Meet Strikes: The App That Makes Options Trading A Breeze

Today it is our pleasure to unveil the 4th startup (out of 10 selected so far) from the StartupYard Remote Lab program. Strikes is for people who think option trading is complicated. Strikes is an AI powered options trading app that simplifies options trading and increases user’s chances of being profitable. We sat down with Grace Carrillo and Andrii Leus, the co-founders of Strikes to talk more about what they do and their plans for the future.

Hi Grace and Andrii, tell us a bit about your personal journey, how did you meet and what led you to start working on Strikes?

Andrii: I’m a finance professional specialised in quantitative finance and fundamental equity analysis with over 8 years’ experience in the investment management industry. I was an equity research analyst and was deeply involved in the investment decision process. I personally experienced the drawbacks of investment research in its current form.

Grace: I am an engineer and data scientist specialised in statistical analysis, quantitative research, NLP & Machine Learning. Our story starts online, as did most stories that began in 2020! We were both taking an online specialization on Natural Language Processing (NLP). By that time, Andrii was already cooking up an awesome B2B startup idea on the asset management industry. He needed a co-founder a bit more on the tech-side to help him build it. I found out about it on the NLP course slack channel and reached out to him on LinkedIn. That same week we were writing up our action plan to build our AI SaaS company.

Grace and Andrii – co-founders of Strikes

Yes, you guessed it, Strikes was not our first idea! It was during our time at StartupYard, and after hours and hours of meetings, pitches, and feedback from StartupYard mentors, that two things became clear:

- People have started trading stocks and options at rates never seen before. They are taking control of their financial lives. And what we had built so far for our B2B startup would be very useful for everyday option traders. By going B2C, we would help people directly and tap into a much larger market.

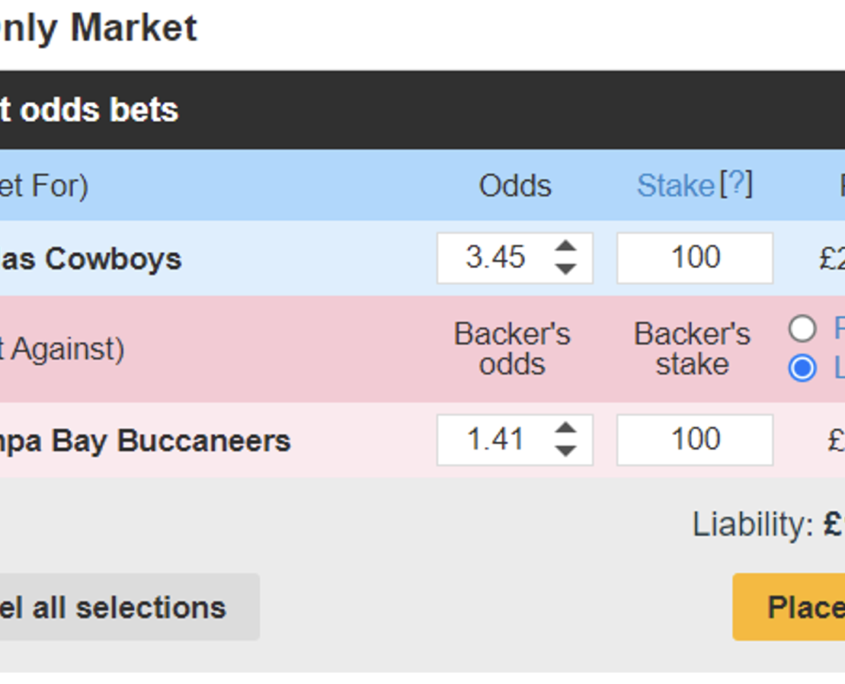

- How similar professional sports trading and options trading are. I know, random, but bear with me. In sports trading, you bet for or against a team, a player, or any possible outcome, before or after the event. You know what other people are doing by looking at the probabilities of each outcome, and there are tons of tools you can use to make good trading decisions. And most importantly, there’s always a strategy you can follow. Options trading is kind of similar. Market’s going up? There’s a trade for that. Market’s crashing? Lots of trades for that. Not moving? Trades for that too. Except, it’s full of jargon, you don’t know what others are up to, and there’s not many tools available to everyone.

We said to ourselves, what if we can present options trading in a way that anyone can understand. And we mean anyone. And not only understand but have the tools and insights they need to make the best trading decisions. Kind of like sports trading.

And that’s how Strikes was born. Well, that and quite a few hours of brainstorming on a new name!

Interactive Brokers Options Trading Screen

Why are you a good match for this project?

Andrii: Our mission is to empower everyday people to maximize the benefits of options trading. To achieve that, a whole bunch of specialized financial tools and metrics needs to be translated into an easy-to-understand language for someone with no financial background.

And the diversity of our experiences enables us to succeed in that non-trivial task.

I have both educational and professional experience in options trading, while Grace has worked as a data scientist, machine learning engineer, and has experience in sports trading. As Grace mentioned before, options trading and sports trading share some similarities.

Grace: Our diverse experiences complement each other, and we believe in our mission.

What prompted you to start developing Strikes? What did you see as fundamentally wrong with the way retail option trading works right now?

Andrii: Options trading used to have a high barrier of entry in terms of capital. Retail investors would first need to deposit a lot of money and then be ready to pay high commissions. This made options trading an expensive activity most people couldn’t afford.

