Meet Decissio: Your Jarvis for Investment Decisions

Decissio is StartupYard’s second portfolio company from Kosovo, following on the success of Gjirafa, from 2014. Dite Gashi is an expert in blockchain and AI technology, who set out with a simple vision: making decisions make sense. Through the course of the SY program, Dite focused more and more on the decision making process for investors, accelerators, and portfolio managers for monetary funds, eventually identifying Decissio’s kick-off product.

I sat down with Dite this week to talk about how he got here, and why he thinks he can change the way investors and startups communicate, and make decisions together.

Hi Dite, tell us a bit about where the idea for Decissio came from? Why decisions?

I have a strong technical background in computer science and I’ve recently graduated with an MBA. I think of myself as a good bridge between technology principles and business-economics. As I was working with blockchain solutions for several years, I could not help but see emerging patterns between these fields.

My feeling is that if you take the state of any existing entity today, whether it is a business, organization, country or even an individual, their current state is defined by decisions made previously. If you look at it from this perspective, the decision making process and history can be represented as a ledger.

Dite Gashi, left, participating in StartupYard’s voice training workshop

A topic that fascinated me since I can remember is the distinction between success and failure. How come some companies manage to grow so quickly and maintain their success? What about others, who seem to have everything in order – just to see t all crash down like a sand castle? How can we quantify these?

The history of mankind is man trying to master nature. As humans we always have been obsessed with avoiding dangers and seizing opportunities by making the right decisions. At its core that is what defines our survival and growth.

We have done that in several ways and the compounded knowledge that we have has served us very well. With big data and smart algorithms being introduced, our progress will achieve exponential growth. We want to be a part of the revolution in a narrow scale starting with investment decisions.

You joined StartupYard as a “napkin startup,” meaning you had no code written, and no finalized product idea. Now you’ve identified a market, and you’re building a product. How did you get from there to here?

As Peter Thiel says in his book, now the startup classic “From Zero to One” getting started from just an idea to actual customers is the hardest part. I am glad StartupYard was there to help us make the leap.

The evolution of Decissio has been very much a child of real-life experience. I have personally spoken to more than 20 people involved in venture capital, and Decissio as a concept was born out of these deep discussions.

When I joined StartupYard, I knew I wanted to use blockchain technology and machine learning, to help decision making processes. What I didn’t know yet was just how profound the problems with investment decision making really are. And one of the profoundest problems in investment decision making is that of information: what is relevant information and what isn’t? How do we understand our own inherent biases about information?

Human beings are good at judging other human beings, for example. We have feelings about people, and we are great at certain kinds of pattern recognition. We are good at recognizing things that are missing; things that are just sort of off. We know when we don’t like something or someone, even if we don’t know why. So many early-stage investors rightly say that the bulk of their decision making process is about people.

But that’s just a part of the story. The truth is that information bias can change the way we feel as well. Someone who we wouldn’t normally trust can trick us or mislead us by giving us indications that they are doing better than they are. We can call this “fake traction,” or “fast talking,” and it’s something investors are very familiar with. Investor, particularly in very risky and speculative industries, have to be constantly aware that they can be led down the garden path if they aren’t very aware of what has actually been proven, and what is just talk.

And that understanding slowly evolved into Decissio, which became a platform where real and verifiable information can be gathered, and more importantly, contextualized so that an investor can easily and clearly see the real situation of a startup or a company they want to invest in, or which they have in their portfolio, and use that intelligence to augment their own decision making.

What are some of the key pain points for VC investors, or accelerators, or others, and how do you solve them?

As noted above, a key point is data. There is usually not a lack of data, but a problem of scope, timeliness, accuracy, and precision. Many startup investors that I spoke with shared experiences of being unable to make decisions about investments because the data they were seeing was not clear enough, not presented in the right way, or was too broad or too specific to base decisions on.

And that problem doesn’t stop when a company gets an investment. Plenty of startup investors also complained of how difficult it really is to know the status of a startup in their portfolio, relying on the founders themselves to come forward with that info. The founders first of all pick the data they want to share themselves, and sometimes it isn’t the right data, or the data they provide isn’t helpful to the investor, or doesn’t provide the investor a chance to intervene and help the startup.

