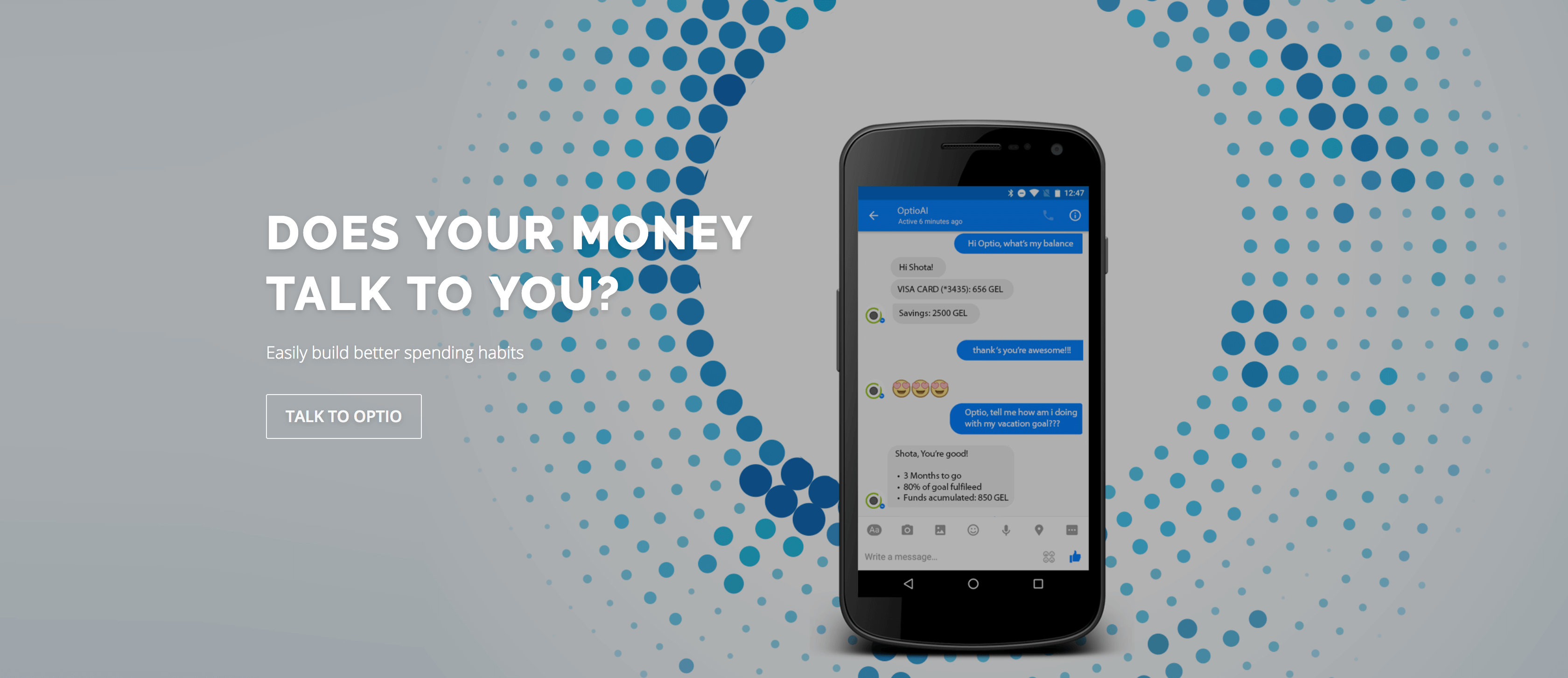

Meet OptioAI: A Fitbit for your Finances

OptioAI is the next generation of personal finance management applications. Though to be fair, it isn’t really an application at all. Instead, the first Georgian startup to be attend StartupYard (a member of the current Batch 8) has a new vision for personal money management: one driven by conversation, rather than calculation.

OptioAI is an AI layer, that stands between the vast troves of data that banks hold about their customers’ activities, and the customers themselves, who can benefit from a deeper understanding of their own relationship with money. The traditional budgeting and expense tracking approach is replaced with a more casual, and more user driven interactive experience, based on chat, or even voice. What’s going on with your money? Now all you have to do is ask.

OptioAI gives its users insights into how their daily finances work, how they spend money, and what they could do to improve their own financial situation. I sat down with CEO and Cofounder Shota Giorgobiani to talk about the future of money management.

