StartupYard Batch 8: Visualized

Applications for StartupYard Batch 8 closed this weekend. Selection has now begun, and acceleration will kick off in September. You’ll get a full overview of the selected teams only after they’ve been with us for at least 1 month. Until then, we have some initial data to share with you. For the past few years, StartupYard has shared anonymized application data with our community, to give you a picture of what’s going on in StartupLand East of Germany.

As we did for Batch 6, and then again for Batch 7 we find it very useful now to look back on the applications, and see what’s changed this time around. Where are people applying? What are startups working on? What are the hottest buzzwords? Previous experience has shown us that StartupYard applications can be revealing about the key trends to watch for in the next 6-18 months.

Here we’ll give you a visual trip through our applications for this round, with our analysis, and comparisons with previous years.

StartupYard Batch 8: Who’s Applying?

StartupYard Batch 7 was the first time that StartupYard attempted two rounds of acceleration in one year. As we noted last year, the increase in frequency did not affect the number of total applications significantly. This round, despite the open call closing just a few months after Batch 7’s Demo Day, we saw more applications even than Batch 7.

And, at least according to our initial scoring, the quality of applications has risen yet again, despite the shorter pause between programs. We expect to invite up to 30% of applicants for a first-round of interviews with our selection committee – a percentage more than double that of Batch 6 and possibly more than even Batch 7, which was a great year for qualified applicants.

This year also continues the trend of better overall match between startups and our program. Up until around Batch 5-6, it was typical for StartupYard to receive about 60% “Junk” applications – applications so bad or so disconnected from our core focus, that they couldn’t be seriously considered. This year, despite growing hype among high tech startups, junk appears to be under 25%. This is something we would have thought impossible two years ago.

What Applicants Say about Themselves:

The above is a “raw” word cloud, including the 150 most commonly used words across all application questions that involve a free-form response. In this cloud, the most commonly used words have been compressed to emphasize the secondary words, so what you’re seeing is not precisely to scale.

Still, we recognize some bog standard words that are familiar in any application: platform, product, marketing, customers, content, and people.

Here is a look at the same data, but now with the most frequently occurring words to scale:

What is perhaps most interesting here is what is not here. In previous years, certain words really stood out against others. Words like Data, Marketing, Mobile, and Platform, along with wildcards that seemed to vary by year like Advertising, Education, and Management.

This year, there is no strong contender for the buzzword of the year, except for Customers, which is frankly odd. While the focus of this cohort is Deep Tech, and while many of the startups are dealing with AI, Machine Learning, Blockchain, Big Data, and other related issues, the applications are much less buzzword heavy than in previous years.

Why this change? We noted last year, especially during the final selection round, that many of the applicants had seemed to pepper their applications with these buzzwords in order to draw attention to themselves, even if the Deep Tech aspect of what they were doing was not central. This year, despite many companies with a central focus on this kind of tech, the applications talk about more banal issues such as Customers, Software, Product, and Service.