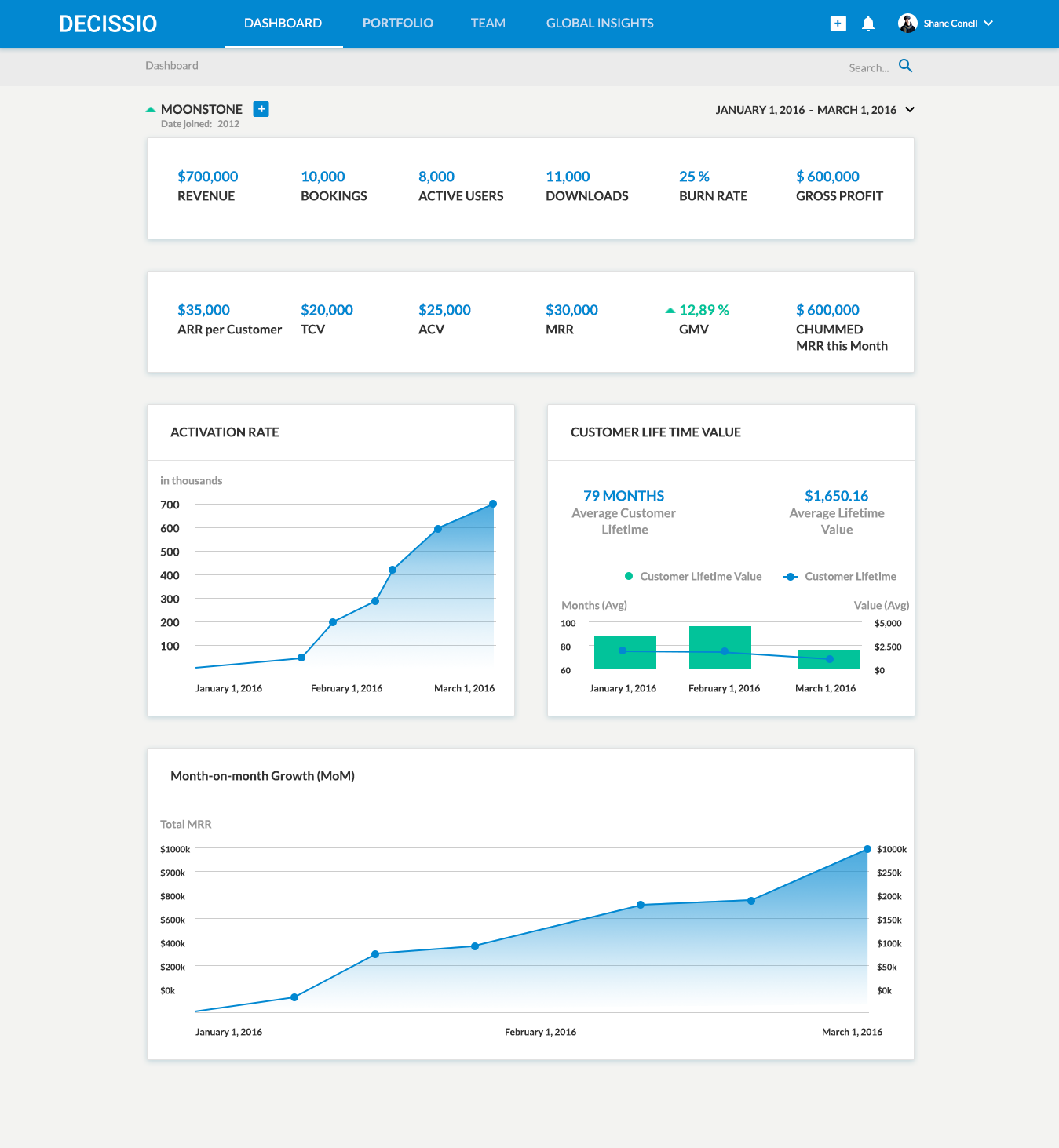

The basis of a good relationship has to be one of understanding. So Decissio is going to solve that problem by bringing a startup’s relevant data directly to the investor in a very easy to use dashboard, that provides a range of datapoints from the APIs of common platforms, like Google Analytics, MixPanel, Intercom, even Slack. The idea is to give the investor a very clear heads-up on exactly what the current status of the company is, including even clips about them from the news and social media, backed up with real live data that can’t be faked, or “massaged” or sugar coated.

