Introducing Elifinty: Hope for the Financially At Risk

Over 25 million people in the UK alone are classified as “financially vulnerable,” often crushed with debt and in fear and confusion over their options. Elifinty is for people who see no way out: a financial AI that offers custom, pre-approved financial solutions for your unique situation, including charitable options and debt consolidation services.

Maysam Rizvi is CEO and Co-Founder of Elifinty. Coming originally from the UAE, he was raised in the UK, where he began his career in banking. Maysam realized following the financial crisis of 2008, that his true passion wasn’t banking, but helping those who banks were unable to help. He founded Elifinty to help the financially vulnerable become a functioning part of the financial economy again.

Hi Maysam, first tell us a little about yourself and how you came up with the idea for Elifinty?

I’m an ex-banker with about 15 years experience in various institutions doing Risk, Investment Banking etc. with senior positions in United Overseas Bank and JP Morgan.

If we want to say “when it all started,” then it was when I was in Iceland in 2007/2008, recovering funds for my banking institution during the financial crisis. I saw first hand the impact of the financial crisis on individuals and businesses. The financial contagion that spread from Iceland and other countries around the world consumed institutions, weakened governments, and shook the foundation of our society at the time.

Maysam Rizvi, CEO and Co-Founder at Elifinty

There I was trying to collect on these debts we knew the debtors couldn’t pay back. It was mad. We had irresponsibly loaned this money, and they had irresponsibly spent it, but somehow our responsibility was overlooked, and we were the victims. Meanwhile these people ended up with less than they started with, and the banks ended up getting even richer.

It was a really painful time for me. It didn’t feel good to do that work. We protected our balance sheets, we blamed others, but I couldn’t sleep. I had a suspicion that if we should blame anyone, it might be ourselves.

I spent years researching and understanding the challenges faced by individuals in debt, and how the banking system as a whole was part of the problem. I started to feel I couldn’t go on doing what I was doing, and ignore the damage the system was causing.

Currently, 50% of people in the UK are classed as “financially vulnerable.” That is about 25 million individuals and there are similar statistics across Europe and in the United States. And I’ll note, that this vulnerability across half the population has persisted despite basically 80+ years of barely interrupted growth in economic productivity and overall societal wealth.

I realized as I got to know the banking world that debt had played a key role in making the economic miracle that the world now enjoys. But there is a dark side, and it is found in that half of population that many of us would rather ignore. Still, debt breeds instability and ultimately suffering, when it is not managed responsibly, and when debtors are not treated humanely.

The idea for a solution in the form of an app came together with me and my co-founders just sitting around a table talking about these problems. Our experiences and expertise along with the learning we’ve had about the financial crisis and the banks role in that crisis, led us to realize that if anyone was going to try and solve this, it should be us.

For those of us who have never had subprime debts, can you describe the kinds of people who have these debts, and what some of the conditions are?

In our research we’ve seen a number of factors that can put you on the path to financial vulnerability. One major misunderstanding is that a financially vulnerable person is a poor person. While this may be true, a financially vulnerable person is someone who might be impacted by a small event that can, for example, increase their expenses by £100 and they have no mechanism to deal with it.

Being financially vulnerable means not being resilient: not being able to keep going in the face of even a minor difficulty. Many people have their finances like a house of cards. One blow, and it all comes down fast. Debt makes that process even worse. Perversely of course, lenders punish those who have difficulties paying their debts by giving them higher rates of interest, creating an incentive for some lenders to create more bad debts, and keeping bad debtors from becoming good debtors.

Some of the reasons for becoming financially vulnerable are:

- Lack of financial understanding. Financial education is the number one factor. People generally get stuck in difficult situations because they are choosing the wrong financial products for the wrong financial situations. Consider the person who bought a car using a credit card, credit card interest is typically over 20% compared to a car loan of 5-9% per annum. Worse yet, credit card companies actively encourage this type of behavior by offering rewards for taking on this kind of debt.

- That leads to having high cost credit. These range from 20% APR credit cards to your payday loans that typically have interest rates over 1000% per annum. Individuals having high cost credit are stuck in a downward spiral, constantly losing the battle to financial survival.

The simple fact is that many people are financially vulnerable simply because they lack sufficient “social capital,” to ask for and receive the appropriate kind of help. These are people who feel intimidated by walking into a bank, and who may lack the self-confidence to assert themselves over multiple interactions.

