment from your side. This is a balance I always think we can do better.

Any last piece of advice for any other StartupYard alumni facing the same dilemmas?

As I said, better to oversell than to undersell. Always build your pipeline of partners and customers, even when it seems like a deal will happen. Always have an out, and a B-plan that is already underway. If you find yourself and the whole company depending on one event that is beyond your control, then you have already dismissed too many good options.

You will not fail if you can continue to add value to the company in some way. If what you do can be made to impact your bottom line, then you’re probably doing the right thing. Investing in your core technology, all the time, is one thing you can do. You should always see a few steps ahead: “ok, if this deal doesn’t happen, how do I make this investment pay off anyway?” I would say this has been key to us turning a profit this year.