The Sales Trainer’s New Best Friend: MindBoxVR Reveals Open Beta

/in Startups, StartupYard News/by StartupYardSales Trainers know the value of real world experience. But how can they provide it to large groups of trainees in a limited time? Mindbox VR, a StartupYard Alum, has the solution, and any sales trainer can use it today. Peter Tomasovic, CEO and Co-Founder of Mindbox VR, is a StartupYard alum from Batch 8, focusing on a VR solution for sales and customer service training. Mindbox started out as a tool to help mental health professionals treat the symptoms of phobias, such as a fear of heights, or of insects, using VR simulations as a form of immersion therapy.

During the StartupYard program, the Mindbox team hit upon sales training as a novel use for their VR technology, which allows non-programmers to quickly and easily create scenarios for sales and customer service training sessions. The biggest advantage of using VR for these purposes is that it simulates a real-life experience, and can also be used to generate statistical data that sales trainers can work with to improve the performance of trainees with time. Plus, MindboxVR can be used to train many people at once, and even after the training for skill reinforcement.

You can check out MindBox’s open beta now by clicking here.

I talked with Peter this week to find out how MindBox got to where they are.

What have been your biggest challenges since the StartupYard program? How have you solved these?

Our biggest challenge has really been to find out what our customers really need from Mindbox. Separating the “nice to have,” from essential is super important to be able to deliver something that works on the first try. Our customers don’t always know exactly what will be the most necessary features, because most have never used this technology before, so it’s a process of discovery for all of us.

When we were at StartupYard, lots of companies wanted to work with us on the process of validation and experimentation, but in the end they want to have a useful delivered product, so you have to get it right.

Slovak entrepreneurs Peter Tomasovic (right), and Andrej Rybovic (left), Co-founders of Mindbox VR.

Another challenge was to hire new people versus do-it-yourself. When we counted costs for new people, onboarding, learning them technology, understanding product specification, we decided to develop the first version ourselves and use external experts only when solving specific problems or for feedback. This allowed us to move more quickly short term, but it will be a challenge then to scale up the team and delegate when demand is increasing.

How did you arrive at the set of features you have now, and what do you plan for the next iteration?

For the current set of features, two sources of information were most important:

- companies and training agencies (customers)

- our advisors

In the case of potential customers, the Pareto principle worked for us. We met with lot of companies, 80% of them gave us “standard feedback” and lot of brainstorming, which was mostly distracting. The other 20% gave us what we have now – a set of features, idea of the scenarios that could be interesting, company use cases. And what is important, is that we are still in touch with these companies and they are now strategic partners.

It is a learning process to understand which prospects are going to be your real customer, and which are going to distract from the development process. We are still learning this.

Our advisors gave us key support here. During StartupYard we met 3 great people, Serge Dupaux, Jana Zurkova, and Silvia Pánková – experts in the fields of HR, business development and sales. We have regular meetings, we had a one day workshop, where we defined a customer journey with the key product features, etc.

For the roadmap and next iterations, we have a set of features from meetings with companies or analysis of competition. But most important for us is to make pilot implementations and find out which features are really crucial. That is the reason we are right now focusing on selling and looking for partners.

What kind of people can most benefit from MindBox VR?

MindBox VR is like a swiss knife for every sales trainer in customer service, product training and sales training.

Unlike most training solutions, MindBox VR is about interaction and immersion. It allows a trainee to interact with voice and reply to a virtual customer. The physical act of doing the interactions repeatedly is many times more effective than just listening to a speaker or reading about the techniques.

Once a training program is created by a sales trainer in Mindbox VR, it can be started on any Android device, but also in a VR headset. Currently we are supporting mobile VR headsets like Gear VR or Google Daydream. This makes it really easy for a sales trainer to deliver their program with whatever equipment they or their clients can afford.

If you want to train customer service, you can prepare a training where virtual customer asks you typical questions. They can be standard, like questions about warranty, transport, returning product. Or the can be more “tricky”, like “This product is very cheap. Isn´t it a fake?”. The trainee has to reply to such questions. The mix of standard and non-scripted interactions helps employees to internalize the company policies and best practices, and to be more comfortable in unexpected situations.

So why should a sales trainer use VR instead of more traditional methods?

The key is repeatability and a systematic approach. We all “know” how we would act in some hypothetical situation. But in actual truth, we don’t really. When you are in a real life scenario, there are a million complicating factors to consider, so having the learned experience is the best way to help people be prepared. However, simulations using real people are often less realistic. Co-workers know each other and are often friends. Co-workers want to help each other, naturally.

When you do play-acting in sales training, the situation is never the same for each participant. It might work for some, but not for all. VR allows us to replicate a specific situation very precisely, and apply systematic testing and feedback on performance. The human approach is still critical, as we are talking about soft human skills, but VR can support this with a data driven approach on top. We don’t want to replace trainers or in-person training, but to augment it with easy-to-use software tools.

Moreover, sales trainers can set keywords in conversation – critical words that must be said by the trainee when replying. Practice makes perfect, is the saying. Most important about training with MindBox, is that the trainee has to speak, and really answer questions. It’s not just a dumb script, but a simulation that feels real, and that can change according to what the sales trainer plans.

This way, you are not developing only knowledge (like when he is reading or watching a slideshow) but also skill, because you have to think about the information in a sentence and actually come up with the right answer for that specific situation.

After the training, trainers will see statistics, reports and complete transcripts of communications with customers, so they can deeply understand what is working, and what needs more work.

Are you looking for funding or more partners? Who should contact you?

We are in touch with some VCs and investors, but for them it’s most relevant to have traction and signed contracts with customers. That’s especially true because this technology is so new to the market, and the market has to be proven.

Therefore most important for us right now is to acquire more early customers and partners who want to really improve their training processes and be among the best in the industry. We have an open beta version, and sales trainers can start training from day one.

We also have 2 example trainings, which a trainer can easily adjust for company needs and start training quickly to see the results. The most relevant first contacts are HR people responsible for corporate training, learning and development, as well as independent professional sales and customer service sales trainers. Heads of sales and those in charge of personal development programs will also find a lot of value in what is available today.

StartupYard is Looking for Founders!

Are you a startup founder ready to accelerate your business with CEE’s best network of top mentors? StartupYard’s Batch X Open Call has started.

Our focus this round will be on Automation, Blockchain, and the Future of Work. If you’re working on a hard problem involving Machine Learning, IoT, Identity, Payments, Security, or Decentralization, then we want to hear from you. Find out if StartupYard is your key to a big future.

Announcing Batch X: Automation, Blockchain, and the Future of Work

/in StartupYard News/by StartupYardRamez Naam: 3 Ways We Fail At Predicting the Future

/in StartupYard News/by StartupYardLast week in Prague, the famous inventor, sci-fi author and speaker Ramez Naam gave a talk about one of our favorite topics: Exponential Innovation, under the auspices of DirectPeople. Ramez Naam is not only an award winning author, he is also a veteran of Microsoft, the holder of 19 separate patents, and the founder of Apex Nanotechnologies, which is the first company to create software tools for molecular design.

The partnership is fitting, as DirectPeople works with companies and startups to realize innovative new projects, building teams around new ideas and executing them for banks, energy companies, and telcos, as well as smaller firms. (Full disclosure: Petr Sidlo, CEO at DirectPeople, is our mentor, and Phillip Staehelin their Innovation Evangelist is our mentor and investor.)

The talk centered around an introduction to exponential thinking, much like those we have written before. What really stood out from the talk however, was Naam’s particular attention to the reasoning that so often fails to predict radical changes in the business and technology landscapes. As important as the exponential innovation framework is, we must put it in context with the logic that has failed to match it over and over again.

The talk was a long one, so I’ve chosen to focus on 3 key errors that perpetually lead industries as well as individuals to dramatically underestimate the effects of innovation over long periods. As Naam pointed out in his talk,

3 Ways we Fail at Predicting the Future:

First: Disruptive Innovation Comes “Bottom Up”