Hi Shota, tell us a bit about your team, and how you ended up founding OptioAI.

For me the ideas behind OptioAI go back to me being a kid. I remember how my mother was budgeting and tracking each and every financial transaction in our family. That’s the way she is. Very responsible.

As it was a really tough time in Georgia, it was vital to control your daily spending to survive. I believe most Georgian families were doing the same. Since then times have changed, the situation in Georgia changed, I grew up, but as soon as I got my first salary, I understood how important it is to manage your money.

The solutions I found for that just never fit my way of thinking. I don’t want to manage every cent the way my mother needed to, but I do want some control over my money. I want a middle road.

Once my co-founder and childhood friend George and I were talking about this problem, and discussing our personal approaches to money management. He also had the same problem and developed his own methods.

We found that for us both, the problem always came back to the interface between a person and their finances. It’s always about numbers: amounts, dates, times. But if we’re being honest, this isn’t really the way that most people think about their money.

You can build a fancy budget in spreadsheets, and have all kinds of plans and variables. But should I buy a pizza tonight for a treat? Can I go to the movies Friday night? These questions remain pretty much as hard to answer as before.

I think that’s why a lot of people don’t track their finances, because at the end of the day, it doesn’t help them make daily decisions that much. It just introduces more data.

Slowly, over many discussions, the idea of OptioAI was born. We wanted to offer people a middle road between fully dedicated expense tracking and budgeting, and just flying blind, not knowing what you’ll have a week from now.

We liked concept so much, that decided to start working on that. As a team, we know each other for a long time, we were classmates and we even had a business together in Georgia in the past. Both of us have long-time experience in our industries: I’m a software architect and engineer while George is a banking specialist.

left to right: Optio AI Co-founders George Mirzikashvili and Shota Giorgobiani

How is “AI for Personal Finance” different from what most startups in this space are doing?

Our mission at OptioAI is to make money management simple and accessible for everyone. It should be as easy as asking simple questions to your virtual advisor and getting instant answers.

Imagine, you are at grocery store and want to know how much you can spend on groceries during the week. Or you’re surfing Amazon.com and want to buy a cool new gadget, but aren’t sure you can afford it, or if you need to wait a month.

Those small spending decisions you make on a daily basis don’t always seem very important, but they add up to a lot of uncertainty over time. €5 here, €3 over there. For a working class person, this is the difference between saving and going into debt.

People don’t want to think about it. Our user feedback tells us that these end-of-the-month surprises are the biggest cause of financial stress. Most people don’t know how much they spend on food, for example. It’s usually more than they think.

So you are trying to show people the results of their smaller decisions?

Exactly. People can convince themselves that a few Euros wasted don’t matter. But they do matter, if you do the same thing hundreds of times in a month.

Buying things is an emotional process, and with most budgeting applications, people are asked to be rational. It just doesn’t always work that way. Am I going to spend an hour analysing my finances and making projections to see if I can buy an Apple Watch? Probably not. I’m going to be making excuses for myself about why I need the thing right now. Even if I don’t.

So to change someone’s mentality, you need to appeal to them in that moment with feedback that fits their mindset. “Can I buy an AppleWatch right now? It’s a simple question, and it deserves a simple answer.

So that’s where we connect the dots: we take historical banking data that our users already have and use AI on top of that, to extract insights, understand a user’s lifestyle, make predictions and proactively help them in building better spending habits.

If OptioAI knows you won’t be able to get by this month if you buy that AppleWatch, then it can just tell you: “Listen my friend, it seems like a good idea, but take a day to think about it. Meanwhile, you need some money to eat this month.”

Or maybe it says: “yeah! You’ve been good this month. Time to indulge.” Making decisions is about understanding the individual’s situation. You need to support good decision making overall, not just always tell the person not to spend money.

Why do you think no one has offered your target customers this experience until now?

The mobile banking era showed a lot of people that their banks were not innovating around customer experiences. Many banks have barely changed their mobile apps since first launching them. Today that trend is really coming to a breaking point. People are fed up with their banks, and are more ready than ever to ditch them for a completely new solution.

We’re targeting millennials, who are quickly becoming the most valuable cohort of consumers in western countries. I think there are several reasons their needs have gone unmet. PFM isn’t a part of the core business of traditional banks. Their thinking about their customer relationships is shaped by consumer banking of the 20th century.