If you walk into a bank and ask for a loan, you must answer questions. You must then gather certain documents which you may not understand. You must then return and get a decision. Many people don’t have the nerve for this, and fear a negative outcome.

Meanwhile, a short-term lender or even a loan-shark can makes the process of getting a payday loan very easy indeed. Walk in with a paycheck, walk out with a loan. The customer sees an immediate response, and feels immediate relief.

Payday lenders know this. They listen to a customer’s problems and offer real solutions. Their customers don’t feel judged or shamed for being bad with their money. Though the customer may not be taking a deal that is good for them in the long run, they really are solving a short term emotional pain and crisis. That is powerful competition for a traditional bank.

You’re targeting people at risk of default and bankruptcy. How do you work with that type of consumer? What are some of their unique problems?

Most importantly, we need to work with these types of customers in as humane a way as possible.

Banks and subprime lenders both have motivations which are fundamentally misaligned with their customers when it comes to debts. It’s this: to a bank or a payday lender, a person is a number. A big bank wants to get an “underperforming” customer off their balance sheet, and a payday lender wants to get a cash-cow at high interest onto theirs. Getting people out of debt is not really in either’s interests. Banks want people who can comfortably pay, and short term lenders want people who have no choice but to pay them.

This is where we stand: between two industries who either don’t want to work with at-risk customers, or do want to work with them, if only to take advantage. Our aim is to turn these at-risk individuals into healthy members of the economy who have healthy levels of debt, and the ability to pay it back.

We’ll do that by bringing a hybrid and gamified approach to each individual at-risk consumer. Do they need cash flow management? Debt forgiveness? Restructuring? We can use open banking data and a network of charitable public organizations to catch these people who are grinded between the gears of banks and payday loans.

Banks will tell you, and with justification, that they do test many tools to help their customers become better credit risks. But a bank is a big organization, and it’s primarily focused on its bottom line, at the end of the day. They would like for their customers to be more financially healthy, but they are not able to focus on these customers. Rather, they are incentivized to get rid of them.

Elifinty aims to work with both charities and banks to stabilize and improve the finances of “bad debtors.” How do you see your future relationship with these institutions?

The UK already has a well-developed network of private and public charities that do things like rent-support, utilities, income support, and debt forgiveness as well. There’s a big range of them, but because of the nature of their work, they are most often focused on particular localities and specific cities. Their reach is limited in that most of their funding does have to go to doing what the charity promises.

We absolutely need these charities, but they are not able on their own reach the people who need their help most, before the biggest financial and life damage has been done due to financial struggle. Often these charities step in when families are already splitting apart, when drug addictions may be involved, and when people are at a particularly low point. We want to help charitable money reach people before their lives are truly cracked open, and get them the right help before that happens.

For charities, we can digitize their services and get them to the right people earlier, when it has the maximum impact. This helps them help more people, and it helps them show their funders that they are making a difference, leading hopefully to more funding.

Elifinty can streamline their enrollment processes so they can access a self-managed portal that stays in the charity’s control, and not ours. Far from replacing charities, we’re going to give them the tools to make a bigger difference.

On the other hand, we will be working directly with banks too. As I said, a bank’s focus in getting bad debts off the balance sheet. We will be able to help them do that in a way that serves the customer’s interest as well. The truth is that such bad debts are typically bundled and sold off to debt collectors or debt investors, often for a small percentage of the total amount, with the bank taking a loss, often over 80%.

In the future, Elifinty could function as a marketplace for that debt which favors the organizations that have the most human practices in debt collection or reconsolidation. For example, a debt collector who runs as a non-profit organization, looking only to cover its own costs, or a charity that buys debt in order to forgive it.

Collectors and debt aggregators today can be incredibly aggressive, intimidating, and heartless. They rely on consumers not understanding their rights and feeling afraid of the consequences of non-compliance. We want to break that whole industry, and make this kind of abuse a thing of the past. We want to convince banks to work only with collectors who stick to an ethical and humane system.

That won’t be easy. Regulation in the US is practically non-existent, and almost totally uninforced in this market. In the UK, things are better, but abuse is rampant. Still, we believe that offering a better way can show the financial world that we don’t need to stoop to these evil tactics to have a fair and equitable society that takes personal responsibility seriously.

