Meet Puulse: The Real-Time Payment Platform for the Gig Economy

Today we sat down with Mounir Felloula, co-founder of Puulse to talk more about what they do and his plans for the future.

The Puulse Team

Hi Mounir, tell us a bit about your personal journey towards founding Puulse. How did you get here?

I’ve always been fascinated by the potential of technology to drive financial inclusion and empower individuals. My journey led me through roles in investment banking and tech startups, and along the way, I saw the challenges faced by gig workers in terms of delayed payments. Puulse was born from my desire to create real-time payment solutions that could provide financial stability and convenience to gig economy workers.

Who is Puulse for and what problem are you solving?

Puulse is designed for businesses looking to attract, retain, and engage gig workers efficiently. We’ve created a platform that empowers companies to offer real-time payments to their gig workers, which, in turn, solves the issue of delayed payments, providing financial stability and a better overall experience.

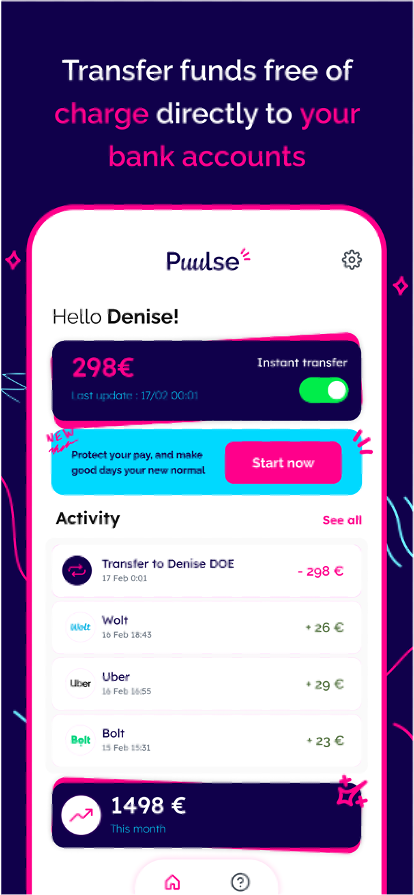

The Puulse App

You are not the first startup to try solving this problem, and there are already available proven solutions. Why should a company look at Puulse? What is your “killer app?”

Puulse stands out due to our steadfast dedication to real-time payment solutions, which forms the core of our platform. Our distinctive user experience design draws inspiration from serene apps such as Headspace, ensuring that the payment process is not only efficient but also enjoyable. Our journey has been remarkable, having successfully served eight platforms in Europe, a testament to the effectiveness and trustworthiness of our solution. The user experience we offer is unparalleled in traditional banking environments, with an interface designed to bring a sense of calm and tranquility to the payment process, creating a unique and pleasant experience

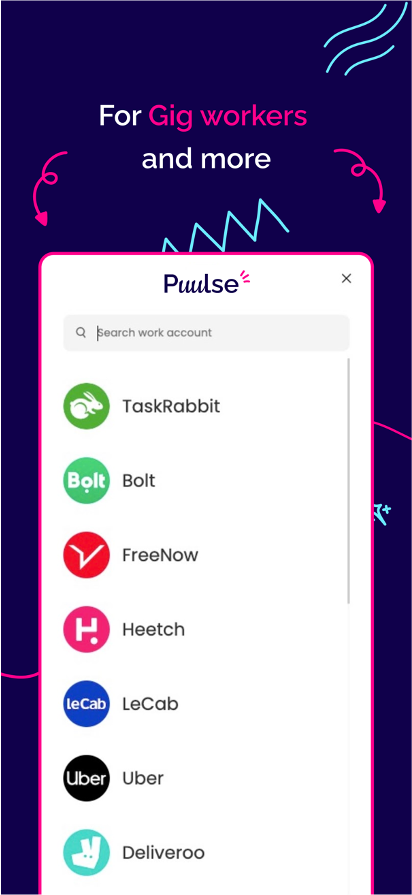

Real-Time Payment with Puulse from these partners

How big is the team, and why are they a good match for this project?

Our team consists of seven dedicated individuals, including my co-founder Steve Fepeussi, who was an early employee at Kry, a healthtech unicorn, and Hatim Mushtaq, our CTO, who was with iZettle, acquired by PayPal. Our diverse backgrounds and extensive experience in finance, tech, and product development make us a strong and versatile team well-suited for this project.

What have been your team’s biggest personal or professional challenges in making this project a reality?

Our journey has certainly had its share of challenges. Perhaps one of the most significant was making the transition from a focus on product development, typical for a tech team, to understanding the critical role of marketing in promoting our product. This shift in perspective has reshaped our vision of marketing, highlighting its importance alongside product development.

Who is the ideal customer for Puulse? What do people need to get started with Puulse?

Our ideal customer is any company that employs gig workers and believes that a more engaged workforce naturally leads to growth. Getting started with Puulse is straightforward, and we’re here to guide our customers through the process.

