Meet Shufflup: Bringing the Benefits of Crypto Trading to the Masses

In our continuing series of up-close, in-depth interviews with the founders of the StartupYard Batch X companies, we come to another of the 3 companies that join us this round are working in the field of crypto asset trading. ShufflUp is working to make the growing world of crypto-currencies and crypto asset markets available to regular people. It’s a fully automated trading platform that uses techniques from electrical engineering and high-frequency trading to generate steady profits for small-time investors. The team comes from India, and has decided to locate its operations in Europe, incorporating in Estonia.

Shufflup Co-Founder and CEO Shilpa Mitra is a data researcher with 5 years experience in statistical data analysis. During her engineering career she has focused on building software, and in the process got into close proximity with many programming languages. She was part of a collaborative research project with Tokyo Electron Limited during her Ph.D. studies which culminated into a full length academic research paper, published in one of the esteemed peer-reviewed journals. She is captivated by the possibilities of blockchain transforming the current inefficient financial system. I spoke with her this week about Shufflup

Hi Shilpa, first of all I want to highlight your career so far, because at 26 you’ve accomplished a lot of amazing things, including studying for a PHD in electronic engineering. Can you tell us how you got to where you are?

First of all, I want to clear this that I am not a PhD.

My Co-Founder Sromana Mukhopadhyay and I went to the US with the vision of changing the world through our love for maths and technology, like any other PhD student might think during their first year of study. By the end of the first year, we had published two research papers in two esteemed peer-reviewed journals, completed almost all the courses, taught a bunch of undergrad students, cleared the dreaded PhD qualifying exam but still somewhere the creative soul within me was not satisfied.

Co-Founders Sromana (left), and Shilpa (right) come from the same region in Eastern India and studied in the US together

I realized that I can better utilize my data-processing skills to develop something which is useful for the people I care about and this realization brought me back to India. The tech-lover within me got fascinated by the revolutionary concept of digital currencies and the more I learnt about them the more I realized that they possess the power to change the future economy.

Going from electronic engineering to blockchain technology seems like a big leap. What got you interested in working on blockchain and cryptocurrencies?

You can say it began as an academic sort of curiousity. There are interesting mathematical concepts in blockchain technology, and the idea of distributed databases and trustless networks.

I started reading the whitepapers of various cryptocurrencies in order to understand the underlying blockchain technology. I started trading with crypto-coins on various exchanges but soon enough spotted the obvious inefficiencies of the crypto market. I realized these inefficiencies provided the potential of being even larger than the inefficiencies of the current unbalanced financial system. Upon researching more and after some days of digging deeper, my calculations proved that the inefficiencies that prevail in more than 15,000 crypto markets and 500 exchanges are capable of creating 440 thousand arbitrage opportunities per second, which are capable of producing 8-10% profit each month.

Now let’s dig deeper into how two electrical engineers have done it, considering we have always dealt with electrical signals and currents coming out of transistors. As electrical engineers we have used time series analysis to predict the useful lifespan of transistors. We realized that the data coming out of exchanges is also time-series data and the same time-series analysis tools can be applied to exchanges’ data as well. It is simply the source of the data that has changed, not the nature of it. Hence is not a ‘big leap’. It is because of our backgrounds that we are able to build everything we are building today.

Just imagine the global currency system as a series of outlets and inlets, just like an electrical grid. You have a peak flow that is predictable. You have a directionality in the system that can be modeled and observed. You can see that money and transactions flow across the system in a certain way, based on the capacity of the various parts of the network to manage the traffic, as well as the actual needs on the side of the users of these systems.

Now, whether it is crypto-currency or forex or electrical grid systems, the same type of statistical analysis can be applied to predict movements and to design the ideal way of managing those movements. What we do is called “currency arbitrage,” but it resembles electrical grid arbitrage as well. Providing liquidity where it is low, and sucking up liquidity where it is high, in order to keep the whole system stable, is the same whether you’re dealing with crypto tokens or energy itself.

Q: What are you trying to accomplish with Shufflup that you think no other platform has been able or willing to do?

Arbitrage and automated trading are not new concepts in the least. Our approaches to these activities I believe are unique, however I want to be clear why we have chosen this direction for our company.

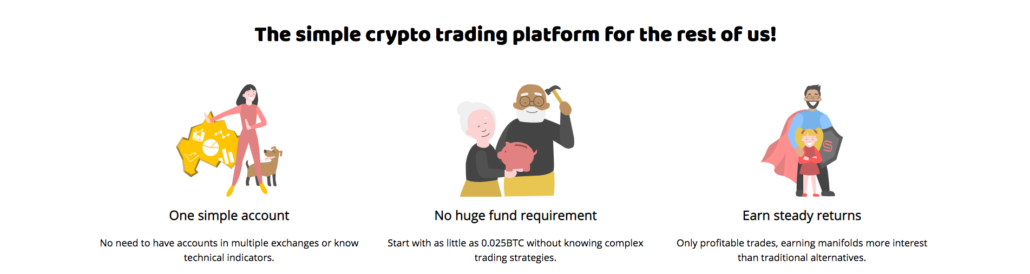

Unlike other complex crypto platforms, which try to serve more sophisticated and more liquid investors, at ShufflUp we are trying to help that section of people in society who are neglected and not taken into consideration by other crypto trading platforms. There are 25 million crypto wallets in the world and out of which only 3- 5 million are in active use, whereas the world’s population is 7.44 billion.

