Meet the 2015 Startups: BudgetBakers, Stress Free Mobile Finance

BudgetBakers came to StartupYard with a unique problem. With a popular and highly rated app on the GooglePlay store, in many ways, they’d already won the “Game of Startups.” But like many startups, the growth hadn’t translated to profitability yet, and the popularity of their app, then called Wallet, hadn’t translated to the number of paying users they’d need to keep growing as a business.

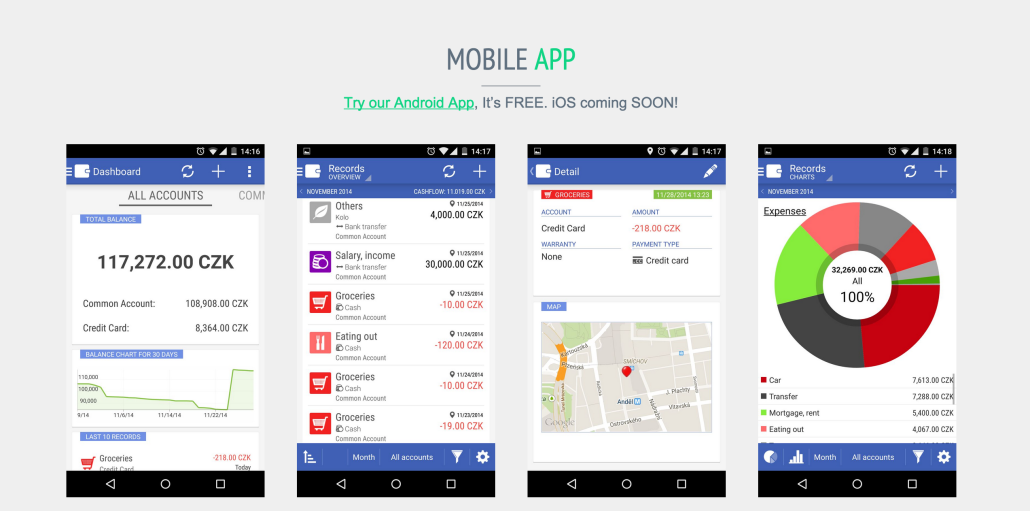

Beautifully designed and expertly constructed, the software immediately caught our attention. The team too, co-founders Jan Muller Martin Jiricka, were eager to take the next steps. Here’s Jan “Honza” Muller talking a bit about the BudgetBakers journey, before and during StartupYard:

Q: Hi Honza, tell us about BudgetBakers. Why did you choose to tackle the problem of personal finance and budgeting?

A: Well, it all started 5 years ago. I just wanted to learn how to develop for Android- at that time it was a really new platform.

Also, I wanted to make an application for my personal use, to track my finances. I called that original application Wallet. Through the years, the application has become more and more popular, and more complex. It’s coming soon to iOS and a web app, and is already on android (the Android app is still called Wallet for now).

As BudgetBakers has grown, I’ve changed as well. Since I founded BudgetBakers, I’ve started a family myself and become a dad. I’ve come to really understand the need for smart daily money management. When I quit my job late last year to work on BudgetBakers full time, that only reinforced my need for solid money management. That’s quite a motivator to get BudgetBakers right!

As an entrepreneur working for myself, knowing how much I have to spend, and how much I should spend on everything my family needs is really important- for me and for my partner. We need a smart way to make smart decisions as a family.

People are afraid to think about their budgets and the money they spend every day. But we find that once they get going, that sense of control and security is really addictive. It certainly is for me!

When we’re growing our families and our careers, we can come to let money concerns dominate our thinking. But we don’t think rationally or effectively about our money- we just worry about it uselessly and inefficiently. I’ve come to see what we do as a way of saving people from that trap.

So that’s how BudgetBakers grew into what it is today- more than an expense tracker, it’s your personal finance assistant. It thinks about every little penny, so you don’t have to.

Q: What makes BudgetBakers different from competitors like YouNeedABudget or Spendee? Why should people use BudgetBakers?