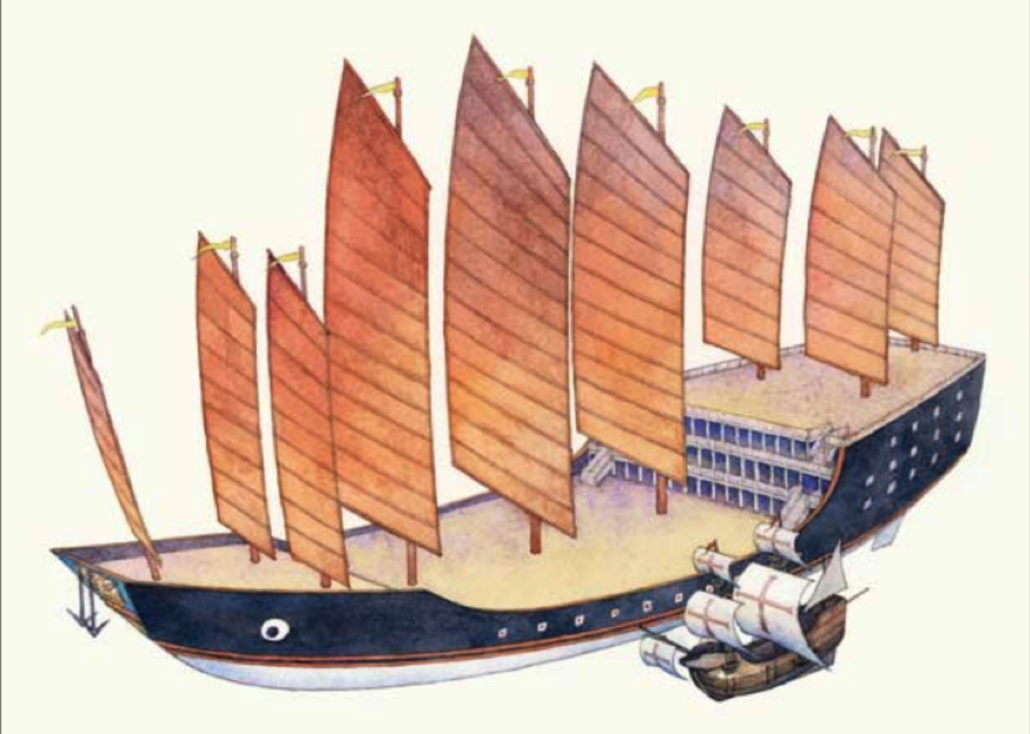

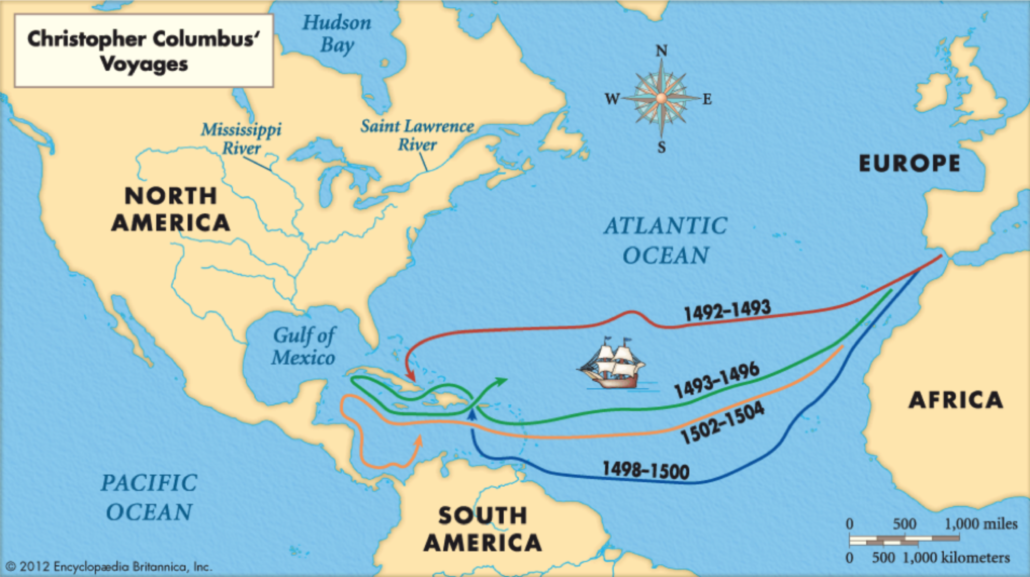

One of the key analogies Naam used was the broad history of world empires beginning around A.D. 1400-1500, with two key events: the European discovery of America by Columbus’s fleet, and the exploration of South Asia by Zheng He of China.

To scale: the flagship of the Chinese fleet of 1400 (larger), and the Santa Maria (smaller).

Though the two events bear remarkable similarity in their timing and boldness, there the similarities end. Columbus’s voyage was an accidental success. Attempting to circumnavigate the globe with too little food and resources, his fleet was saved by the accidental discovery of Cuba, a fraction of the total distance to his actual target, East Asia and India.

Zheng He, on the other hand, commanded the most technologically advanced navy in the world. His ships made Columbus’s tramp fleet of the Nina, Pinta, and Santa Maria look like bath toys in comparison. His expedition was well planned and financed, took much less risk, and made much more important near term discoveries for China in the form of large potential trading partners.

Yet, Columbus’s voyage set off an imperial age in Europe that lasted for nearly 5 centuries, and saw the colonization and Europeanization of most of the world. Zheng He’s 25 year exploration of South Asia and East Africa ended in the burning of his fleet, and the closing of China from the outside world for another 4 centuries.

Why these two vastly dissimilar outcomes? Moreover, why did the results of a well funded, professional, and government backed expedition (that of Zheng He), result in nothing of significance, when the poorly funded, badly planned expedition of Columbus ended in Spain’s domination of South America for hundreds of years, and Britain’s eventual domination of half the world?

Top Down V. Bottom Up:

There is one key differentiator: China’s exploration of the known world was a top-down affair, instigated by the emperor, and carried out on behalf of China’s leadership. It was essentially a government program/ Meanwhile, Columbus’s voyage was backed by Queen Isabella of Spain (after other monarchs turned it down), but she served as little more than a financier. The project was from the beginning a bottom-up effort by Columbus, and would have been doomed to failure and the death of the entire fleet, if not for America conveniently sitting between Europe and Asia. Columbus lucked into a discovery that eventually made him rich and famous. He took the key risk (with his life), and so he also owned his share of the rewards.

Again, Naam directs our attention to the effects that leadership structure had on the resulting discoveries. While Zheng He returned to China a hero, his discoveries and fleet were the property of the Emperor, who chose simply to dismantle them, rather than to take the risk of engaging with foreign trade and potentially coming into conflict with foreign powers. To China, the fleet represented a cost and risk that was evaluated based on the status quo. Since the voyage proved that China was the most powerful nation on Earth, the Chinese saw no more reason to engage with the outside world and risk their already safe position.

Stability Becomes a Liability

Columbus was in a weaker position from the beginning. So why did he win? Naam argues that it is because of the inherently competitive nature of European politics at the time. While China was unified under the Ming Dynasty for 3 centuries (from 1368-1644), Europe’s political landscape was inherently unstable, and composed of hundreds of individual state-like entities, with nobles fighting for position and consolidating control of their regions.

It was that instability which made it difficult for any one government to back Columbus, and it was the need for a competitive advantage that drove Isabella, who had only just united Spain under one ruler, to fund him. The price of not having state control of the expedition was that Columbus himself (along with the explorers and conquistadors who followed), personally profited from their efforts. A traditional of entrepreneurial exploration was established because Europe could not afford to publicly fund it.

Thus, Columbus’s voyages were highly disruptive to the established order because Europeans were desperate to gain competitive advantages over neighbors. Meanwhile China, the strongest nation in the world at the time, had no such need. In fact, quite the opposite, as opening itself to trade only served to destabilize China when it eventually did realize it could no longer afford to remain closed. It was finally Britain that forced the opening of China and established Hong Kong as its trading colony in the late 19th century.

One does not have to look too hard here to recognize the tech startup and the modern corporation. Stability for its own sake can turn to a liability over time, as hungry younger competitors adapt too quickly and are too numerous to be stopped.

Second: Exponential Innovation is Deceptive

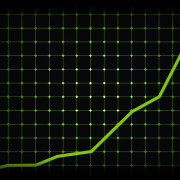

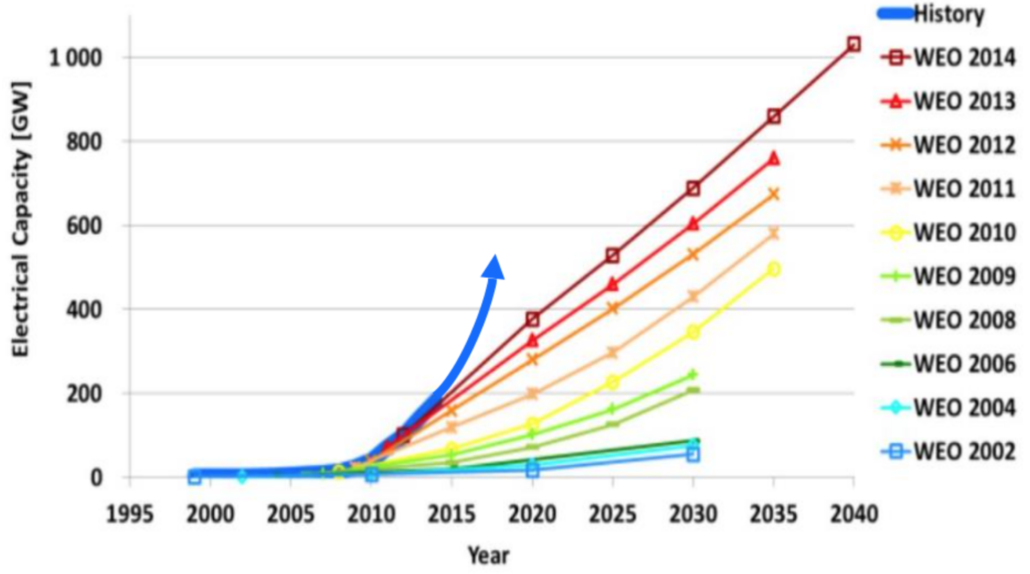

Naam spent a lot of time covering the ways in which exponential innovations deceive people into seeing them as always just about to slow down. This is because the fundamental drivers of innovation are often mistaken as being the same as they were before the exponential growth curve took effect. He shared this graph, for example:

The graph shows a classic exponential curve in the electrical capacity of solar power from roughly 1998 to 2014, along with the World Energy Organization predictions of future growth. As is plain to see, every single prediction over 12 years shows static growth, but realigned from the new actual baseline in any given year. Every prediction is not only wrong, it’s wrong in exactly the same way.