On the other hand, all the great data in the world isn’t very useful if you can’t contextualize it and use it to make better choices. That’s why Decissio will be more than just a data platform- it will be a decision engine that helps investors to get actionable advice about investment decisions. We will do this by learning from the way investors use the platform, and, over time, by widening our understanding of data trends and their relationships to the industries in which our investors work.

Over time, we will be able to build an engine that deeply understands the trends in the market, and provides actionable advice to investors, and eventually to startups as well- helping them to calibrate their expectations for investors based on the real situation.

Without revealing any secrets, what was the thing that surprised you most, after talking to over 20 VC investors about their decision making processes?

The fact that many of them aren’t really as organized or as systematic as you would expect, given the power they have and the amount of money they manage. In the end, we are all just people- and investors are just like everyone else (although they may not see themselves that way).

Most of them do not have strong data solutions, and I was astonished by how much of their decisions were based on gut feelings. That serves them well and our goal is not to suplant their judgement – at the end of the day they still make the decisions. We want to enhance their gut feelings with data.

This is sort of like using AI for medical diagnostics. The AI is very good at recognizing patterns in data. But just in data. An AI can’t tell you if someone is lying by the look on their face (at least not yet), and an AI doesn’t have a lifetime of connected experiences that inform its judgement about people, the way a person obviously does.

So we don’t seek to change that. But we do seek to help in situations where judgement is clouded by our misunderstanding of data.

I will give you an example: in the 1990s, studies were conducted by researchers at Cook County Hospital in Chicago about triage decisions in cases of suspected heart attack. What the studies found was that the questions that physicians asked patients they suspected of having had a heart attack were actually making them less likely to give a proper diagnosis. For instance, asking a patient whether they have had a previous heart attack, according to the data, does not help a physician to diagnose the patient. And yet physicians always asked, and that changed their standard of care.

The result was a decision chart that was implemented around the world, in which doctors were instructed to only ask specific questions that helped them make a determination of the best care for the patient. The result was a rise in the response time, and the success rate, of treating heart attacks.

The physicians, at the end of the day, still need their judgement to understand how to treat the patient, how to talk to the patient, how to assess them, and what not to do. But it turned out that in this specific case, having more data didn’t mean making better decisions. Not all data is good data. So having AI as a backup for human decision making processes is very important in a data-filled world.

You talk in your pitch about “decision fatigue.” Can you explain why this is such a big problem, and why investors should be particularly concerned about it?

Our minds have a limited capability, and there is simply no way around that. The only way we can go about it is to acknowledge our limitations and let advanced tools help us when possible.

We make around 35,000 decisions a day. And each of those tiny choices is a mental effort. It can tire us and stress us out. Mistakes earlier in a single day can affect your thinking for the rest of the day. A bad experience 10 years ago can negatively affect your decision making today. We can all relate to that experience.

You make around 35,000 decisions a day. No wonder you're tired - Sy2016/2 Startup: https://decissio.com/ Share on XDecision making stamina is of limited capability so it is important to use it wisely. Several key decision makers of our times including Obama, Zuckerberg and Steve Jobs handled this by eliminating small decisions – such as what should I wear today, by having the same type of outfits ready for them daily. As trivial as that sounds, that ensures them one decision less per day, which in annual terms compounds fairly well. Not feeling the stress of wondering if you’re dressed appropriately can be a huge relief.

Investors are prone to decision fatigue since the nature of their work involves large sets of daily decisions. In addition to that, all their investment decisions are important. Deal flow management, term sheet structuring, hiring and firing can all take a toll on the day of a investor. As these decisions may or may not break the firm, if they make bad investment decisions surely places them in a dangerous place. And the thing is, having a bad morning can cause you to make a very expensive mistake later in the day. It’s very random.

So we help them by eliminating some of that burden- at least the part that they have the least control over to begin with.

How will investors use Decissio to make better decisions?

In an investment decision there are inputs that come from the investment specification. A VC receives startup data, due diligence, market research and financials as inputs. Then there are the key performance indicators that are results coming from the operation of the company.

Decissio correlates successful outcomes with positive inputs to give investors hindsight advantage, before they decide to go with an investment. We use decision trees and self-adjusting regression algorithms to connect these factors in a way that was not possible before. That means an investor has the benefit of experiences they don’t personally have- Decissio will be able to recognize trends no human will notice.

Before the investment is made, Decissio performs a pre-screen where it looks at ratios of data provided and whether they make sense. It cannot always determine if something is wrong or right, instead it raises red flags for the investor team to go and analyze thoroughly.