The Co-Founders in New Jersey during PHD studies.

Other algorithmic trading platforms are making their tools available to this bracket of tech-savvy and the so-called ‘accredited’ investors who are already in the business of crypto trading. At ShufflUp we will initially target the rest of the 20 Million passive wallets of ‘HODL’ers who have bitcoins sitting in their wallets and doing nothing. Then we will move forward to target retail users. We are primarily focused on small investors and the minimum deposit is 0.025 BTC. At present in order to use ShufflUp, a user only needs to have bitcoins in his wallet, deposit them to our platform, sit back and relax to see his profit steadily moving up.

With ShufflUp, no complex setup or figuring out innovative trading strategies or 24/7 monitoring is required, ours is a no-brainer and hands-off platform. We want to be a sensible bet for the average low income person who wants to profit from a dynamic, changing economy.

Can you tell us a bit more about how your technology really works?

At ShufflUp, our mission is to bring cryptocurrency profit to the masses because we believe digital currency is the future. A part of making that future work is distributing the gains of growth in the crypto market, and getting more people engaged with it. Through our technology, we have been able to eliminate the long-standing issues of arbitrage crypto trading. To realize significant profit through this form of trading by a single trader, huge funds are normally required upfront. A person also requires his/her funds to be properly distributed among several exchanges and the right coin-pairs where the opportunities are occurring. Basically, you need a large reach and high liquidity to profit from helping to maintain the balance of the system.

ShufflUp aggregates data from several exchanges, analyses them based on historical data patterns to understand where the next arbitrage opportunities are going to happen and distributes the funds in those coin-pairs. As of now, our system processes 40,000 datasets/sec to identify the next set of arbitrage opportunities. Needless to say, this will go on increasing as we scale.

Identifying the opportunities is one thing, but not all of them are executable for various reasons, such as network latency, high associated fees and volume associated with the trade. In order to avoid order slippage our technology determines the exact quantity at which to place the order based on statistical correlation and then executes only those trades which it predicts to be executable.

So far our algorithm has correctly predicted and executed 99.62% of all the arbitrage opportunities that have occurred during the last 3 months in the integrated coin-pairs. One of the things that few of you who are familiar with crypto arbitrage trading must be wondering is the transaction time and transaction fees associated with the arbitrage trading. Our smart system distributes the funds in such a way that it reduces the transaction time & fee by 90%. Also it is important to mention that all the profit that our system has made during the last 3 months is after taking into account the maker, taker, deposit and the withdrawal fees in the exchanges.

We have been organizing our private beta for the past 3 months with 12 investors – 2.5BTC and generated 55.2% profit for them. Also 250 users are in the pipeline eagerly waiting for our product to go public.

Many people including many mentors of SY have asked us, ’what if these opportunities gradually diminish in numbers as the market matures?’ That is a valid concern, because as a market matures technically and in scale, arbitrage becomes more common, and so less profitable.

But here I would beg to argue that even after so many years discrepancies still exist in the traditional market. Arbitrage always becomes more complex, but it does not go away. We will have to continue to evolve and learn from existing datasets. In that sense, our early mover advantage will be increasingly important, as we will have more data than others who attempt to enter the market later.

Having said that we have two very different trading strategies currently under simulation which will drive us forward in the path of our broader vision. One of them is based on complex predictive trend line analysis coupled with a few technical indicators which we know only the top experienced, disciplined, dedicated and the rich bracket of traders can take advantage of. The other strategy is based on analyzing market psychology because ultimately, market prices are created by the constantly fluctuating perceptions of market participants.

Here too, you can take some clues from understanding the flow of an electrical circuit or grid. The needs of a system can be understood through outside indicators. For example, famously, electrical grid operators must study television schedules to understand when consumer are likely to turn off their televisions at night, in order to ramp down the supply quickly enough not to over-power the grid. They must understand the upcoming weather patterns in order to provide enough power to the grid to run cooling systems.

You can apply the same macro forces analysis to crypto trading as well, which is something we don’t believe is common in this market yet.

Q: What do you hope that Shufflup will be able to do for its users in the next few years that they can’t do now?

As we are targeting the masses, or in other words retail investors, we will have our focus in developing an end-to-end solution for our users where they will be able to buy not only Bitcoin but also other cryptocurrencies because with arbitrage we will have an umbrella of cryptocurrencies. They will be able to buy these at a much lower commission than what is available at other exchanges/platforms.