A: First of all, BudgetBakers is not just a mobile application.

We are constructing a fully integrated platform where people can learn how to get control of their personal finances, and gain peace of mind for today, and the future.

More than that, we want to go further than just helping people to track their individual expenses and manage their budgets.

Managing money is an important family priority as well, and one that people have a hard time with, especially when they’re just starting their careers, and thinking about saving for a house, maybe a car, or that vacation over the summer.

You get your paycheck one day, and the next day it seems like everything disappeared. Where did it go? That can cause a lot of stress.

A lot of families aren’t on the same page when it comes to their finances- they don’t know how much they can reasonable expect to spend every month, much less how much to save for the long term.

So we’re not only perfecting personal finance via a fully integrated web-based, and mobile platform, but we’re also building in tools to encourage couples and families to begin cooperating to manage their money more effectively.

I don’t think you need to have a lot of money to be happy, but I do know that you need to have enough. That’s where BudgetBakers comes in- our platform helps people to understand what enough looks like. Are you sure you can afford that trip to the movies on Saturday? With BudgetBakers, you will be sure.

Q: A big hurdle for BudgetBakers so far has been gaining traction with users. What are the unique challenges you face in getting people to commit to your approach and platform?

A: We have 4.4 star rating on GooglePay, and we get about 1000 new users a day. We use the UserVoice platform to keep in touch with our users, and we’ve also recently hired a new team member to help with community management, blogging, and marketing.

That said, we’ve found from the beginning that our users need a lot of convincing to really start using BudgetBakers to the fullest. It seems like a big commitment, and it seems more complicated than it is. Part of the learning curve for us, especially at StartupYard, was to see how many opportunities we truly had to convince users to stick with the program, and we weren’t converting as many as we could have.

With the help of some awesome mentors and workshops, like Bogo Shopov on GrowthHacking, and Fiodor Tonti on UX/UI, we’ve had our eyes really opened to the opportunities we’ve been missing, and we’ve seen that we have a lot more room to grow and understand our users even more. That’s very exciting.

Right now, we are working on expanding our efforts in content marketing, and community building, to find new ways that BudgetBakers can reach out to its community and offer them tips, advice, and above all encouragement to make the right financial and spending decisions. There are a lot of people out there who need a little encouragement, and we want to be the ones to provide that.

Q: What do you think are the major blockers for most people when it comes to getting their finances under control? How can BudgetBakers fix that?

As I said, I think one of the biggest obstacles we have when it comes to getting people to take control of their finances is fear. People are afraid that once they open up their finances and take a look, they’ll be shocked at what they see. Sometimes they really are!

But we find that as people use BudgetBakers, they get comfortable, and they start to really enjoy the control they have over their spending. The stress in little spending decisions can start to go away, because they have a very good sense of what they should be doing with their money.

Maybe there’s a little extra in the restaurant budget this month. Great! Order a pizza, or take your girlfriend/boyfriend to a nice dinner somewhere. That’s a wonderful feeling, to know you aren’t cheating yourself when you do that. Control of your finances can make you feel virtuous and proud, and it makes you want to do better, and set better goals for yourself in the future, to hang on to that good feeling.

People have to “rewire” a little bit to make this transition, and that isn’t easy. They have to stop being so emotional about their money, and be a little more analytical- stop worrying and start thinking. BudgetBakers helps with that switch, but it can still take a big effort.

Q: Ease of use is also a major concern for any budgeting software. How are you planning to make BudgetBakers more intuitive and less work intensive?

A: We have a lot of plans on how to make our users more comfortable, and make the daily habit of budgeting and expense control simpler and more rewarding.

Today we have a smart watch application which allows users to enter transactions even without taking their phones from their pockets. Also we have automatic bank statement parsing which works with a few Czech banks so far. We are working towards expanding that ability.

In the future, it’s important that we offer our users ways to integrate directly with their banks, making expense tracking practically automatic.

It’s a balance. With BudgetBakers, the value is in the peace of mind that it gives you about your finances- it reminds you to control your spending, and it keeps you honest about what you can afford, and what the best decisions for you really are. You need to engage with your budget on a daily basis, but you don’t want that to be too much work or too much stress.