Why would that continue to happen for 16+ years in a row? Surely someone at the WEO might notice it happening and try to figure out why?

Exponential Innovations are on a broad front:

Naam provides a partial answer in this blog post on the topic. He points out that predictions typically take a snapshot of the industry at the present moment, and extrapolate expected advances based on what appear to be limitations to growth that are non-surmountable without a step change in the technology or the underlying economy.

This works most of the time, because most of the time the specific conditions for exponential innovation aren’t met. Namely: that advances in different aspects of a technology produce feedback to affect growth in other areas. Innovation is happening on a “broad front.”

In this particular case, the reason the predictions are wrong is not because their underlying assumptions are inaccurate, but because they are about the wrong things.

For example, predictions of the slowed growth of solar energy may point to theoretical limitations in the materials being used to make solar panels. Indeed, solar panel efficiency is not growing as fast as it did in the past. Instead, as Naam points out in his post, the manufacturing methods are improving faster instead, which is compensating for the diminishing returns of material science advances.

This effect repeats itself over and over again. If it isn’t manufacturing, it’s software. If it isn’t software, it’s infrastructure changes. If it isn’t that, it’s changes in the consumer business model that accelerate growth. The growth in total wattage keeps going up exponentially because all these advances are driving each other forward at once.

Third: Exponential Innovation is Democratizing

On the last point about innovation around the economic models of new technologies, Ramez Naam took special care. He argues that exponentiality of innovation depends on the technology’s ability to be democratized over time.

In fact, in reference to solar power, he used Nuclear energy as a counter-example. Despite the enormous efficiency and effectiveness of modern nuclear power, it is failing to keep up with solar energy in the growth of its footprint. In fact it is declining. Predictions by Isaac Asimov and many others about a nuclear future in which atomic cores power watches and handheld computers, or even body implants, are now severely dated.

Why is that? Naam argues that it is because Nuclear power is difficult or impossible to democratize. Simply because of how it works, and its ability to be weaponized, atomic power must remain under the control of governments. This means that the core technologies involved with nuclear power have fewer chances to influence other areas of technology growth, and vice versa. Nuclear grows in a kind of parallel, where advances don’t greatly benefit other technology areas, and so other technologies don’t arise to create demand for new innovations.

Nuclear is not doomed because the technology doesn’t work, but rather because it can’t be enmeshed with other businesses and technologies. Like China’s great navy in 1400, nuclear is a state operation: it can’t be democratized because it is too dangerous.

If we go back to the previous example of Columbus and Zheng He, we see that a classical prediction would state that the Chinese technical superiority would allow them to predominate or to catch up quickly with the west. But what actually ended up happening was that the west innovated around the business model of exploration first, and the attractive monetary incentives led a revolution in technology that profited from the scalable finance model that colonization had created.

Consider the fate of nuclear vs. solar power in that context. Nuclear is far and away more complex technology. The only problem is that might not matter. The innovation that advances on a broad front and permeates society will win out.

By the time the British Empire came into direct conflict with China, it was the English who had developed the use of colonies as markets for their own goods, rather than a source of resources for the use of their own governments or ruling classes. Thus the English could afford conflict with China, because colonization was immediately profitable to those involved, rather than to established players only.

Indeed, this innovation is what made the American revolution the opposite of a disaster for England. Because England had repurposed itself as the workshop of the world, the growth of American power and economic strength helped the British empire to finance itself through trade with America. Britain had innovated away from the old definition of an Empire through mercantilism and trade. The state did not have to directly fund exploration and colonization because it shared the profits with the colonies themselves.

The English democratized economics itself. That was the innovation. It was one China still struggles to match.

So too with solar energy: solar power can afford to compete directly with traditional sources because it brings the benefits of the new technology closer to those who will profit from it. Even when solar was not at cost-parity with traditional fossil fuels (which is no longer true), it was cost effective for those who adopted it, because they saw the benefits personally, and over the long term. The risk of adoption had an appropriate reward.

Unlike with nuclear power or coal, which require long-term up-front investments far from view of those who pay for them, solar is a source of energy consumers and businesses can own themselves. This means they’re increasingly likely to invest in it, and to see less risk in doing so. The technology is thus democratized, and suddenly it can be the basis for knew, previously unimagined products or businesses.

The innovation can be in the business model this makes possible: not always in the technologies that underwrite the growth. Exponential Innovation shifts streams and goes around obstacles, rather than charting a straight line in one area. Thus predictions from the WEO may accurately represent technological limitations, but still fail to predict growth because they are using an outdated economic model.

Is There a Better Way to Predict the Future?

On the one hand, if predicting the future were as easy as a new mental framework, then everyone would be doing it already. Yet on the other, we can avoid making the same wrong predictions over and over by paying attention to what causes an exponential growth cycle in a particular industry or technology.

One of the key takeaways for me from Ramez Naam’s talk was that exponential change occurs primarily where there are multiple axes of advance being explored at once. If one hits a wall, another can cause the technology’s adoption to grow any way. What is inherent in an exponential growth model is that growth never depends on one particular characteristic of a technology, but rather on the overwhelming incentives it creates. People want it to grow, and so it does. That was the fundamental insight of Moore’s Law decades ago. Limitations we recognize as crucial today can become meaningless tomorrow, because the incentive structure for innovation is self-feeding.

Singularity University uses a framework called the 6 “D”s (also used by Ramez Naam), namely: Digitized, Deceptive, Disruptive, Demonetized, Dematerialized, and Democratized. In broad strokes, they argue that an organization or industry becomes exponential when the following conditions occur:

- Advances are based on an already exponentially scaleable platform (ie: computing, or energy generation)

- Advances appear to be insignificant or even slow at first, although capabilities are doubling and redoubling on small scales.

- Advances begin to outperform existing solutions at sub-scale (eg: Solar vs. Coal)

- Cost falls as demand rises.

- Advances become commoditized and ubiquitous.

- The underlying technology becomes commonly achievable and can be applied anywhere.

Given these conditions, a technology may reach an exponential growth curve, and if we recognize a technology that begins to fall into this particular virtuous cycle, we must closely examine whether or not traditional predictive frameworks of the future remain useful.

OptioAI On Their Journey from StartupYard to Techstars

/in Life at an Accelerator, StartupYard News/by StartupYardLast month we announced that OptioAI, a member of StartupYard Batch 8 and StartupYard’s first Georgian startup, had joined TechStars Berlin. Techstars is the world’s largest accelerator network, with over 1000 invested companies, and $3.3bn raised over the past 12 years. OptioAI is through the first month of the program already, and will present at the Berlin DemoDay on April 19th.

OptioAI joined StartupYard with a plan to create a text-based finance management platform for millennials who weren’t seduced by traditional banking (which is to say, most of them). Today their core mission remains the same, and has evolved to become a text-based platform that “makes your money talk to you,” by connecting users with their financial data in a natural way, via voice and chat.

I checked in with Shota Giorgobiani, Co-Founder and CEO at Optio, to find out how the Techstars program is going. Here is what he had to say, this time via email.

Were you surprised to be selected for Techstars right after the StartupYard program?

The funny thing is, applying to TechStars started more as an experiment.

We’d heard how hard was to get to Techstars. Techstars does not officially publish information about the number of applications they get for every batch, but rumors say that only 1-2% of initial applicants get to Techstars and the number of applications per program can be near 1000.

Furthermore, Techstars generally accepts only 1 or 2 early stage company per batch, so it looked almost impossible right from the beginning. Our goal was to understand how the process works and prepare for the future when we would be “ready,” but as always, you never know when you are “ready” and what “readiness” means. So we ended up by being selected for Techstars Berlin, which actually is a great outcome of the “experiment!”

How does the application process work?

The first part of the selection is pretty much standard: you send your application, you are shortlisted and then have a Skype call. If you are in the final round, you are invited to selection day.

Some cities have 2 meetings with startups and some just one, but overall it’s the same as at StartupYard. The main difference is the final selection process: It’s not like a “traditional pitch” competition, or a series of one-to-ones, it’s more a face to face meeting with the whole selection committee.

We had 2 meetings, each for 15 minutes with 2 different groups. The idea of this meeting for Techstars team is to get to know the team. It’s a known fact (and it’s true not only for Techstars) that most of the time, especially early-stage startups are chosen because of the team, not because of the idea or product. And when I mention team, not only the credibility of the team is important (like how many years have you been in the industry), but also if the team can be managed and helped to make better decisions or not.

This was something we really improved on at StartupYard: how to listen and to show that you are taking questions seriously; how to engage with debate and not be defensive.