Why are there not more stringent controls on the types of debts that consumers can get themselves into? What would you advocate for in terms of regulatory or legal changes to the current system?

As I said, the market is not unregulated now. The problem with debt is that fair or unfair, there will always be those who have the skills and the knowledge and the luck to make it work no matter their financial situation. Then again, there will always be those who get into trouble, even if they are relatively lucky, and not necessarily dim or stupid either.

When the economy is growing, it just gets easier to get credit, and as a society we accept that this means that some of the money will find itself in the pockets of people who shouldn’t have it. It’s only when there’s an economic downturn that we turn the screws on these people, and make them pay for their mistakes. That’s something I learned in my years of banking: those who are blamed are often those who we should have considered more carefully to begin with.

One the great mistakes, I think, that occurred during the Great Recession of 2008 was that politicians got so focused on saving the banks, they didn’t think about what would happen to all those people who the banks had lent money to. Rather than forgive their debts and clear the bank’s toxic balance sheets that way (which is what I would have preferred), the governments instead injected even more money into the banks, and left the banks still to collect on the outstanding debt they had foolishly created themselves.

In that way, the banks got paid twice during the last crisis, and the debtors paid twice: first by losing their homes and their savings, and then again by having their tax money go to keeping the banks liquid. Many people from that period have never recovered- and this is not even to mention that nothing has fundamentally changed. We still have a massive pile of debt at the core of the world economy, and no real way of paying that back.

I do believe that initiatives like PSD2 and GDPR are causing some needed disruption to this cycle. Giving outsiders in the financial industry like us an ability to compete on a level with banks is going to bring more customer focused solutions to the debt problem, and I think that’s a great thing. I also think GDPR can go a long way to cutting down on the bad actors in debt collection, and it will force banks to be more transparent about what kinds of people they are contracting with to collect debts. This can’t happen in the shadows anymore.

We are a part of the Open Banking Consumer Forum, which advocates for a code of conduct for finance companies, to try and protect consumers from becoming essentially a source of funds for bad actors. I believe PSD2 and GDPR on the whole are going to help that mission.

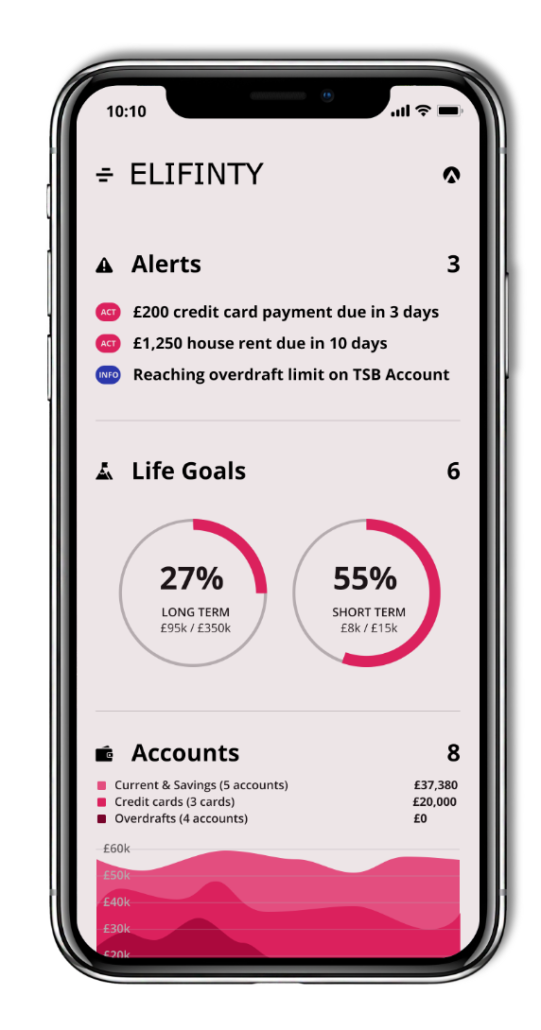

How exactly does Elifinty’s technology help its users to make better decisions and stabilize their finances?

Two important aspects. First: predictions. We are able to use PSD2 Open Banking data and customer supplied data to predict the likelihood and the size of a potential financial disaster for an individual, and we are able to then put that person in contact with the right solution or service for dealing with that problem, even before it becomes really serious.