We will also have two different schemes for our users based on a long-term and a short-term approach. If someone prefers to keep their crypto with us on a short-term basis, we would take a 20% cut from their profit, on the other hand if they stay with us on a long-term basis, we would take an even smaller cut from their profit. We are planning to go into partnerships with different companies which would enable our users to pay for their rent or coffee or pizza directly from our platform at a discounted price. Again, this is helping to spread the use of the currencies, and make them more attractive as a real utility to more parties. At ShufflUp, we are dedicated to expediting the mass adoption of cryptocurrencies.

Why do you believe so strong that blockchain technology can make the financial system more efficient, or more fair?

I firmly believe that blockchain is the future of finance, and this technology will do to the financial system what email did to the postal system. Remember, the postal system is not dead because of email. It’s bigger than it was when email came along. But we use it very differently now. We use it for much more important things. The use cases that migrated to email did so because the electronic form made so much more sense than the physical, in almost every way. I believe the same will occur around blockchain.

Blockchain will have a profound impact on the consumers who will hugely benefit from greater efficiency, greater security and greater transparency. A new decentralized financial system would remove the intervention and complexity that exists in the existing financial system and would lower the barrier to entry for those people who are currently denied entry (the unbanked population).

Yes the financial system would also become more fair as blockchain’s underlying protocols support stronger identity management thus helping regulators combat illegal money laundering and terrorist activities. The truth is that the financial system as it exists today is not technologically backwards, but it is built largely to the benefit of the wealthy nations, the rich, and the powerful. It has few real incentives to provide tools for smaller investors and for the poor and unempowered to use modern financial tools. That is a growing problem that I believe blockchain technology can work to counterbalance, and help to democratize access to finance.

What other things can blockchain be used for that most people have been ignoring?

I think in the areas of e-voting by bringing more transparency so that election results are honest and accurate, coming from a country like India I believe a fair electoral system can bring much needed socio-economic change to developing countries.

I also think the sharing and gig economy can strongly benefit from decentralization, as many of the existing systems are designed to benefit a relative few at the top of organizations, and are not equitable to the people who use the system. You can see this with companies such as Uber, where the drivers are being pushed to work for the minimum amount possible, while the company itself needs to take a larger portion of their earnings to stay solvent as prices continue to drop. If this system were mediated by a cryptocurrency where the economics were more transparent, I believe consumers could make better decisions, and those working in the gig economy would get access to fair compensation for their work.

As it is, these markets today work on a “black-box” basis, meaning that you simply have to believe that a company like Uber understands its own economic model, and that the driver understands the cost/benefit of working for them, and that the price you pay is fair and equitable. You must take the word of the company on faith, without proof. However, in a black box model, the company at the center is incentivized to change the rules in its own favor, and to profit from a lack of information from the parties it transacts with. That is not a system in which the good of ordinary people is the focus.

Decentralization means that the ability of the rich and powerful to take advantage of your lack of information in everyday economic decisions is neutralized. That is the ultimate promise of cryptocurrencies, and what we should all hope for in the future.

How did you start working as a team? What makes you the right people to build Shufflup?

Sromana and I know each other since our undergrad days (about 8 years). We initially started preparing for several competitive exams together, cracked all of them, and got admission to the PH.D. program in the USA together. In that way, we became a team before we had a mission. We noticed the loopholes of crypto trading world in a joint effort and wanted to solve it together.

Data analysis and data processing, dealing with different statistical tools like Wavelet and Fourier Transform has been our forte and this project requires deep digging of data.

Coding of course forms the backbone of any startup and both of us are well-versed in a plethora of programming languages like PHP, NodeJS, Javascript, C, Java, Python, CSS, etc.In college we organized a national level technology festival where both founders were part of the managerial team. We together raised funding, and scaled the number of participants by 1500.

We are each other’s best critics, and constantly pushing one another to perform better. For all the above reasons we felt uniquely qualified to work as a team and solve the problems that we are solving now at ShufflUp.

How has your experience been at StartupYard, and in Europe generally? Did it match with your expectations, or did it surprise you in some way?

A: Prague is a beautiful place to live, extremely peaceful with an extremely systematic and well-connected transportation system. These are the kinds of things that I notice as an engineer by training: that this is a society that understands organization of public spaces very well. Europe in general has wonderful advantages for quality of life.

StartupYard has been great so far, I love the people here at SY as you let us be ourselves yet push us at the right time in the right direction. We can’t thank you enough for accepting us into this program as it was a huge validation as well as support for us that we are moving in the right direction. We got to learn a lot from some of the mentors, actually formed a lot of ideas that we are working on now, which would never have been possible without SY.

Being in SY and attending the workshops helped us ‘know’ about different core metrics of building a business about which we did not have any idea even a few months ago. The most important thing which I learnt is finding like-minded investors who will push your company in the right direction and not just crave to get manifold returns. Basically I can go on and on, on how being at SY has been such a learning experience and a much-needed one for us.