Meet Piixpay: Instant Crypto to Fiat Conversion

Piixpay is the first startup from Estonia attending our program. For the past 3 years, Piixpay has built a payment infrastructure to make the bridge between crypto and fiat as easy as a bank transfer. Transacting in crypto-currency can still be difficult and the volatility might deter a few companies from accepting crypto-currencies as payment vehicles but Piixpay has solved this by allowing real-time conversion to fiat..

Initially used by individuals to convert their crypto, Piixpay now sees more and more interests from eshops and crypto companies (exchanges, wallets) alike.

We sat down with Hannes Kree, the co-founder and CEO of Piixpay to discuss more about how Estonia is positioning itself as a crypto nation and how Piixpay intends to be a major player in the payment industry.

Hi Hannes! Tell us a bit about your personal journey towards founding Piixpay. How did you get here?

Initially, together with my partner, we launched a mining facility in 2014. Little-by-little we realized that we cannot hold all our crypto profit as we had to pay bills, which are of course in EURO.

We used exchanges to convert our crypto to Euros but our orders filled dead slow. On top of that, as the market volatility grew, and prices fell – we were losing money. We had to find a solution to make simple crypto-to-fiat payments.

And this is how Piixpay was born, where we do crypto-to-fiat transfers instantly and securely.

The instance and security are our focus from day one. No more exchanges, no more waiting, simple Euro payments with crypto just like your regular bank.

Moreover, it came really from our personal needs and it turns out that others share the same need. Now, with growing users we are at full speed.

Our long-term vision is to create a simple bridge between crypto and fiat with our infrastructure products. Imagine a platform where users transact in whatever currency they like and store their wealth like a modern crypto-bank

How long have you been involved with crypto and how has the landscape changed in your mind?

I started in 2013 when I bought my first mining machines. Back then, crypto was considered a hobby. The community was small and there were not many channels to gather information. Bitcointalk was one source, and some of our Estonian mining crowd. I believe crypto really got mainstream in 2016. This is when the technological and investment ecosystem really developed. It was the time when cryptocurrencies came out of the cellar.

Bitcoin especially stopped being connected only with Black markets. In 2017, during the ICO Boom, we saw a huge generational move. You see, we live in a very much digital penetrated society, soon ruled by young people. Nowadays for Millennials, crypto is the native asset to store value and transact.

On the other hand, Blockchain technology was recognized on a high corporate level. It is evident how much has been built for the past 2 years. We also see that some governments are embracing it and making regulatory frameworks. Of course, It’s not all rainbows. Cryptocurrencies are still used for ransoms etc. But nevertheless, the community and technology matured, and I think this is just the beginning.

The Piixpay Team

You are from Tallinn, Estonia. Why are so many crypto companies coming from the Baltic countries?

I believe the case, especially for Estonia, is because of our e-government. 98% of Estonian services can be done online. With a combination of good IT talents and legislation, this gave a green light for many crypto companies. In fact, many acquired crypto licenses. That’s all good, but soon they have to comply with the new regulations. The good news is our Financial Inspection is working closely with the Estonian Cryptocurrency Association. We take an active role there to steer the dialogue into a fair and prosperous environment for blockchain startups.

