9 Things Not to Do When Talking to Investors

We’ve seen people make every single one of these mistakes, and we’ve made some of them ourselves. Live and learn. So here are 9 things not to do when talking to investors.

Talk About Exits

Perhaps your dream is to found a startup, get some investment capital, pump up the valuation for a nice fat IPO, and blow town with a suitcase full of €500 notes, headed for a major tax haven. A noble dream, to be sure, but not one that inspires a great deal of confidence.

No, investors like to see that the stake you keep in your newly minted company is going to keep you properly motivated. And motivation is more than dollar signs: it is derived from satisfaction with your position, passion for your product, camaraderie with your team, and, of course, also money. So focus on those intangibles that you have that will keep your business moving forward. Don’t count the profit that someone’s investment is going to bring you, when you leave them holding the bag in 2 years. That’s not nice. And as the old adage goes, no investor wants to give money to a company that needs the money. They want to give money to a company that can use the money well.

Investors don't want to give money to a company that needs it. They want to give to companies who can use it well. Share on X

Be Oblivious and Don’t Listen

In StartupLandia, obliviousness can be a good thing. Who would start a company like yours without being at least somewhat unaware of the potential drawbacks, the sleepless nights, the stress, the headaches, and the thought of near certain failure? Obliviousness can preserve your sanity while you attempt to do something that most ordinary people consider to be basically insane.

The thing is, while that kind of youthful naiveté can even be attractive to investors, it so often comes with a far less attractive trait attached: you don’t listen. Investors at least like to think they have some advice and experience you can learn from. Certainly, they want to you to fully understand what taking their money entails, concerning your responsibility to them and to your company. So you need to listen carefully to what investors say.

You don’t have to follow their advice, and you don’t have to take their money, but you do have to listen- now, and into the foreseeable future, until such a time as your leadership and the product you make have proved themselves repeatedly.

Ask for an NDA

Don’t ask for an NDA. You’re probably not working on anything sensitive enough to warrant this annoyance to an investor. I’ve written a more extensive piece on this, and you can read more about it there. But really, unless you’re dealing with technology so sensitive and valuable that some level of paranoia is truly healthy (cure for cancer, for example), then an NDA is not going to do anything but waste time.

Don't ask an interested investor to sign an NDA. It's pretty much never worth it. Share on XSay: “I have no competitors.”

We’ve all heard this: ‘if you have no competition, you have no market.” Besides, if your product asks for anything from a customer, be it money, time, or attention, you are by default in competition with all of the other things a customer could be doing with that money, time and attention. All businesses compete for customers. If they don’t, they aren’t businesses at all.