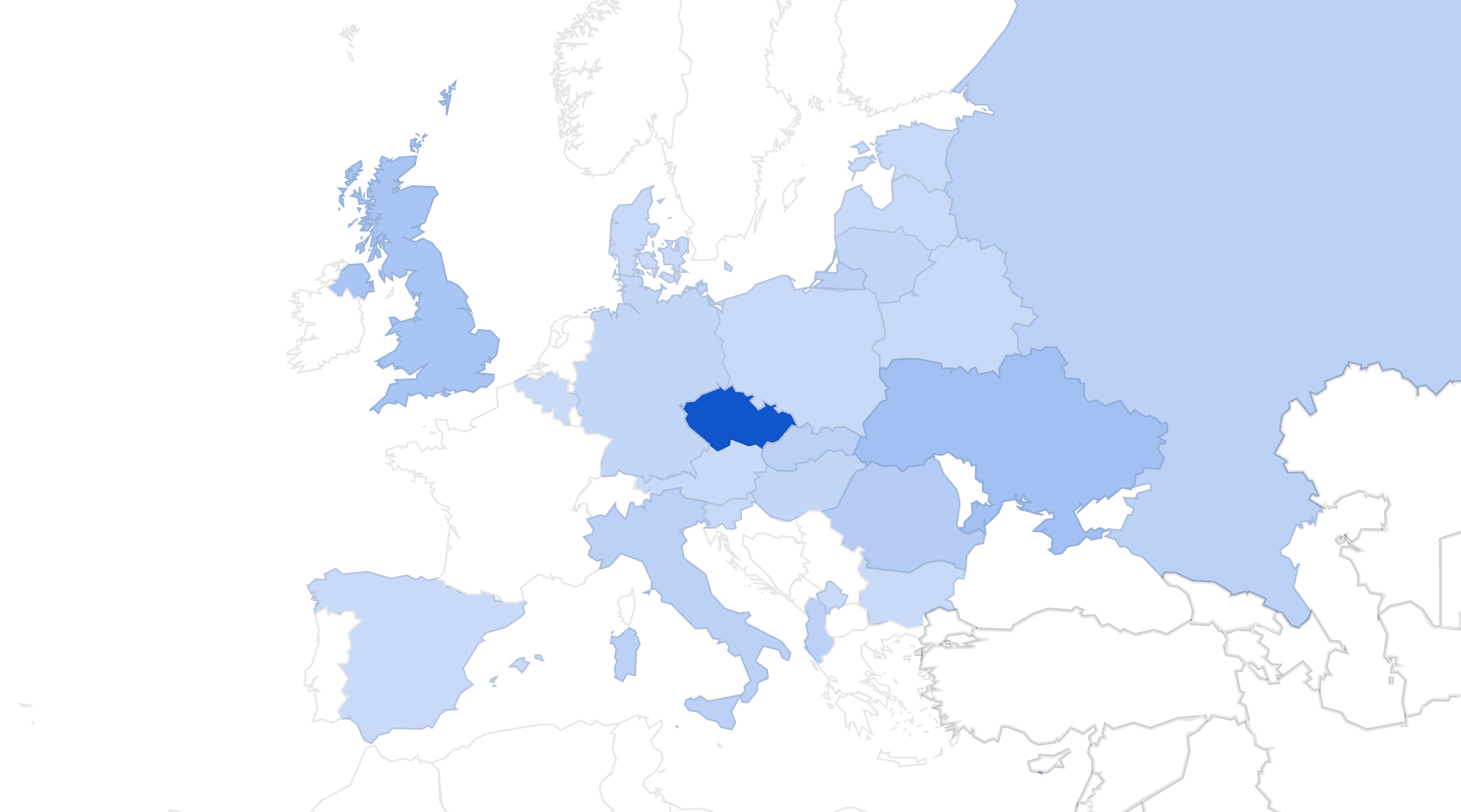

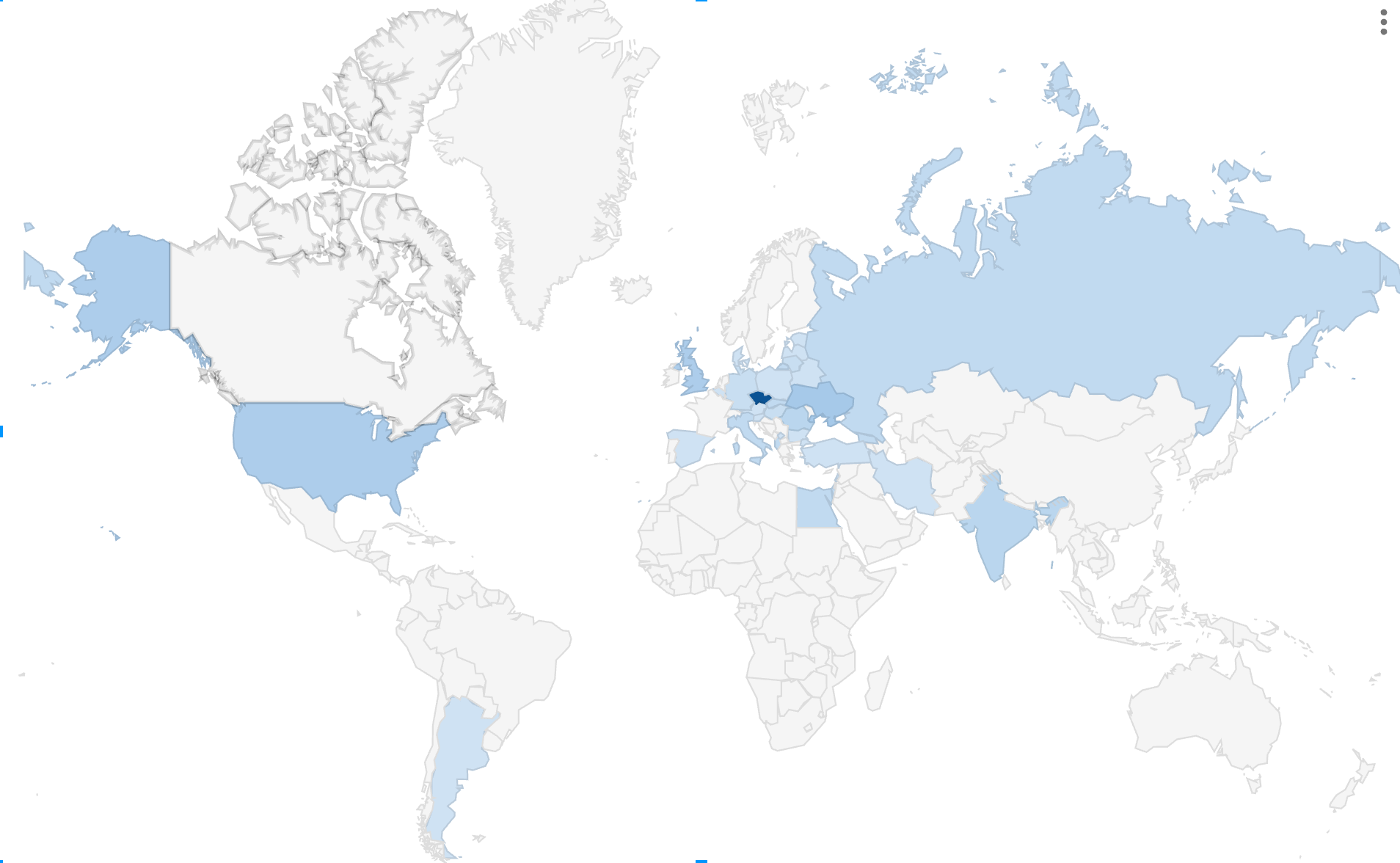

Where are Startups Applying From?

The above is a heat map of applications by country. Those in the palest blue represent no more than 2 applications in total from that geographic area. It should be noted that this data is imperfect, as the question being asked is “Where are the founders located right now?” And is not a question about either incorporation, or national origin. We expect, for example, that many of the Czech applicants will have team members from other countries, and that a number of applicants will be of a different national origin than represented here.

Anecdotal evidence tells us that by asking this question, rather than “Where are you (or will you) be incorporated?” we get a better picture of startups by region, as many choose to incorporate abroad for various reasons. We also do not group startups by regional market focus for the same reasons: many would be focused on English speaking markets as a default, and a breakdown of that data would be less useful.

Here is a worldmap with all countries represented:

Here is what the location question looks like in a to-scale wordcloud:

As you can see, Czechia is still the heavyweight, with 30% of the total pool represented. Next are some surprises, such as Ukraine (7%), and the UK and USA (Both 6%). Slovakia, as with the past two cohorts, is nowhere to be seen at only 3%, and unlike our last round, Hungary has also faded away, at only 2%. Romania holds at a lower than expected 4%. Bulgaria and Poland are practically absent with only 1% each.

Here is a look at the applicants with Czechia removed:

Why are we surprised? Well, for several rounds, the Visegrad 4 countries had been on the rise in our applicant pool. Bulgaria and Hungary made strong showings last year, and we expected that to continue. It has not. Instead, to our surprise, we received more applicants from the USA and UK than ever before. Is there a growing appetite in this post-Trump, post-Brexit world for the old continent? It seems that this may be the case.

In Which Domains are Startups Working?

One of the key items every year is the breakdown of “domains,” or areas of tech innovation where the startup is working. This is often somewhat different from the market focus, as startups seek to apply new technologies to old problems, or bring existing technologies into new markets for the first time.