Also very important is to show what you have. No matter if it’s a working product with 1000+ users or mockups of your idea. You should be excited about what you are doing and you should naturally show this excitement. It’s even good to start your talk with the demo (and most of the time – you are asked to do so).

One last thing: 15 minutes is too short period to cover everything. You may be tempted to use up your time talking about your plans, but you should be able to cover most important topics in 2-3 minutes and move to the Q/A part, where you have a chance to show your competence, passion, vision and also show where Techstars can help you. So you should be prepared and be able to manage your time well.

For us, it was a little challenge, because we naturally tend to speak a lot about our company, and you should really train yourself to do it quickly. At the end of the day, it’s all about the match: a personal match between team and Techstars and clear view of how Techstars can help, if any of these is missing, I think you will not be accepted.

How did StartupYard prepare you for taking on this next step? What has been the biggest challenge at TechStars?

I can talk about that for hours, but to be short and clear: I think, based on our current stage, we had little chance to get to Techstars, if we had not been in StartupYard.

There are clear reasons for that: at StartupYard we learned to describe what we do and who we are quickly and clearly. This is a crucial thing, you should be able to explain in 2-3 mins why are you building the company, what are you building, how this team can achieve the goal and etc. And that’s very hard to do, it takes time and practice. Second is credibility: I think it’s very hard to get into the world’s top accelerator just by sending the application. Sure you can, but for us, at such an early stage and being from Georgia, it feels impossible.

Credibility and your network are so important, aren’t they?

Your network is your key to the world! You have to always be building it up and making it stronger.

For example, our story with Techstars actually started in Prague, in StartupYard, where we meet Techstars Berlin MD, Rob Johnson, and had the opportunity to talk with him and tell what we were doing. Rob was there because of StartupYard, so already you can see the network effect.

Rob suggested we try and apply for the upcoming program. When someone tells you that, listen to them! That’s a shortcut to being noticed among hundreds of applicants, because it comes from within their network. It comes with a degree of trust and confidence.

And believe me, if you are not already generating revenue and growing steadily and are still proving that your product makes sense, such a “shortcut” can be your only chance.

Overall, StartupYard gave us a lot of direct knowledge and experience and maybe even more importantly, wisdom, which helps us every day at Techstars.

For example, after one bloody month of mentorship in Prague, we had a very clear understanding of how the process looks and feels, how to prepare for meetings, what to expect from mentors, etc. Having that experience is invaluable when you get to Techstars and it helps you get the most out of the mentors there.

How has the move to Techstars affected your strategy going forward? What do you hope to get out of it?

The main challenges now are achieving strong product-market fit and finding a sustainable business model.

So far we have not changed our strategy overall, but that’s an ongoing process and considering the stage of our company, there can and will be changes. For now, we are still working to give millennials an easy way of managing their money through conversational interfaces. At the end of the program, we want to have good traction in terms of users, the finalized core of the product, a clear vision of our business model and 1 or 2 pilots with potential B2B customers. That’s the plan for now.

Have you made big changes in the product?

Yes, we just released an updated version and lots of changes are ahead.

We decided to focus on the simple, yet very valuable functionality of the product, so we narrowed down our long list of the feature set to something, we believe is valuable for our users on a daily basis. Still, we have to do lots of experiments and see how it goes, but we are now more solid in short-term vision and plan.

In short, we want to create a super simple tool/routine for our users, that can help them with daily money management. No long-term savings goals, no 5-year plans of repaying your mortgage – we are focusing on daily money management. Sounds simple, but as usual, the devil is in the details: if you can’t manage your daily spending, there’s no chance to solve your long-term problems., So for now, that’s our main focus and strategy.

Our Top 3 Reasons Startups Fail: Featuring CB Insights Data

/in Starting a Business, Startup Tools, StartupYard News/by StartupYardThis is going to be a post about what makes startups fail. But first of all, if you don’t regularly read CBinsights and receive their newsletters, then stop reading this post and go sign up. There’s a reason most newsletters don’t have 400,000 weekly readers.

If you do, then you may have seen a bit of content that CB insights has been updating consistently since 2014: The Top 20 Reasons Startups Fail. This is a list compiled from a sample of over 100 “Post-mortems,” written by founders and employees of high profile startups that failed.

The list is ranked by the number of times a specific reason for failure is cited – each post-mortem contains some combination of these reasons:

StartupYard’s Top 3 Startups Fail, and How to Avoid Them

We won’t detract from this piece by hashing out every reason startups might fail. Instead, we’re going to focus on 3 of these reasons, and how to avoid letting them kill your startup before it starts.

Some of these reasons also explain why we choose not to work with some startups that apply to our program. If you’re thinking about applying to an accelerator or talking to early-stage investors, then these are important questions to ask about yourself and your business.

-

Ignoring Customers

Oh boy. This is a big one. For me, this is the big one. The mistake that kills a startup dead like a beautiful rose in a dry vase. Ignoring your customers, refusing to think about them and to be driven by their needs, is the kiss of death.

It all starts so innocently: a humble coder working nights and weekends on a passion project. That’s the way a startup should start, but the nature of a startup is to grow – not just in size but in mentality.

Every startup investor and mentor has had this conversation:

Mentor: who are your customers.

Founder: Well we are our own customers.

Mentor: Yeah… but who is going to be your customer? What do they need?

Founder: They need our product.

Mentor: Why?

Founder: Because it’s awesome. They’ll love it.

Mentor: Yeah but… why your product? What not a competitor?

Founder: Because we are newer/smarter/cheaper/better UX, etc.

Mentor: How do you know that’s what they’re looking for?

Founder: Because we are the customer.

Points to you if you can spot the tautology in this reasoning. I strongly agree that a problem you are passionate about solving has to be one that affects you. In that sense, you should be your first user, you just need to remember that the customer is somebody you can also learn from.

A good way of remembering that is this: you didn’t buy your product. You built it. Your customer will buy it. Even if you both have the same problem, you are not the same person.

Again, it’s essential to create something you would use yourself. It just isn’t enough. Great products involve a deep insight into the motivations of customers; even when that insight is a very simple one, or an instinctual one, it does not come about by chance, but by observation and curiosity about people.

Thinking About Your Customers:

How to avoid this one? It happens that we’ve shared a lot of content on this theme. Positioning for Startups, Bulding a Killer Customer Persona, and The “We” Problem, are good places to start.

In short, it comes down to having a process. Here is one you can try:

- Develop customer focused product/messaging frameworks (aka: Positioning)

- Make educated guesses about your customers in that framework (aka: Personas)

- Test these frameworks with real people and an early product or mockup.

- Redevelop your product and business strategy based on what you’ve learned

There’s not one way to do this, but there are plenty of ways to do it poorly. Not having a clear idea of what you know and don’t know about customers is a mistake that’s easy to avoid. Paul Graham put it this way in one seminal blog post:

“When designing for other people you have to be empirical. You can no longer guess what will work; you have to find users and measure their responses.” -Paul Graham

2. Lacking Passion

“You need passion,” we are so often told. Less often are we told what that means.

I think this is why some founders confuse “having passion,” with “being energetic,” or “assertive,” or “dominant.” These are not the same things.

Passion comes from within – it’s not a performance art; it guides what you say but also how you think, what you are willing to do, and what setbacks you are willing to accept. In short, it’s not about how you behave, but about who you really are.

Everyone has some passion. It’s the thing that keeps you up at night, and bothers you throughout the day. A little voice in your head telling you something needs to be done.

Understanding their own passion is pretty hard for some people. We’ve seen that a lot. We spend a lot of time with founders trying to find out what gets them really engaged and excited about their work. What gets you out of bed in the morning is what’s most important in your work.

One of the first thing we ask applicants to StartupYard is: “Why are you doing this?” The answer says a lot about your passion.

A lack of passion is easy to spot, if you know what to look for. Here’s an overview of the qualities that typically tell us a founder lacks the passion they need to move forward:

- Risk Avoidance: Founders who are unwilling to take risks, such as leaving a job, moving to a new place, or bringing on a co-founder.

- Waiting: The founder who bases their decisions on the actions of others; who waits rather than acts with intention. “I will leave my job if you give me funding.” “I will decide what to do based on what investors say.”

- Focused on Money/Valuation: Some founders who are overly focused on “getting the best deal,” do so because they value control and personal gain more than achieving their stated goals.

- Motivated by Opportunity: I sometimes say: “don’t pitch me an opportunity, pitch me a company.” A founder who talks about getting a piece of a huge market might not be doing what they do out of a love for the work.

- “Win At All Costs” Attitude: In my opinion, this happens when founders confuse passion for ambition. Ambition isn’t a bad thing, but it isn’t passion for what you do- it’s a passion for winning. Your passion for helping customers has to ultimately outweigh your personal ambitions, or else you won’t make decisions based on what’s right for them (and thus your business), but rather what fulfills your ambition.

Seeking your Passion: How do you know you’re doing things for the right reasons?

In my view, this is a simpler question than people often make it. We are taught from an early age that we should emulate those who are successful, but education systems often don’t help us to really understand why successful people are special to begin with: because they have a passion for what they do.

For all the tactics, tricks, and habits of the rich and famous, passion underlies everything. People succeed when they do what they are good at, enjoy it, and are willing to work harder at it than anyone else.