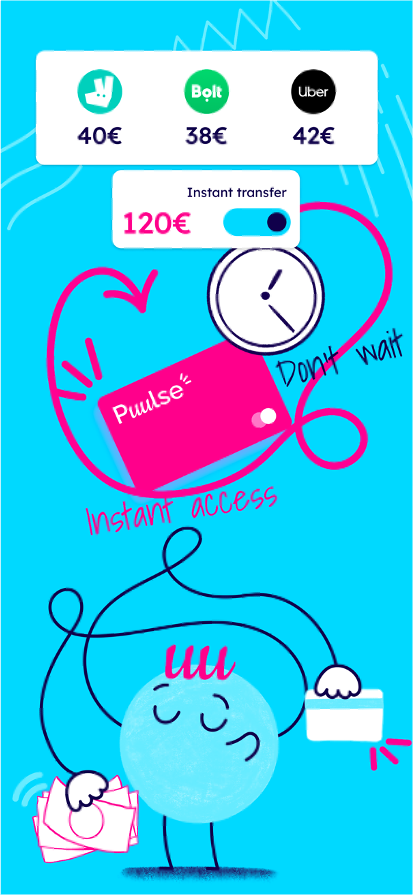

Piece of Mind with Puulse

What do you hope Puulse is going to be in 5 years, as a business, or as a technology? What would be your ideal scenario?

In five years, we envision Puulse as the leading real-time payment platform for the gig economy, not only in Europe but worldwide. We hope to be at the forefront of financial innovation and to have played a significant role in empowering gig workers across the globe.

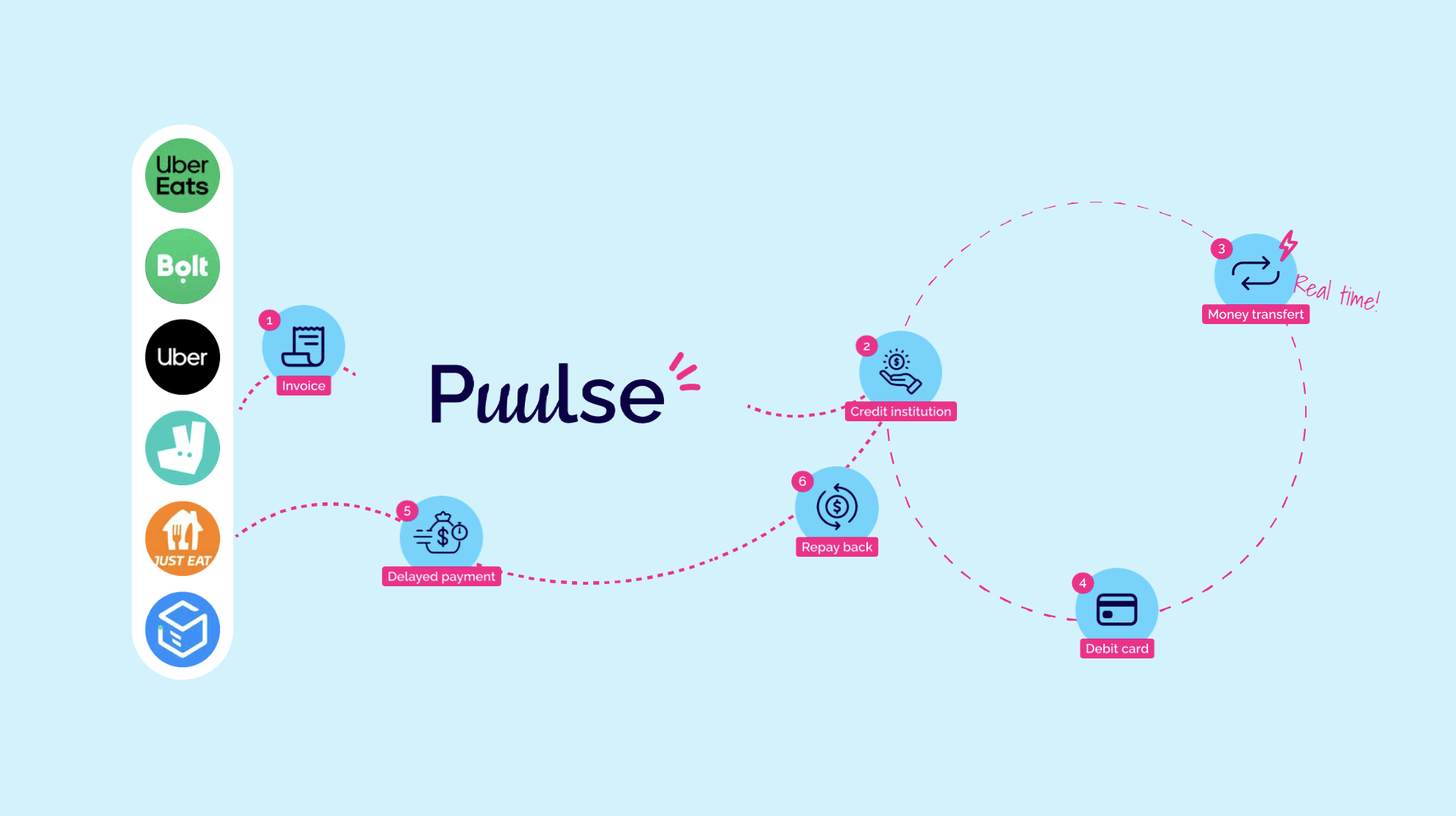

How Puulse allows Real-Time Payments

What was the most valuable advice you got during the StartupYard program? Why was it so helpful for you?

The best advice I received was to stay focused on our core business and avoid getting distracted by noise. Additionally, the network we’ve built in the program has reshaped our perception of marketing, making us realize its significance alongside product development. This combination of insights has been invaluable.