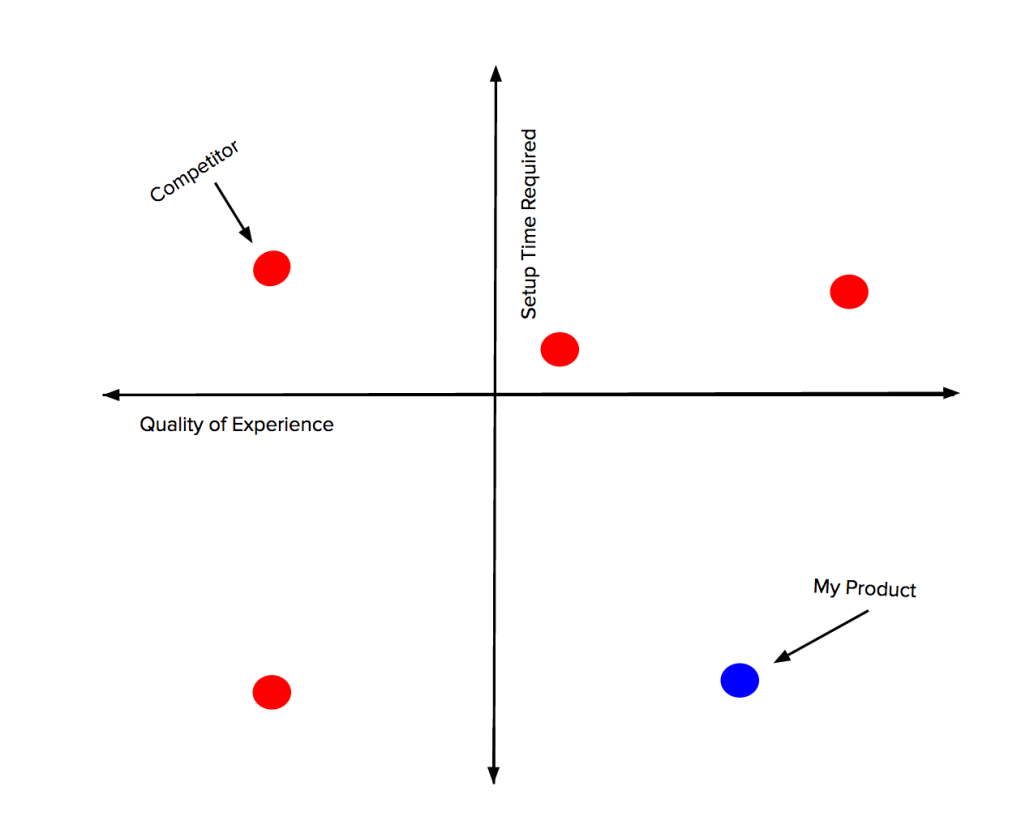

No, more often saying this is actually saying that you haven’t thought much about your market, your users, or your potential challenges. This past week, I ran a product positioning workshop with all of our startups. I asked them to position themselves against competitors based on relevant vertices for their market. The values on the X and Y axis are less important than the insight the teams can derive from comparing themselves to other businesses in the context of customer needs, wants, budget, or other factors. For example, a graph might look like this:

Your graph has impressed us. Would you like that money in a suitcase, or do you prefer a novelty sized cheque?

As I noted, the values on the vertices can change to fit your market situation: is it about price, or time investment, or is it about the annoyingness of ad-support, or about some other value on the Y axis?

The X axis is also dependent on the market needs. But a successful business needs to find a suitable position graph that places their product somewhere that the competition isn’t competing well. In the above graph, the competition can offer good quality, but at the price of convenience. So my product has to be convenient and high quality. That is my market opportunity.

This sort of position graph also helps illustrate your market strategy. You wouldn’t market yourself as top-shelf quality if a competitor already holds that reputation- your quality would be a help, but it would not be enough to justify your product. If you can’t find a graph that shows a worthwhile market opportunity in concrete terms -something nobody and nothing else yet does well- then you may not have a viable product idea at all.

Tl;dr: If you can’t be better, be cheaper. If you can’t be better or cheaper, then you’re going to need a very good market strategy.

Don’t Have a Plan to Use The Investment

One VC I spoke to recently put this problem in terms of ambition. Wanting investment doesn’t make an entrepreneur particularly ambitious, except in the sense of possibly being greedy. Instead, a poorly laid or incompletely laid plan for go-to-market based on a number of possible investment outcomes is a sign that you don’t really care enough about your product and its future. If you did, you would have plans for any contingency, including a way to bootstrap your product.

Approaching investment this way, with an eye towards showing investors exactly what their money is going to do, also gives a founder much more leverage. It is a much more attractive argument to an investor that a founder *could* launch without his or her support, but that this support would only stoke the fire of success further. Being dependent on investment means being dependent on investors, and few investors want a founder who can’t stand on their own. This means being responsible, and having a solid, and detailed plan for how you would use money invested in your company.

In “A Unified Theory of VC Suckage,” which I recommend as good reading, Paul Graham theorizes that VCs suffer from perverse incentives to invest too much money into startups that don’t need it, and can’t properly use the investment. What can make such a situation doubly more dangerous (and frequently did in the late 90s and in the 2000s), is that founders also believed that a bigger valuation was actually going to make them rich. Which it did, at least on paper. This has caused more than a few companies to IPO when they shouldn’t have, and to crash spectacularly. It has also caused many worthwhile projects that needed much smaller seed-funding to struggle to get it. But having a plan for what to do with the money you take in will show an investor that you’re ready for a big investment, or for a smaller one.