Just consider the following questions if you want to get in touch with your true passion:

- If I were rich, would I stop doing this?

- Are there better uses of my talent?

- Am I waiting to enjoy what I am doing?

- Am I doing this in order to be able to do something else?

If your answer to any of these is “yes,” then you ought to think hard about what you’re doing. You haven’t yet found your passion.

3. Missing Product-Market Fit (PMF)

“When a great team meets a lousy market, market wins. When a lousy team meets a great market, market wins. When a great team meets a great market, something special happens.” – Andy Rachleff, CEO, Wealthfront

Even if you’re doing something you really care about and you’re doing it for customers you understand really well, you can still fail to make the right product for the right market.

Andreessen-Horowitzs has a fascinating post on product market fit, in which they quote Andy Rachleff who developed the PMF framework, starting with what he calls a “Value Hypothesis:”

“A value hypothesis identifies the features you need to build, the audience that’s likely to care, and the business model required to entice a customer to buy your product. “

There are two sides to the PMF equation. Market, and Product. Missing PMF means failing to address a specific market with exactly the right product, at the right price.

Right Market

Andreessen-Horowitz heavily emphasizes finding the right market first, which is another way of saying that you must identify the right problem to solve. If you pick the wrong market, you can end up building a product that people love, but won’t pay for.

This happens more than you’d suspect: plenty of popular products have never gained good PMF. Even mega-popular products like Twitter can teeter on the edge of failure, and take over a decade to achieve PMF (which Twitter seemed to do only in 2017, with their advertising business and focus on media and news).

Other orphans of bad PMF are products like Tumblr, Vine, Soundcloud, and BetaMax tapes. Each of these has either failed, or is now on life-support. The latter example of BetaMax is included in this extensive list from Business Insider. In fact, virtually all the products in this list failed because of lack of PMF. Not because the products were bad, but because the business model didn’t work: the market didn’t sustain them.

The Right Product

“First to market seldom matters. Rather, first to product/market fit is almost always the long-term winner.” – Andy Rachleff

So picking a problem you can solve, for a market that wants a solution critical. Still, you can manage this and still fail. The product that solves that problem also has to appeal to the customer enough for them to use it.

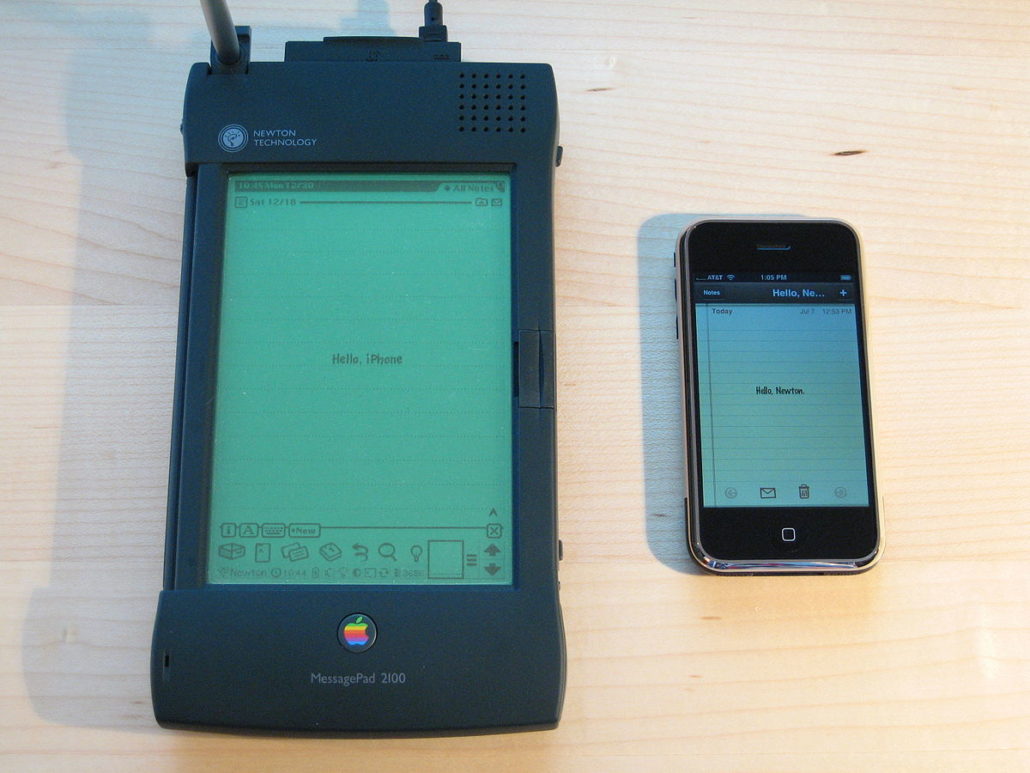

A great example of this also comes from BI’s list: The Apple Newton line, which lived from 1993 to 1997, and which Wired later called a “Prophetic Failure.” What most people don’t know about the Apple Newton line was that they very accurately predicted three distinct product categories, which would emerge in the following 15 years: the smartphone, the tablet computer, and the modern consumer laptop.

In many ways, looking at a Newton from 1995 feels like looking at a cyberpunk version of a modern device, made to look like a 90’s product.

The Newton failed in three categories that would go on to be the fastest growing market categories in history for computing, but still failed because the technology wasn’t ready. As the project lead Steve Capps said later: ““We were just way ahead of the technology. We barely got it functioning by ’93 when we started shipping it.”

The series failed at least partly because the market was not ready for such devices, but also because of its infamously bad character recognition feature. Even though later editions of the devices improved on the original, it was too late for Apple, which would spend the next 20 years rebuilding itself and slowly reintroducing all of these concepts in the form of the iPhone, iPad, and Macbook.

Testing the Value Hypothesis:

Like listening to your customers, PMF is all about trial and error. Make certain assumptions, test them with a minimum viable product, make more assumptions, and test them. The clearest milestones for PMF come from customer feedback about the Value Hypothesis.

You can begin to test this hypothesis right away, even with just an idea- with no product to show. It’s pretty simple: if you get confusion, lack of enthusiasm, or even hostility, either it’s the wrong product or the wrong market. Find out what the person you are talking to does want, and also look for others who do want the product you’re pitching. Chances are the answer is somewhere in the middle.

This is a bit like fishing. Either change the location or change the bait. It just takes time and consistency. Fish long enough, and you can get lucky.

For example, I was attending a tech conference a few months ago, when I got the chance to meet the former Senior Vice-President of a major electronics company. He mentioned that he helps early stage hardware companies find PMF, and I mentioned we had just such a company seeking PMF: Steel Mountain.

He asked me what the company did, so I gave him the 90 second water-cooler pitch. Within a few moments he was nodding. When I got into some of the features, he was saying: “yes… yes.” When I finished, he exclaimed: “I can’t believe no one has done this! When can I buy one?”

This, I must repeat, was the former Senior VP of a major electronics company, whose products you probably own. Nobody had ever pitched him this particular idea in just the right way before. That is a powerful indication of PMF. You don’t have to convince the customer they need the product, because they know they need it.

Still I may lack some important information. Is this customer representative of a distinct market segment? Is the business model workable for the target market? Does the product work the way they want and expect?

You still have to explore all those details, but enthusiasm for the product’s core value proposition is a great milestone. It was then the Steel Mountain team’s job to continue testing the product with the same customer and others like him.

Chatler Raises 330k to Help Brands Chat

/in Startups, StartupYard News/by StartupYardJanos Szabó, along with his team at Chatler, are alumni of Startup Batch 7. They joined StartupYard along with 2 other Hungarian founded teams, Ouibring and Beeem.

When I spoke with Janos about his company way back in early 2017, this is what I had to say:

“The past year has seen a boom in chatbots, which have become a buzzword in the tech industry, most particularly with retailers and big brands. StartupYard this year handled dozens of applications for chatbot startups, but despite the buzz, none of these seemed to us to have really discovered the inherent value of automating customer interaction on social media, and in customer care. Chatbots are not a new idea, after all, and much of the recent hype has come thanks to Facebook opening its platform for 3rd party developers, which has spurred renewed interest in new applications for chat.”

Today these words seem more true than before. Today, brands and marketers are facing the prospect of decreased access to their customers across social media channels, prompting them to rethink their social strategies, and put even more emphasis on chat and messaging.

Though we still get applications for chat-bot related startups (and we even took another in Batch 8: OptioAI, which has gone on to join TechStars), finding an immediate recognizable value for end-users remains a big challenge. So we’ve been very pleased with our choices so far, as both companies have been able to prove that the genre can be leveraged into compelling and useful products that people really value.

The Chatler team during mentoring at Batch 7.

I sat down to catch up with Janos about his team’s experiences since leaving StartupYard nearly a year ago, and see what Chatler has accomplished in that time.

Here’s an overview of what I learned, and a look at how Chatler sees the near future for chat, and for itself:

Big Brands Love Chat (and Chatler)

Since finishing at StartupYard, Chatler has signed The Coca-Cola Company as a paying customer in 3 markets, Czechia, Hungary, and Serbia.