There are ways that we would like to make things easier, and entering, sorting, and tracking transaction information automatically will play a big part in that.

Q: What’s your near-term strategy for growing BudgetBakers’ user-base, and how do you plan to keep new users as they join the platform?

A: Budgetbakers has already been downloaded over 800,000 times on the GooglePlay store. When we release our iOS version very soon, along with a substantial rebuild of the BudgetBakers platform, we look forward to adding a whole new group of users.

A lot of users is a great thing to brag about.

But as I said before, one of the things we really want to focus on is making budgeting and financial planning a daily routine for as many of our existing users as we can. We can still do a lot better in that area, and as new users discover the platform, they’ll also benefit from this work. If you do anything for 3 months, it can become a habit, and that 3 month metric is something we’ve been focusing on much more. Can we keep people engaged with their budgeting and financial planning for 3 months? If we can do that, the rewards to our users will extend to potentially their whole lives. We can do a lot of good with some very small, simple changes to the way they engage with BudgetBakers.

For example, a big takeaway from the StartupYard workshops, particularly with Fiodor Tonti and Bogo Shopov [ workshops on UX/UI and growthhacking], was that BudgetBakers needs to utilize the data we collect from our users, and make that part of our overall value proposition. People want to feel a part of a community, and be rewarded for meeting their financial and savings goals. Gamifying the platform and rewarding users with insights and advice is a big part of how we will improve our user retention, and help people to be more financially secure and independent.

Q: You’re based in the Czech Republic. What about the region represents a unique opportunity for BudgetBakers? What challenges does location present for the company?

A: BudgetBakers works anywhere- it works with any currency, and in about 25 languages so far. We have users all over the planet. Of course, because we’re based in Central Europe, this is where we are exploring our first corporate partnerships with banks, telecom providers, and others who can help us add more value for our daily users.

We have a large userbase in the Czech Republic, and that’s partly because of good word of mouth. It’s also because this region doesn’t have access to some of the largest competing platforms, like Mint.com, and because the market here is more fragmented, with more localized apps and platforms, tailored to specific markets.

In addition, banking and financial services are also more fragmented, meaning that building larger partnerships is a slower process than in places like the US. However we count that as an opportunity, to be the first to spread in a way that less ambitious projects haven’t managed to do.

There is no market leader in this category yet, particularly in Europe, so there is a lot of room for growth. Banks and telecoms are desperate for ways to add value for their clients, many of whom are choosing lower-cost, more mobile solutions. We are exploring these types of partnerships that add the value that people are looking for from their financial institutions, but are not yet receiving.

A lot of people (including StartupYard mentors) have challenged us on how “new” and “innovative” BudgetBakers is. There are a lot of expense trackers out there, and budgeting software is as old as spreadsheets. But you have to remember, that the mobile and financial technology that really adds value for end-users is still really new. In the context of business and government, legacy methods are fine, but users today want mobility, interconnectivity, and always-on functionalities. They want their software to work with them, not just for them. So it’s not a new idea, but it is a new way of looking at budgeting for many people.

Q: Tell me about your experience so far at StartupYard. How has BudgetBakers grown during your time here? How have your plans changed?

A: By entering SY we had to slow down development of the new version of BudgetBakers and start focusing more on management, finances and defining the strategy that will bring us to next level.

At the beginning it was very unusual for me, because i was used to spending my whole day programming. I had to turn towards management, and that was a challenge for me. But now I have to say, it helped me to crystallize my vision in term of growth and success.

I’ve come to realize that our priority has to be our customer experience and our market strategy, instead of just building an ever richer feature set. There’s no use in creating the world’s most amazing software, if nobody is ready to use that software to make a positive impact in their lives. So we’ve had to adjust our attitude towards development, and grow up as a company and a team. That’s been an amazing experience for us, and we’re really glad we decided to do it.

Learn More at www.budgetbakers.com

Follow BudgetBakers On Twitter @BudgetBakers