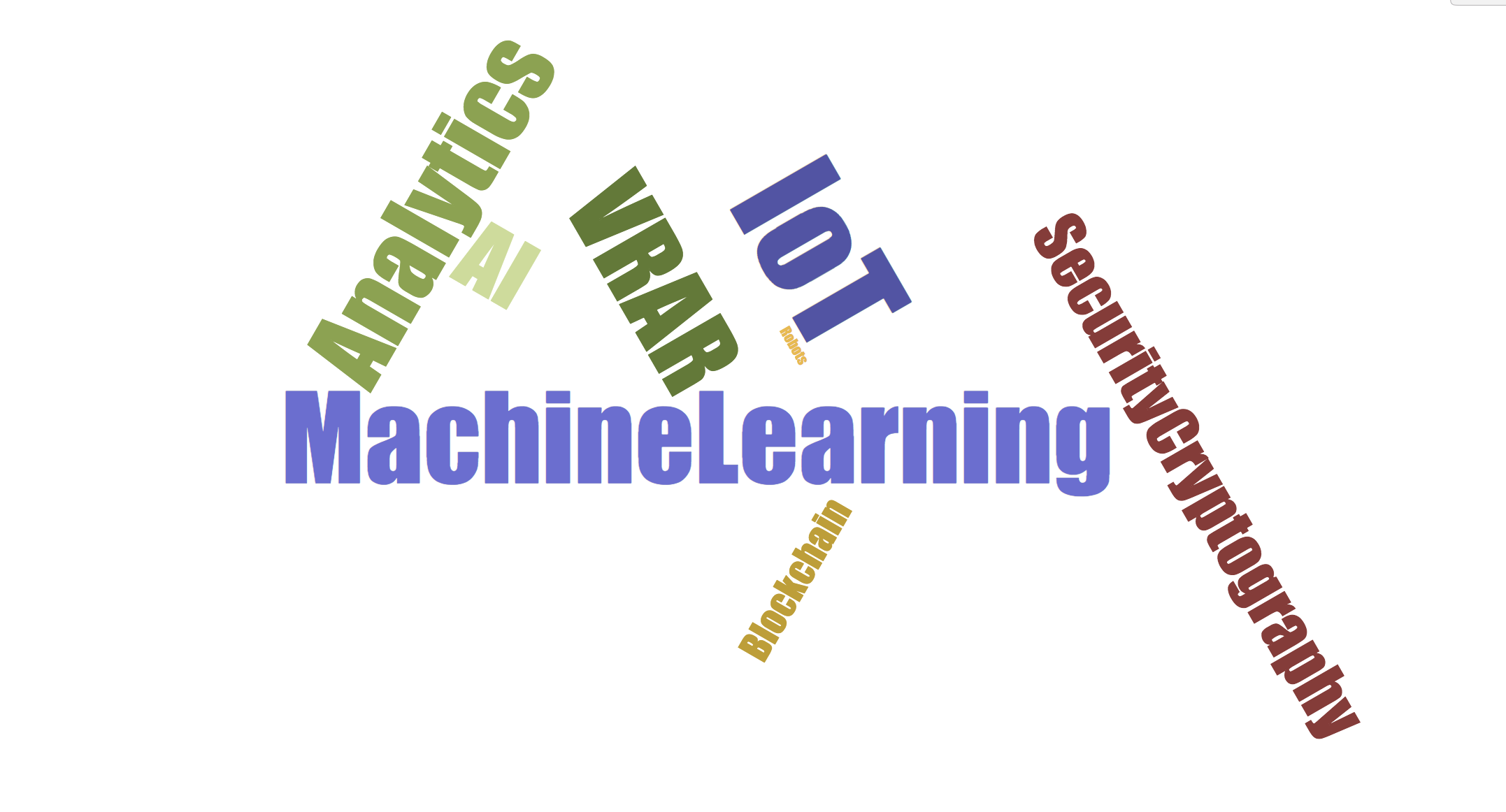

Here is a cloud of domains for this year:

(Note: Startups that designated themselves as “other” are excluded here. Typically “other” denotes a marketplace or very specialized area of development. The total for “other” is higher than any other domain, but this does not provide any useful insight).

As you can see, IoT (Internet of Things) and Machine Learning, along with VR/AR, take the top spots this year. Analytics and AI remain important, and Security/Cryptography are also well represented. Minorities in this round appear to be Robots, and Blockchain. There were 4 applicants in Blockchain technology this year, compared with 20 in IoT, and 15 in Machine Learning.

What Applicants are Working On

Also interesting is a breakdown of what markets startups are working in, according to them. A startups primary market, in our experience, is less important than the way in which they mix the market and tech domain. For example, AI or Gambling are two relatively fuzzy terms, but put them together, and you get a pretty good picture of what a startup is working on.

Here finally we do see some clear leaders in terms of markets. Whereas the previous look at buzzwords was about what startups talk about generally, this is about how they describe themselves specifically. As you can see, Software is strong as ever, while Marketing and Entertainment, along with Analytics and Development rounded out the top 5.

While Marketing was the leader last year, followed by Data, this year Data is on par with other secondary terms. Again, we see a trend towards more general terms, even as startups become more focused on Deep Tech solutions. Is this because the buzzwords have become less of a selling point, and more of a central focus, such that they don’t need to be mentioned so often?

Last year, upon examining the Batch 7 data, I remarked upon the same phenomenon:

This chart looks very similar to previous years, however it is broader and less specific. Few terms, other than the obvious ones like Business, Platform, Data, Manage, and App, are given special emphasis. This is somewhat different from last year [Batch 6], in which terms like Marketplace, People, and Mobile were big standouts along with the most common tech terms like Platform and Data.

Is the way startups are describing themselves changing? Is there less emphasis now on mobile, or has it simply become an assumption that all products have mobile implications? Mobile may be taking its place alongside other words that are now seen as redundant- it may be shifting from an emphasis, to a more broad category that is easily understood, and thus little mentioned.

This year those words seem to be strongly predictive: there has been no reversion to a set of narrow buzzwords, but rather a broadening of terms used by startups to describe themselves. As the hype cycle ebbs and flows, we may now be entering a new maturity stage for startup founders as well – in which there is an increasing emphasis on basic business problems, rather than on buzzy tech bells and whistles.