Chat via Facebook messenger is a growing category for major brands, who see chat volume increasing faster than any other channel. In addition, recent major changes in Facebook’s algorithm have left big brands scrambling to refocus on messenger as a prime channel for customer outreach. As Facebook decreases brand access to customers via the newsfeed, companies like Coca-Cola are looking to messenger as a bigger part of their future strategies.

That puts Chatler in the right place at just the right time to help big brands handle their social media presence, when content may become less important than personalization and two-way communication.

Many big brands currently use contact centers operating enterprise CRM software, so Chatler has responded by developing API integrations for software companies like vcc.live. The company provides contact center CRM software for major brands and contact centers in Germany, Poland, Hungary, and Romania. In turn, these larger software providers can offer their brand clients, and also their retail and finance clients, the option of adding Chatler’s AI layer into their current toolset for customer care communication.

That’s a win-win for Chatler, who can provide the core AI functionalities for large clients that already have enterprise solutions in place. With Chatler, enterprise CRM providers can focus on providing the full stack of services to clients. Chatler will be used in this context to monitor communications, and develop automated suggestions and responses that are shown to get the best responses from customers. Chatler can help contact centers use their collective expertise more effectively, and refine customer support techniques using AI.

Investors See the Potential

Chatler has now raised 330,000 Euros (100m Hungarian Forints), from seed investment program of Hiventures Venture Capital Fund Management Ltd.

The investment has helped Janos and his team to build and prepare the launch of their enterprise-ready API, and it has opened doors to high-profile events and demo days, such as those of KPMG, and MOL, Hungary’s largest energy company.

And of course, Chatler is hiring! They’re looking for everyone from developers to salespeople. If you’re in Budapest, or if you’d like to be, and you love what they’re doing, send them an email.

Corporates are Slow, but SME is Interesting Too

While the Chatler team has had to wait longer than they would have preferred to release their API for enterprise customers (which is one of our Startup Facts), the waiting has also reignited their interest in SMEs and social media influencers, who can get value out of Chatler right now.

The team has already recorded some traction by selling their solution to Startup Safari, a well attended city-wide event for tech people in Budapest and elsewhere. Safari will use Chatler to manage the high volume of messages they receive during the events. In some cases, Chatler will work in parallel with a chatbot to allow fully automatic responses to simple questions on schedule, location, and other details of individual events.

That’s why Chatler has created a browser plugin that allows individuals or companies to begin to create a knowledge base from their correspondence on Facebook. Over time, Chatler’s AI functions will begin to suggest answers to common and eventually even complex questions as well. The plugin is designed to enhance the normal chat experience via Facebook, not to redesign it or to fully automate it. Chatler calls this “Next Level Chat.”

We have tested the plugin, and it’s very simple to use. Give it a try!

Leading the Chat Conversation

Chat is a unique channel for customer communication. It isn’t email, it isn’t the phone; it’s something different.

Chatler helps SMEs maximize their content strategy reach.

That’s why Chatler has also been developing content for SMEs and big brands to learn about this form of communication in the business context. They have started an active blog, where companies can learn about engaging with their customers, Chatiquette, and turning your chat channel into a content marketing channel as well.

Want to learn more about Chatler? Message them!

A messenger code. Scan it to talk to Chatler.

The best way to interact with Chatler is through their own product. You can start a conversation with Chatler on Facebook Messenger by opening the app on your phone, selecting “People” at the bottom of the screen, and tapping “Scan Code.”

Welcome to the future.

StartupYard Batch 9: Visualized

/in StartupYard News/by StartupYardStartupYard Batch 9 kicks off in a little over a month. Final selections are happening next week. Time flies! We can’t wait to see who will be joining us for Batch 9.

Every round, we like to share a visualization of the application process. While we haven’t made the final selection, we can share our initial data about the applicant pool. All data is anonymized, but you can get a nice sense of the trends we encounter with each round.

A full overview of the selected teams will be available at least a month after the start of the program (so no earlier than May).

As we did for Batch 6, and then again for Batch 7 and Batch 8 we find it very useful now to look back on the applications, and see what’s changed this time around. Where are people applying? What are startups working on? What are the hottest buzzwords? Previous experience has shown us that StartupYard applications can be revealing about the key trends to watch for in the next 6-18 months.

Here we’ll give you a visual trip through our applications for this round, with our analysis, and comparisons with previous years.

StartupYard Batch 9 : Who’s Applying?

StartupYard Batch 7 was the first time that StartupYard attempted two rounds of acceleration in one year. Batch 8 and 9 also come in close sequence, with applications closing on Batch 9 only 2 months after the end of Batch 8. The pattern in volume of applications has remained the same: we received almost exactly the same number as with Batch 8: 149 in total.

Below is a word cloud of the areas in which Startups identified their top skills and the markets they are working in. Note: we have eliminated the word “software,” due to its ubiquity in the application pool.

As we can see, Finance takes the top spot, along with Transportation, and Artificial Intelligence coming in second. We can hardly be surprised by this: between Bitcoin and Blockchain hype, Uber’s continued fascination for tech people, and the many emerging use cases for AI or IoT, these areas are naturally attracting fortune-seekers with new ideas.

In Batch 7 and 8, we noted that Marketing took the top spot in terms of which domains the startups were interested in. This was followed in the past by Data, and then Marketplace.

Going even further back, startups from Batches 5 and 6 were still focused on Platforms, Mobile, and Apps, with UX and UI being important skills to mention. Today, these terms barely appear. It seems platforms with good UX and UI are now seen as default requirements for new products.

Marketing is Dead: Long Live Marketing

Interesting to us is the fall from grace of Marketing, which led the board for years. It may well be a reaction to the broader cultural shift toward suspicion of Big Data and Advertising that have dominated the tech conversion in recent years. Facebook and Google have particularly been the subject of much concern over privacy, the spread of propaganda, and the wellbeing of users.

The rising focus on AI along with Blockchain seems likely to be part of a shift in general consumer sentiment against the mass collection of private data, with its inherent loss of privacy and control over our experience of online services. At the same time though, these terms are increasingly being used as instruments of marketing: companies now talk about using Blockchain and AI to do things for which these technologies may or may not be huge game changers.

While data is still the foundation of AI, it may be that startup founders see what they’re now doing as beyond the data mining business, which is already quite crowded. Big Data may have simply become a fact of life. On the other hand, new privacy regulations in Europe, and a cultural backlash against big data collection may be pushing entrepreneurs to avoid the need for massive data collection.

Finance and Distributed De-Uberization

Finally, Finance has made a big break from the crowd, likely because of rapid shifts in the way consumers are treating finance products. PSD2, European open banking regulations that force financial institutions to allow customers to share their financial data across multiple platforms, was meant to drive more innovation around consumer finance products.

We see increased interest not only in personal finance, but in insurance management (both B2B and B2C), payments, and consumer/corporate investing.

In addition, the sudden rise of the ICO, and thousands of emerging technologies based on the Blockchain, have inspired startups to become “finance” oriented companies. Tokenization of services and networks opens the opportunity for financial products to become involved in more areas of the economy than before.

Whereas in years past, we saw many applications interested in the “uberization” of many services, today startup founders are seeking to “blockchain” everything, from in-person payments to insurance contracts, to day-labor.

This cannot be too surprising, given that the sharing economy Uber has represented for many years has really failed to deliver the benefits it has long promised. Indeed, Uber itself has still failed to become a sustainable business, and has suffered a severe backlash from consumers – once the name on the lips of every founder, Uber is no longer in the conversation.

Whereas “uberization” leverages a common platform like a mobile app to create a marketplace, and extracts rent from the different participants, blockchain startups forgo the platform in favor of a protocol that can be remixed with other services, and which is not centrally controlled.

This is doubtless appealing to startup founders, because it distances them from the deeply unpopular practices and cultures of companies like Uber. Uber still takes a large share of every transaction on their platform, but it is increasingly clear that their centralized model does not deliver significant benefits to the market (which has been largely covered up by Uber’s massive subsidies for drivers and riders).

This is not even to mention that Uber itself is not a sustainable business after nearly a decade in operation. It lost nearly $4 billion in 2017, leading Forbes to label its business model “fundamentally broken,” something many critics had been pointing out for years already.

Startup founders are realizing that services like Uber are certainly attractive to consumers, but they are also asking: “why do you need Uber the company to have Uber the marketplace?” Most of what Uber can deliver to customers and drivers can be done more fairly, more reliably, and more cheaply using a distributed service model.