But today the cornerstone of consumer banking is not walking into a branch and talking to someone. Millennials don’t do that. They don’t want to do that. They want the bank’s services “a la carte,” picking and choosing for themselves, online, what they are interested in. Banks have been working towards offering PFM solutions, but it’s very hard to commit to something they don’t see as a core activity for them.

Plus, only certain types of customers like using a full PFM. It’s always going to require a lot of attention and time from the user in order to work well.

So first PFM startups emerged, and now I foresee a wave of AI-enabled finance applications that will do for the majority of customers what banks and PFMs can’t do: which is put a human face on your finances, and keep things simple enough that people don’t just give up.

What about the millennial generation is inherently different, and why do they want these new approaches?

In one sense, every generation is different, and in another, they are all the same.

Millennials have the same needs as older generations: they need financial products, cards, savings, loans, etc. But their expectations about how they get those products are completely different.

For millennials who are “digital natives,” everything has always been online, and accessible via computer, and then smartphone, instantaneously. Everything happens now.

Online banking evolved as a kind of version of impersonal in-person banking, which makes sense for someone who is used to in-person banking. Wait in line. Get your card in the mail. 3-5 business days. That’s what banks are like.

To someone who has never banked in person, online banking services make much less sense. For example, why does a transaction take hours or days to execute? That isn’t true in any of the other products that millennials use. Why is money different?

Why can I get packages delivered to my door faster than a wire transfer between two electronic accounts?

Of course it’s because banks used to get away with being slow, and they think they still can. But to people who grew up with a smartphone, 3 business days is a lifetime. It’s ridiculous to them. It’s unacceptable.

Another important thing is how young people use so-called “conversational interfaces.” In the past few years, messaging apps have surpassed every other category, and become the focus of many online activities.

Now younger people want their services to connect with them via messenger, and they don’t want to go to some company’s website and deal with their unique UI, and maybe-maybe-not mobile-friendly interface. Voice assistants like Siri and Alexa are a response to that desire to bypass the traditional web, and get information and answers in real time.

For millennials like myself, time spent scrolling is time wasted. Websites and apps are for the old internet. The new internet is where I am, when I need it, in the form I choose.

In a funny way, it really is something older generations wanted as well. In the past, that personal relationship between you and your banker was an in-person thing. But banks got rid of that, and made themselves faceless companies. Now we are using technology to “re-personalize” them, but around the types of interactions that work best with modern technology and lifestyles.

Millennials want transactional relationships. We want to be understood but not judged. Our generation avoids bureaucracies and hates formalities. We want “personalization at a distance;” experiences made just for us that feel personal, but are also done privately, anonymously, and without judgement from another person.

How can banks and PFM companies adapt to serve this new user base? How can they take advantage of what OptioAI is doing?

If there’s enough vision and understanding from their side, I think it’s pretty easy. Banks can even boost the process.

If you are a bank that is trying to adapt for younger users, you need to look at what they are already using and why. Where are they spending their time? That should tell you what seems natural to them, and you should work out new ways to make your services available in a similar way.

OptioAI can help banks to do that. We can provide the “voice” with which the bank speaks to customers. The banks have all the customer data, and they’re not thinking about how that data is useful to the customer. They aren’t putting it in a language the customer understands. That’s an epic mistake.

PFM companies attract a certain kind of person. I think there are some great examples of PFMs that help their customers a lot. OptioAI can also serve as a way to get those users interested in their finances, and willing to take a “deeper dive” using a traditional PFM. We don’t provide the same kind of value as a PFM does. So we could compliment each other well.

Your vision has shifted quite a bit since joining StartupYard. Which of the mentors has had the biggest impact in helping you find this approach?

It would be hard to name one particular mentor or influencer, I think it was more result of teamwork of OptioAI and StartupYard team, as we were “distilling” the information from mentors more or less together, and that’s how we ended up with our current vision.

To be more correct, this process helped us to widen our perspective and correctly articulate what we are doing, I can’t say that we changed our vision by 180 degrees, it was more about understanding and formulating it correctly.

One thing about going to an accelerator, is that a lot of things you think are clear are just not that clear. Even to you. The mentorship process made this painfully clear to us, and we are stronger, and have a stronger vision because of that.

Where do you see OptioAI going in the next year or two?