We’re able to see which customers are at risk of taking bad loans, or who are already beginning to follow the ‘death spiral” of unpayable debts, and arrest that spiral with a quick intervention. Customers may not even need drastic help if they come to us in time.

Beyond that, we are able to use our app to help change the customer’s behavior and thinking about their debts, offering strategies and even tricks to get them out of debt faster. This could be done with or without an outside partner- it would depend always on the persona and the nature of their problem.

We also have some exciting ideas about how we can use debt forgiveness as a kind of motivational tool. Imagine if a person’s debts could be reduced simply by that person meeting daily spending targets, or committing to certain changes in their financial lives? We could bring debt from 100% collectible to only 50%, or 30% or all the way down to zero. All it would take would be the customer committing to changes that make them a better financial consumer, and a charity or investor interested in helping people turn their finances around.

In this way, our hope is eventually to have an end-to-end turnaround process, taking a person who is unfit for the banking system, helping them alter their behavior and gain knowledge and wisdom about finance, and eventually getting them back into the financial world as a productive and contributing member.

Where do you see your features and your main customer base a few years from now? Who will be your key competitors then?

For the near future, we’re focusing on simple aspects of a person’s financial life, like grocery shopping, utilities, car loans, insurance, etc. We will allow our users to save money on these kinds of things in order to improve their financial health. Then slowly we will be rolling out cooperations with charities and other services to tackle the hardest-to-solve debt problems.

My wish is that in 10 years, there won’t be a need for us on the market, because banks and other lenders would have become ethical and human centric. I have hope that we can do that, but I am also a student of history. I sense that our work may not be done in my lifetime, but I want to get started now making finance fairer for all of us.

You joined StartupYard a few months ago. How has the experience stacked up against your expectations and preconceptions?

We thought StartupYard would be like any accelerator. However we were not quite prepared for what it really is. It’s an intensive experience, meetings with 120 mentors over 5 weeks, with a huge range of varying feedback and advice that we had to somehow bring together and reconcile.

That really forced us to stand up and work on our pitch and our value proposition in the face of so many possible objections and problems. At the same time, we got so much support in everything from developing our content and messaging to our design and our management and financial planning that we just didn’t expect to get.

What I love about it here is the sense of urgency you get to accelerate your business. You have to be on your toes and you have to always drive towards your goals. The bad part is missing my family as much as I have. I tell myself it’s for the greater good, but that’s a big challenge for me starting a business. My family is a source of strength.

Why is helping people to get out of financial trouble so important to you? What about the current situation keeps you up at night?

I’m from the UAE and despite what you may think about the country based on movies and TV, with the riches and excess, our family were always focused on helping people as part of everyday life. Our culture before the crazy economic changes in past decades was nomadic, and while we have been in fortunate positions our people were very dependent on the kindness of strangers. We still are in many ways.

I think this is why my Icelandic experience was so profound for me. I couldn’t reconcile how I could do my job, that I knew wasn’t helping people, but really hurting them. In those days I had trouble waking up in the morning and going to work.

Recent events have also convinced me that many of our problems as a global society come ultimately from us not being focused on the human beings who make society work. The UK is a rich place, by historical and current world standards, and yet so many of its people struggle so much day to day. That just doesn’t make a lot of sense. Whether your a socialist or a capitalist, you can’t argue, based on the available evidence, that having half the population under constant pressure is conducive to real economic productivity.

I’m afraid that my children will grow up in an unjust society and despite their own position in society they will not be able to reconcile what I teach them with the harsh realities of life. That’s why I’m doing what I do.

What kinds of partners are you looking to connect with following the StartupYard program. Which existing players can most benefit from working with you to solve the subprime debt problem in the UK?

We’re looking for team members who want to go with us on this journey, and believe in the right of what we are doing. In terms of banks, the big 4 in the UK are Barclays, Lloyds, RBS, and Santander, and we will be looking to connect with all of them.

Credit unions and credit union associations like ABCUL will also make great partners, so we are looking for ways to connect with them.

Charities are a big part of our plans, so we are very open to partnerships across the UK financial charity ecosystem. Anyone can contact me directly at maysam@elifinty.com, or on twitter @elifinty, or visit our website: www.elifinty.com