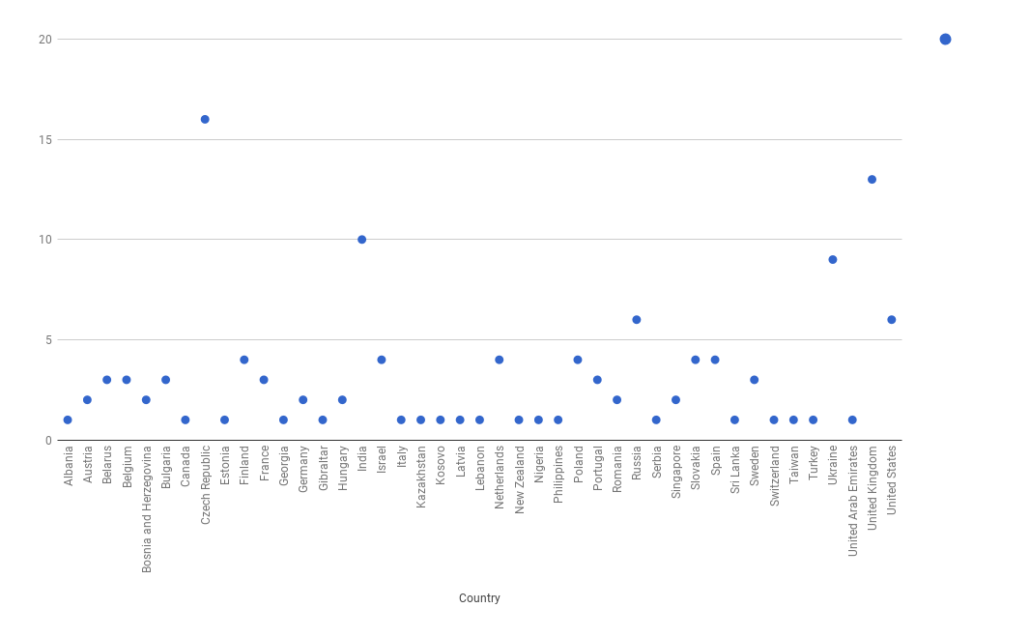

Where are Startups Applying From?

Let’s start with a view on where applications came from for Batch 8, and compare that with Batch 9. Here they are in sequence:

Startup Applicants to Batch 8 – the Previous Batch

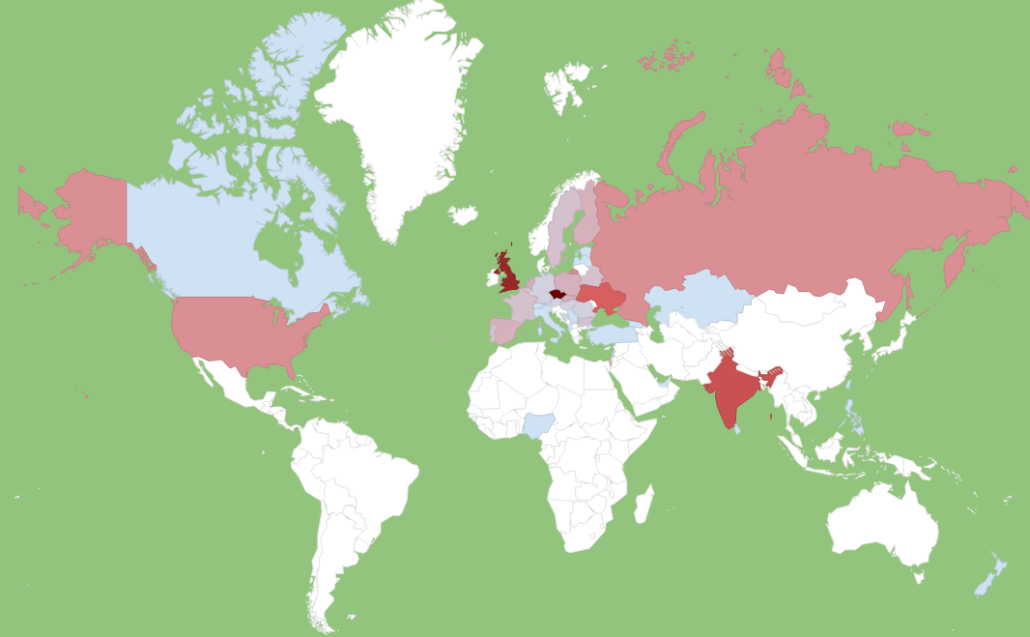

Applications to Batch 9 – Current Batch : Blue = low volume, Red = High Volume

I’ve changed the color scheme here slightly to emphasize the volume of applications from 2nd tier countries. As you can see, Czechia is still the leader, but it leads with only a third the number of applications as even last year. Batch 8 had about 45 applications from Czech companies, Batch 7 had even more. This year, there were only 16 Czech companies in the pool.

At the same time, 0ur geographic footprint widened considerably. This year, we attracted applicants from 44 countries: more than ever before. Batch 8 saw only around 32 countries. New countries included Sri Lanka, Gibraltar, Taiwan, and Lebanon- with one application each.

Which countries saw an uptick in applications? Surprisingly the biggest jump was from the UK, where 13 companies applied. That’s more than any previous year. Perhaps Brexit nerves or political tensions are pushing UK entrepreneurs to seek growth in Europe before it’s too late.

Detailed breakdown of application numbers for Batch 9

Anecdotally, we noticed that a significant portion of co-founders in UK based teams were in fact southern Europeans or other ethnicities. Are startup founders looking to abandon the UK and return to mainland Europe before the Brexit hammer drops?

Applications from Ukraine and India also rose this year. Ukraine’s jump was expected because Ukrainians have recently been granted the ability to visit Europe without need of a visa in advance of travel. This is good news for startups, as it decreases a huge barrier to Ukrainian companies seeking to do ongoing business in the EU. It may also be a matter of concern for Ukrainian startups, many of whom have personally confirmed to me during visits that more young people are leaving for the west than in the past.

Full Employment Has Huge Impact

We had believed in the past that the number of applications from Vysegrad countries would continue to increase at a faster pace. This has not happened over the past two cycles. Instead Slovakia, Hungary and Poland contributed fewer applications in total than came from Ukraine alone.

There may be a key to explaining this in the employment statistics across the region. Slovakia’s rate of unemployment dropped like a rock in 2017, from almost 9% to less than 6% today. Anything under 5 is considered “full employment,” meaning that jobs are available and workers in demand across the income spectrum.

In fact, most of the Vysegrad group are suffering from a lack of workers for the first time since the fall of communism. Poland, Hungary, and Czechia are all below 5%, whereas the European average is about 8%. Wage inflation has increased accordingly, rising in Czechia to nearly the 2007 pre-crisis level of 6% per year.

Meanwhile, unemployment remains higher in Eastern Europe, with Ukraine close to 10%.

For the first time in many people’s lives in Vysegrad countries, governments are taking measures to improve workplace participation among young people, encouraging them to join the workforce earlier.

Because unemployment is very low, wage inflation and working conditions are improving quickly, possibly encouraging more young people to seek jobs in existing companies, rather than starting their own businesses. Increased career security may also give employed people less motivation to leave a comfortable salaried lifestyle and found a startup.

As living standards rise, the risks of starting a business are more obvious: loss of opportunity and income can be more acute when incomes are rising, as people tend to fear losing what they already have. In times of high unemployment, some will take more risks, having less to lose.

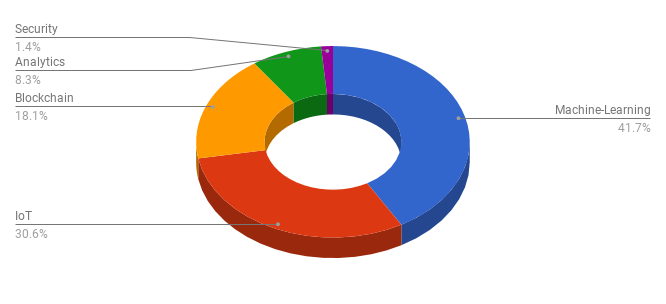

In Which Domains are Startups Working?

One of the key items every year is the breakdown of “domains,” or areas of tech innovation where the startups are working. This is often somewhat different from the market focus, as startups seek to apply new technologies to old problems, or bring existing technologies into new markets for the first time.

Batch 9 Domains excluding “other.”

The core domains we focus on represent more than half of all applications. Of these domains, Machine Learning remains the strong leader it was last year.

However, IoT and Blockchain have strongly edge out Analytics and Security, which have been dominant in previous rounds.

It’s important to note that the domains startups identify themselves as belonging to may be a function of fashion as much as the reality behind the words. Whereas in previous years, we would get many applicants who called themselves “security companies,” today those same companies might emphasize AI, or IoT as their domains, with security being downplayed.

In the previous round for example, Steel Mountain, which makes a security device that employs machine learning to hacker-proof connected homes and devices on Wifi, called itself a Security Company. Today, it might rather call itself a Machine Learning company, which does security, or an IoT device company that uses Machine Learning.

Often the product can be the same, but the emphasis in the application may change to fit the new trends. The security topic has somewhat cooled for startups, as blockchain has taken over many of the same applications, and as security companies become more common.

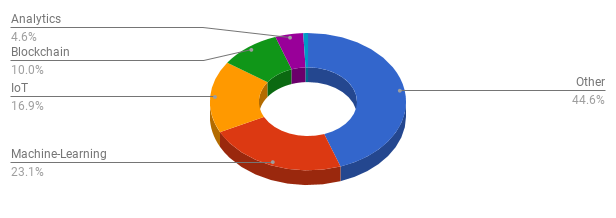

Batch 9 Domains Including “other”

As always, the largest single group of applicants represents none of our areas of focus. Some of these companies do in fact work in IoT, Blockchain, or AI, but they choose for whatever reason to emphasize their domains differently.