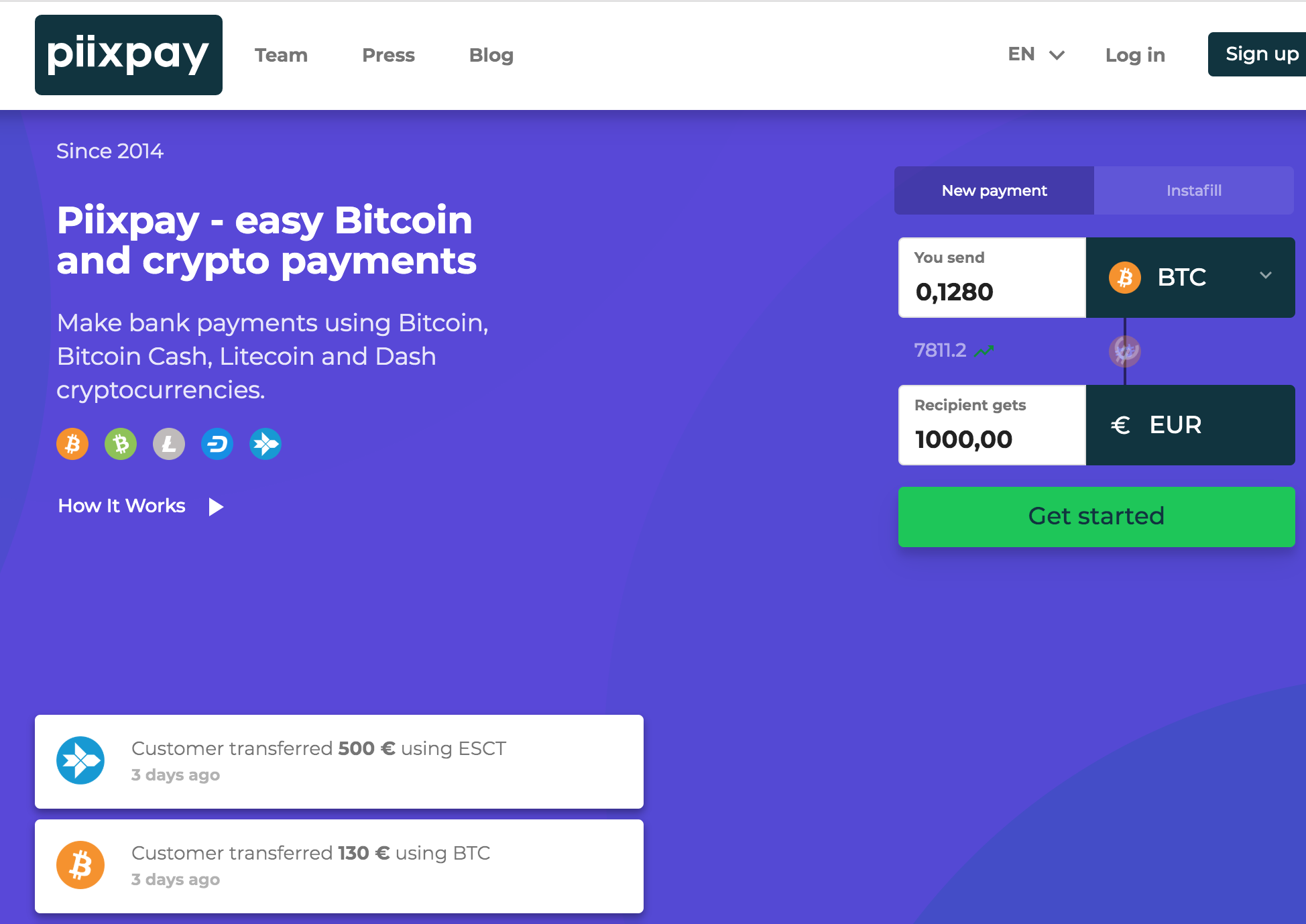

The Piixpay interface

What prompted you to start developing Piixpay? What did you see as fundamentally wrong with the way crypto to fiat payment work online right now?

We saw several problems and inefficiencies in the crypto-to-fiat payments.

Here are the two main points.

Firstly, customers find it difficult to transact with service providers. This is because those service providers don’t accept crypto.

That leads to another problem. These customers have to find a proper exchange to convert.

Let’s see they found it and now they have FIAT in the exchange. Now they need to make a transfer. But they are realizing that they cannot make transfers to 3-rd parties. And even if they do that leads to another problem, which considers banks. These transactions are automatically flagged as suspicious and now the customer is facing suspension. You see it’s a chain of events which show how the crypto and fiat world are divided. Not to mention the many unbanked people any cannot find any stable currency they can transact with you.

Which leads to my second point. Why service providers don’t accept crypto – it’s simple, it’s too volatile. How much did the Bitcoin price change per day? It goes up and down all the time but businesses want stability.

And this is where Piixpay comes into play. We allow the customer to pay the providers with crypto (Bitcoin, Ethereum… you name it) and on the other end, businesses receive and store EURO.

This is all done in a convenient experience for the customer and in a fully regulated and safe environment.

Tell us more about your team. Why are you a good match for this project?

We have known each other for many years and our friendship started before we decided to become colleagues. We have complementary skills and have been in crypto since 2013. Our technical lead has been developing security software for big Telcos. From AML/KYC we have one of the best intelligent officers in Estonia with vast experience with banks. Finally, we have a dedicated sales and business developers with international experience. This is crucial if you want to develop a world-class product.

The Piixpay team

What have been your team’s biggest personal or professional challenges in making this project a reality?

In the beginning, we had legal problems since cryptocurrencies and blockchain technology weren’t understandable. After overcoming this we had to build a top-notch security system. That meant that we need dedicated servers and autonomous power. Now, I am proud to say we achieved the highest level of security without hindering our customer experience.

What do people need to get started with Piixpay?

Just go to https://www.piixpay.com and sign up. Registration and KYC are quite easy. In no time you will be able to make your first transfer.

Who are your customers today and what kind of volume have you processed in 2019?

We processed around 20 Million Euros last year. This is another record for us.

As for customers, we see two main groups.

Private ones.

– Individual traders and crypto holders

Business clients include;

– Miners,

– Wallet providers

– Blockchain Developers

– Gaming Companies.

Also, we see start to see interest from institutional investors and hedge funds.

What do you think is the biggest problem right now in the crypto market, and how does Piixpay help solve that issue?

I see as the biggest problem the interoperability both in crypto and fiat world, but also on a protocol level. By that I mean that still, crypto is not quite streamlined to the traditional financial system. And on the protocol level, the connection between chains is not good, not to mention the connection to external systems.

I can also add to that the lack of education and misconception. For instance, people still consider Bitcoin a scam. But it’s all math there, a protocol just like the internet. This is very needed to be communicated in order to see mass adoption.

As mentioned previously, we want to make Piixpay a crypto bank. A place where businesses and consumers will transact freely. This is how we are solving the market issues.

You are for the first time in an accelerator. What did you expect from the experience, and how has that compared to reality? What has been your biggest challenge in the program?

Essentially, the program was very useful for us in several verticals.

Firstly, we connected to the CEE Blockchain ecosystem. Furthermore, we established vital relationships with investors, while preparing for our next round.

I think one of the key aspects is that the programme is intense but not *too* intense, giving us space to develop our ideas, follow up on business opportunities and run our business as usual as much as possible. Some of the encounters with mentors are leading to large e-commerce players which is very important for us to scale. Finally, we love the StartupYard team and Cedric’s sense of humour.