A high valuation does not make you rich. It makes you accountable. Share on XProject Your Growth Based on a Similar Product’s Success

Everyone knows a “me too” product when they see one. A “me too” market strategy may be no better than that. The old saying: “if it was easy, everyone would do it,” finds a perfect fit here. The success of another product, and that product’s similarities to yours, doesn’t mean much to the success of your product. Investors invest in people, just as much as in products, and execution, despite what we hear in the news, is 10 times as valuable as innovation for any company in the long term.

We often hear about innovation in the media, as if it were the sole distinction of success in technology. In fact, that isn’t remotely the case. While big companies that innovate create magnificent splashes and sell lots of their products, it takes just a bit of scratching at the surface to discover that the majority of that success is ensured by a strong execution of whatever plan the company has. That was as true a century ago for the Ford Model T as it was 10 years ago for the iPod. As true for Microsoft as for Facebook. These companies were not creating products that hadn’t been thought of before. But the background processes that they put in place to execute, reliably and efficiently, won them their market positions over time.

Think the Investors Must Be Smarter Than You

Our director Cedric Maloux told me a great story about an idea he had way back in 2008. He wanted to form a company to develop and market casual games for the newly launched iPhone. This was a market at that time, was worth much less than just a few years later. He discussed his idea with a VC he knew and respected, and the VC advised. “Video games need to be immersive and mobile phones don’t give this experience. Nobody wants to play games the way they used to [with the GameBoy],” the investor argued.

Cedric believed him and gave up on the idea. Growth in this sector has yet to slow since the release of the original iPhone. Investors are not necessarily visionaries.

Don't confuse smart money investors with visionaries. Share on XOnce hosted a meeting with StartupYard and another local accelerator. Its director and host listened to pitches from their startups, and from ours, and nearly without fail, addressed every single team with the same feedback, in sum: “I knew some people who tried what you’re doing. It didn’t work.” Experience is doubtless valuable. But failure in the past is in no wise a predictor of failure in the future. If that were true, the world would not know of most of the revolutionary products it has encountered in the past 30 years. Virtually every single one of them was tried without success, usually long before they were tried and succeeded. Listening to negative feedback like this is good. Letting it stop you is a shame.

Don’t Be Ready

Be Prepared. Always. Having and being prepared to share your financials, your projections, info about your team and your market is essential.

You can’t just chat up investors as a means of figuring out what they want to hear- that’s not the way the dance works. Your vision, your plan, and your goals are what the investors are buying into, so if you try to sell them their own ideas, they’ll know you don’t have a plan you really believe in. Having that plan, and sticking to it, only changing it for strong and valid reasons, is key to getting the right investors involved. So you need to be ready for what the investors might ask of you.

Luckily, there are plenty of investors who will tell you exactly what they would want to see from a potential investment. A great example is our Andrej Kiska, who shares excellent tips on exactly that topic. He lists the number one failure point for startups as not building business forecasts ahead of a funding round.

in Kiska’s words:“The most frequent reason I hear for not building a model is that it is either too difficult or it just doesn’t make sense. But that makes me wonder what would happen if your startup will run into challenges that you consider too difficult or your market will desire a product you don’t believe makes sense and don’t bother to test it.”

There’s another pretty full-proof way of finding out what investors want to know before the meeting starts. Ask them. If the investor is a serious person you might actually want to cooperate with in the future, then they should be invested in you doing a good job, and making the best possible impression. The investor has a boss as well, in many cases, and needs to find justification in talking with you, just as you need to find justification in talking with them. So ask what they expect to find out from you, and plan accordingly. There’s no secret handshake. No checklist- every investor is different, and it’s ok to seek guidance.

Talk to the Wrong Investors

This seems basic, but it’s a mistake a lot of people make. You should know which kinds of investors you want to talk to. Don’t talk to a growth fund if what you need is seed money. Don’t talk to a VC firm unless you’re ready to do due diligence. Don’t talk to an Angel unless you’re looking for an Angel style investment. Each type of deal has its place, but not all money in investment is created equal. Each type of investment carries its own advantages and drawbacks, and you shouldn’t waste your time talking to investors who don’t have experience with companies in a similar situation. Andrej Kiska also has a lot to say on picking the right type of investor.