Our algorithms learn from hundred of running investments therefore the network effect that they benefit from is massive. We place that massive power back in the hands of individual firms.

What about startups. Many mentors cautioned you that startups will be disinclined to use Decissio, because it seems too intrusive. What will change their minds?

Artificial Intelligence, blockchain and data driven companies are revolutionizing how business is done across industries. The revolution is already here and we have to get investors to join it. Not every investment firm has the funds to build their own data teams and solutions. We have built an easy to onboard tool that’s intuitive to use. Using Decissio saves far more time and effort, not to mention money, than the efforts it requires to onboard a company in the platform.

That being said, our belief is that startups will eventually welcome this kind of process, because it will be much more transparent, fair, and informative for them. They won’t be wasting their own time chasing investors who aren’t interested, and they’ll be able to see clearly what investors expect, and what’s wrong with their own numbers. To us, that’s a win-win situation.

What are your goals for growth in the next year or so?

We are moving in full gear towards the first MVP which will be ready in early spring for alpha testers. We want to expand our reach to 100 venture capital and private equity firms by the end of 2017. We are currently working on this and we value our connections highly. Our goal is to learn, grow and serve our investor needs the best possible way.

The MVP should be an instantly useful and actionable set of data and insights that an investor can refer to on a daily or hourly basis, that not only assures they are informed, but also keeps them on their toes, and questioning their underlying assumptions. That’s the initial success condition we want to meet.

How about long term? Where do you see Decissio as a company in 5 years?

Our goal is to scale our technology to serve hundred of thousands of investors and decision makers globally. As soon as we have a stable product in terms of revenue, we are planning to expand our reach into other industries. Learnings from early stage investing, where the data is quite loose and fluid, will help us in tackling more staid industries, in which the data are more stable and predictable.

Our goal is to saturate all fields where collective decision making occurs. Being a part of a startup you always can plan, however the environment is constantly shifting so one needs to be flexible. What we are doing within is creating scalable process and methods from the get go, that allow us to scale quickly

You’re our second startup from Kosovo. Can you talk a bit about the unique experience of starting a company in that region? What are your unique advantages and challenges?

I’m proudly the second one from many to come.

We were lucky to have [StartupYard 2014 startup] Gjirafa’s success coming before us, they really paved the way for us and other startups to start working with StartupYard. This is my second started startup in the region and I have learned so much during the process. If we are dealing with online solutions then it becomes easier because you can market your products anywhere.

On top of that the government does not interfere, so you can enjoy not having to deal with bureaucracy. Kosovo has one of the youngest populations in the European continent. However, our crumbling education system does not produce candidates that are ready to join the job market, leaving professional training to companies. In a sense that might sound like a disadvantage but we have a high employee retention rate, which is important. Young people in Kosovo highly value their work relationships.

Last but not least the standard of living is lower than in most of Europe, therefore if carefully managed, companies operating there can become cost leaders.

How has your experience with mentorship been so far? What surprised you? Which mentors had the biggest impact?

Starting off the acceleration program I was quite stubborn and persistent in my ideas, which is a trait a large amount of startup founders have. In order to go anywhere worthy, one must be persistent.

However mentoring session had a very humbling effect on me. We had the chance to speak with many well known professionals who are kings on their fields of work. Including several high level executives that manage important decisions and millions of euros. That shifted my perspective from a “I know a lot” to “listen and learn” attitude and it served me very well. I became very equipped with knowledge I would have no other way managed to get in such a short period of time.

In addition to sharing advice, mentors have very important professional networks that if you work with them, they would be happy to open up for you. Mentoring sessions in StartupYard I would say introduce an upcoming entrepreneur to the crème de la crème of Prague.

Everyone here really wants you to succeed and of course you never want to let them down.

How has your experience been with acceleration at StartupYard? Did it match your expectations?

I only heard great things about StartupYard before coming here and initially I was thinking it’s probably okay but most of it is going to end up being hype.

I was wrong, StartupYard managed to surpass all my expectations. The teams are so diverse, the staff itself is super knowledgeable and helpful. There is a no-bullshit atmosphere here and everyone is really pushing the hardest that they can. The clock on the wall has a sticker that says “Need more time? – Sleep faster!” and on the first week here I thought “That’s funny” – now I realize that it’s so true. I haven’t found a way to sleep faster yet though.