This has a lot to do again with how founders see themselves and their future in the industry they’ve targeted.

We sometimes ask applicants: “Do you want to be a technology company or an ‘X’ company?” X being insurance, music, entertainment, finance, or 101 other possible domains. The distinction at an early stage is not always completely clear, especially because founders are not always from technical backgrounds, and don’t always see themselves as primarily tech companies.

One conversation we had with an applicant working on Machine Learning revealed that he was focused on one particular industry, and would not be interested in shifting focus. Of course that’s a valid choice, but it’s also something you can’t always tell from the way an application is written. Sometimes applicants begin with one idea, and end up working on something entirely different, aside from the core technology involved.

What It All Means

This data set is too small to draw a definitive picture of the startup landscape in 2018. However, as we have been consistently monitoring trends in our application pool for the past 3 years, we can outline some clear trends.

The state of employment has had a clear impact on the volume and sources of applications. We also believe that the state of the economy has affected the types of companies applying to StartupYard. The ubiquitous “me-too” startups and the local clones of American products and services of 5 years ago are all but gone today. Perhaps many of these ideas have already been successfully executed in Europe, but the state of the economy has also changed the landscape considerably.

In 5 years, networks around high-tech startups have matured, and the communities around Central Europe have gained new heroes in the process (including many of our alumni). The first generation of online entrepreneurs, and successful online businesses, are now engaging very actively with the younger generation of startups, as we have observed within our own mentor community. Banks, Telcos, Insurance companies, Manufacturers, and Tech giants feel the increasing need to engage with early stage companies, and younger tech entrepreneurs now have a menu of options for growing a business with corporate partners, early stage investors, and active Business Angels.

It is a good time for startups.

Startup Skills: How to Create a Killer Talk

/in Marketing, Startup Tools, StartupYard News/by StartupYard6 Silly Startup Mistakes You Can Fix in 5 Minutes

/in StartupYard News/by StartupYardSilly startup mistakes are a dime a dozen. We’re not fans of “startup playbooks,” at StartupYard. Checking off a list of stuff you have to do doesn’t make the difference between a fast growing company and one that is dead on arrival.

That being said, there are plenty of stupid startup mistakes that are easy to avoid. So easy, in fact, that will take you just 5 minutes to fix some of them. Here are 6 of those silly startup mistakes, plus why they’re silly, and how to fix them (in no particular order):

6 Startup Mistakes (And How to Fix Them)

1. Update Crunchbase, Angellist, Facebook, LinkedIn

You know what I and every other startup investor will do when we hear the name of an interesting startup? The same thing you would do: Google it. What shows up in a google search is very important for your first impression – the thing most people will see before anything else.

Here’s a typical experience: A colleague from another accelerator asks me if I have heard of Company X. I Google it, and first thing I see is a search suggestion to change the name to something similar that has more results. Bad sign so far. Hopefully your website is at least in the first page of results. I take a brief look at the website, then go back to the search.

Next, I skim down the list of sites looking for one of the above listed profiles, and check to see how old it is, any recent changes, and any important info. This is where many, many startups go wrong. The info is old, it’s outdated, the profile is inactive, or it’s just not there.

This is not a dealbreaker for me or most people, but imagine you’re in a list of 200 companies I’m looking at. I can find decent information on 100 of them. I only need to pick 50 to contact. What am I going to do with the company that has no relevant data available? Probably I’m going to put it aside. Plenty of fish in the sea.

Keeping these data sources up to date takes a few minutes every few months at most. So you might as well do it. Remember: only one contact can change your company’s future. So don’t make it harder for me.

2. Fix Your Open Graph Meta Tags

Here is a detailed look at how Open Graph meta tags work. The short version of the story is that 3rd parties, like social media and search platforms, use metadata, supplied by your website or encoded in content you share, to display information about the site or the content on the 3rd party platform.

Think of metadata as an album cover that goes along with whatever you post on social media, or in every link of yours that is shared by someone else. What happens if there are no open graph tags on your site and content? Anything shared about you comes along with a handy blank image and no description. Very professional.

How do you fix it? This isn’t a step-by-step guide, but we have a startup for that! start by checking your site at Testomato.com. It takes 30 seconds, and they’ll tell you if your site is in serious need of help when it comes to metadata (and many other problems).

Pro-Tip: SEO Plugins like Yoast for WordPress help you easily create and validate meta tags for content and pages. Which brings us to our next item:

3. Install Free or Premium SEO Software on your Site

We use WordPress at StartupYard, and believe it or not, I strongly recommend that our startups do the same, or at least choose an easy-to-use website builder with plenty of plugins available.

It’s for reasons like this: free software like Yoast SEO, which can dramatically improve your website’s visibility in Google search, and also helps you make sure your content and pages are tagged properly, in the right format, optimized for the right keywords, and well written and formatted as well. Their pro-version does even more, like setup redirects for you.

With the right setup in place, it takes an extra two minutes on a blog post or a new landing page to make sure everything is working properly, and that your customers can actually find in the future. Thanks to Yoast, StartupYard now ranks highly for a number of key search terms that we know startups are using.

4. Make Yourself Easy to Reach

My God, is this a bigger problem than you can imagine. As a scout for tech talent and startups, I’ve spent ridiculous amounts of time playing detective to try and figure out how to contact startup founders without landing in their spam folders, being ignored, or reaching the wrong person.

Keep this important information in mind: You are a startup founder. Not a rockstar. Don’t make it difficult for people to figure out how to talk to you. You might even *gasp* share your phone number as well. I like to know I can at least call someone if absolutely necessary.

Here are a handful of things I wish no startup would ever do on their website until it becomes absolutely necessary.

- Contact forms instead of email addresses – If there’s a better way of showing people that you aren’t accessible, I don’t know what it is. I hate filling these forms, and in my experience, 9/10 times there isn’t a reply anyway.

- Info@ email addresses – Don’t do this. Just don’t do this. Who gets an email sent to info@? As far as I know, it goes right to your spam folder, or to an intern, or a customer service rep. Info@ for a company of under 10 people is just putting out a sign saying: “we don’t want to hear from you.” Put the founders’ email addresses on the site. Let investors (and customers) contact any of them. A pre-revenue company cannot afford to screen emails.

- Auto-responders – I hate this. Again, if you’re a company of 3 people, you don’t need an autoresponder. Just reply to emails. Reply to all emails that are specifically addressed to you, even if your answer is just “not interested, thank you.” Just because your mail client has it as a feature doesn’t mean you should use it.

But what about all the spam, you say? What about when I *am* a rockstar, and my email is swamped with customer questions? There’s an app for that: it’s called email forwarding. Create a new email address that is to be shared only for professional reasons, and forward all emails sent to your public address to a special folder in your new inbox. Check it regularly, and create rules for individual senders who are still using your old address, to route them to your inbox. Done.

5. Print and Carry Business Cards

Hello, yes it’s 2018 and I’m telling you to get business cards. Yes, people can just send you an email, and you can add them on LinkedIn, and, and, and.

The thing is that some innovations are so good, so intrinsically elegant, that they don’t go away even when there are “better” alternatives available for less. To me, carrying a good business card is like wearing a tasteful watch, or having a firm handshake. It’s proforma, but it’s the good kind of proforma.

Just consider some of the reasons why a business card works centuries after its invention:

- It creates credibility. A person who spent money on business cards is taking things seriously. It also makes you seem like a prepared and professional person.

- It gives me a way of remembering your name while I’m talking to you. Believe me, that helps a lot of people. Also, it helps me understand your job and business without having to ask.

- It helps you stand out. Don’t get *too* gimmicky with your cards, but a bit of creativity shows you care.

- It makes it easy for a person to share your contact details with somebody else. That’s what networking is for. A business card makes it easy: “hey I thought of you when I met this person.”

- It makes it easy to start a conversation. Shy people sometimes come up to me saying “Can I have your business card?” This happens often after I’ve just spoken in public, or met a bunch of people at once. Those who don’t want to monopolize your time can take your card, and you can then start a conversation with them if you wish.

It takes 5 minutes to order good-looking business cards online. No excuses.

6. Fix your Email Footers

Kind of like business cards, this is a proforma thing that is really important, particularly because of modern technology.

Having clearly formatted footers in your email makes it super easy for someone to track down your contact details by searching their inbox. Even better, modern smartphones can use this data to provide contact info on incoming calls, and even help people find your phone number without digging through their emails.

It’s also a bit of much needed context when you’re sending messages or replying to large group messages. The worst thing that happens in those situations is that somebody without their name in the email address itself replies without a name in the footer either. You annoy me, whoever you are.

As a bonus, you can use your footers as guerilla marketing as well. Anytime someone forwards an email or you reply to a group, you can include a link to your product with a tagline. That’s nice, isn’t it?

Do You Have More Startup Mistakes That Take 5 Minutes to Fix?

Tweet it to us at @startupyard, and we might add it to this list!

Ready to Apply to StartupYard?

We’re looking for startup founders in Crypto, AI, IoT, and AR/VR!

Get started applying to StartupYard Batch 9. Applications close January 31st, 2018.