The next two years are crucial for this industry, and our young company. We have to get great traction, expand to several countries, create a user experience that everyone loves and prove that our vision matches with our users’ needs. And somehow we have to do that all at once.

That makes for a super hard and exciting journey ahead. But we are loving it.

You have a vision for how OptioAI will fit into a “post-app” technology landscape. Can you describe what that experience will be like for your customers?

This post-app future we’re talking about is already arriving now, as we’ve seen.

Today it’s a text communication: you can talk with OptioAI using Facebook messenger, so there’s no special app that you have to download, install and register. If you are on Facebook, you can instantly start using OptioAI, and that’s how easy it is.

Just to give you quick glance of how it looks and feels: Imagine, you have your personal financial assistant: it goes through your banking statements, knows your balance, gets insights and trends from your historical transactions and works 24/7 to help you.

Every morning, it gives you quick glimpse of the previous day, just giving you info about cumulative spending, and then helps you to plan the day. This becomes a routine that continues every day. So it’s about setting up simple, contextual interactions that are not intrusive, and don’t take a big effort on your part.

Of course OptioAI has plenty of other skills, like you can ask in plain text how you spent last week on groceries, or how much you spend on average at Starbucks during the month. The great thing about this AI first approach is that we don’t have to redesign an app or think about the UI much at all: it’s all about what the thing can do, and what it can learn to do.

But for that, just talk with OptioAI, it’s always better to experience it yourself.

You’re based in Georgia. Are there particular quirks about the Georgian market or culture that you would say give your company an advantage or a fresh perspective?

Georgia is a fantastic country in many different aspects, and I think it’s also a great place for starting and testing your product, ideas and concepts.

For us, it’s a big advantage to start there as we know market, culture, and there’s almost no competition in personal finance management. Operating there is way cheaper than in the EU. On the other hand, because of the market size, it’s very hard to scale there, especially for products like OptioAI.

So, home-field advantage yes, but global impact, not so much. This is why we are planning to scale beyond Georgia as fast as possible. We will use it as our test-bed.

How can potential partners reach out and start working with OptioAI today?

We are ready and happy to partner with interesting companies. We are open for conversations to explore how well our product and potential partner needs are aligned. So if there’s any interest, I would be glad to start conversations today. For that you can reach me personally me at shota@optio.ai

But here’s an even better idea: talk to Optio right now on Facebook, and ask for Shota. Then we’ll be connected in the place where our company really lives.

Talk a bit about your experience with StartupYard. What were the surprises, challenges, highs and lows?

It’s not so common that Georgian startups get into EU or US accelerators and we had a long journey before we got our acceptance email from StartupYard (which was one of the most exciting emails on my life).

If you are going for the first time to an accelerator, the information you have is what you can find in Google, a personal recommendation if you know any alumni. It was hard, it was intense, it was exciting and super challenging.

I think the first phase -mentorship sessions- is one of the biggest advantages and differentiators of StartupYard. Meeting 100+ mentors in about 20 days is crazy stuff. There were days, when we had six or seven 45 minute meetings, one after another. It may sound hard (and it is hard) but it’s like putting your brain on steroids. You get so much information, so many opinions and contacts that sometimes you just can’t sleep later in the evening, because you are still analyzing what you have heard.

You get access to the C-level representatives of industry leaders, banking, insurance, car production, other startups, and the list goes on. In one day you may get a connection, that you would spend several months chasing otherwise. And they listen to you! That is the thing: they really want to talk to you, and many mentors are totally open, which is just a completely different experience from chasing them down and getting a meeting yourself.

But it’s also really hard not to lose your focus. If you are fresh startup and have not yet sharpened your vision, it can be challenging to choose from the feedback what’s important and what’s not. You can be tempted to try several directions at the same time, but it’s a mistake.

So you have to listen, analyze and use what makes sense for your startup. And that’s super hard, believe me! That’s where the StartupYard team helps you, they challenge you and go through the whole journey with you to explore the options and later, make it happen. So this is the main reason why someone should come here: you get a sharp vision, you get fantastic connections and exposure, and a super friendly team, which helps you all the time.

On the other hand, you will hardly have time for the product itself, at least during the first month and half, so be ready for that, get enough sleep before the program, as you will spend your nights on the product.

Applications are open for StartupYard Batch 9!

Are you a startup, or an entrepreneur with a great Deep Tech idea?

Applications are now open.