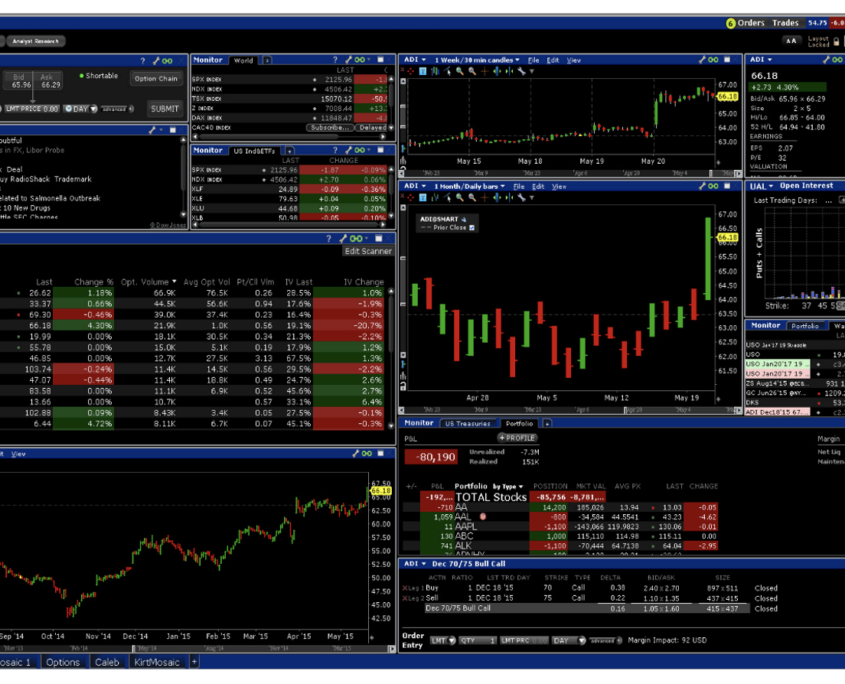

The situation has changed drastically. The huge deposit and substantial commissions have been lowered or even dropped altogether, giving people unprecedented access to options trading. We think that’s awesome because now anyone can experience the two key benefits of options trading: boosting potential profits and mitigating investment risks. But options trading often gets a bad reputation for being “too risky”.

Is it risky? Opinions on the matter are roughly split in two opposing camps:

- One side, with its most active voices being those of financial heavyweights Warren Buffett and Charles Munger, claims that not everyone should be able to trade options. Only those with specialized knowledge. Munger has said that Robinhood is “a gambling parlour masquerading as a respectable business”. For them, the risks outweigh any potential benefits.

- The opposing side portrays the former approach as outright elitist. Robinhood has stated that “people are tired of the Warren Buffetts and Charlie Mungers of the world acting like they are the only oracles of investing”. They emphasize that everyone should have a right to benefit from options trading despite the potential dangers.

We believe that both sides have a point. Everyone should be able to participate in options trading. But right now, it is risky to trade options for most people.

Why? Because, so far, disruptors like Robinhood have widened access to options trading, as in, the ability to place a trade. But that’s about it.

The information and tools you need to make a good trading decision? That’s still not within your reach. Unless you pay fees to multiple data providers, each giving you a different piece of a puzzle that you need to put together on your own. And then interpret what the puzzle even means. Or, and this is the worse one, you are willing to trade options blindfolded. Which is basically gambling.

So, as a result, what we’re witnessing is many retail traders losing money with options because they are unaware of mistakes and dangers that no professional trader would ever make.

The reality is that people are attracted to the benefits of options trading, but no one is helping them to deal with the very real threats they will face. Enter Strikes.

Who is Strikes for and what problem are you solving?

Grace: Strikes is for people who want to trade options, but the jargon makes them roll their eyes and not even try. And, also for those who are doing it but get burned because, as an everyday person, you just don’t have access to the tools and information you need to make good trading decisions.

Andrii: And that’s the problem. Thanks to Robinhood, Webull, and others, it’s never been easier to place an options trade. But no one is helping people make the smartest, most strategic trading decisions possible before putting their hard-earn money on the line. And to not lose it on perfectly avoidable mistakes. So much heartbreak could be avoided with the right push notification at the right time!

Why start a startup focused on options trading?

Andrii: Because, contrary to what you may have heard, options trading is actually a great way to optimize your investment portfolio. But only when done properly.

Grace and I are thrilled that so many people are taking control of their financial lives by trading options because we truly believe it’s the most powerful tool to navigate whatever happens in the stock market. But we are also worried that too many of them are just crossing their fingers and hoping for the best when they trade.

As far as we can tell, there’s no sign that current industry players, old or new, will try to change their platforms and focus on helping everyday people. Why would they? There’s no incentive. They seem to be doing rather well with the way things work right now. We believe there’s plenty of space for Strikes to spearhead the new generation of trading apps focused on helping our users to succeed at options trading.

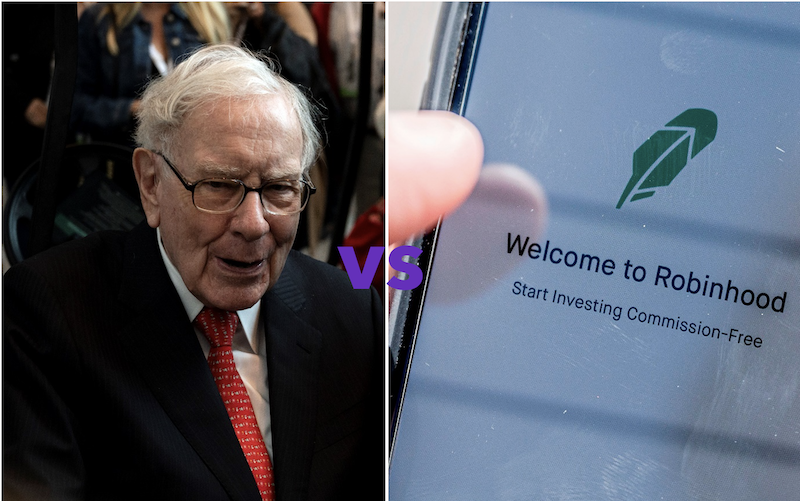

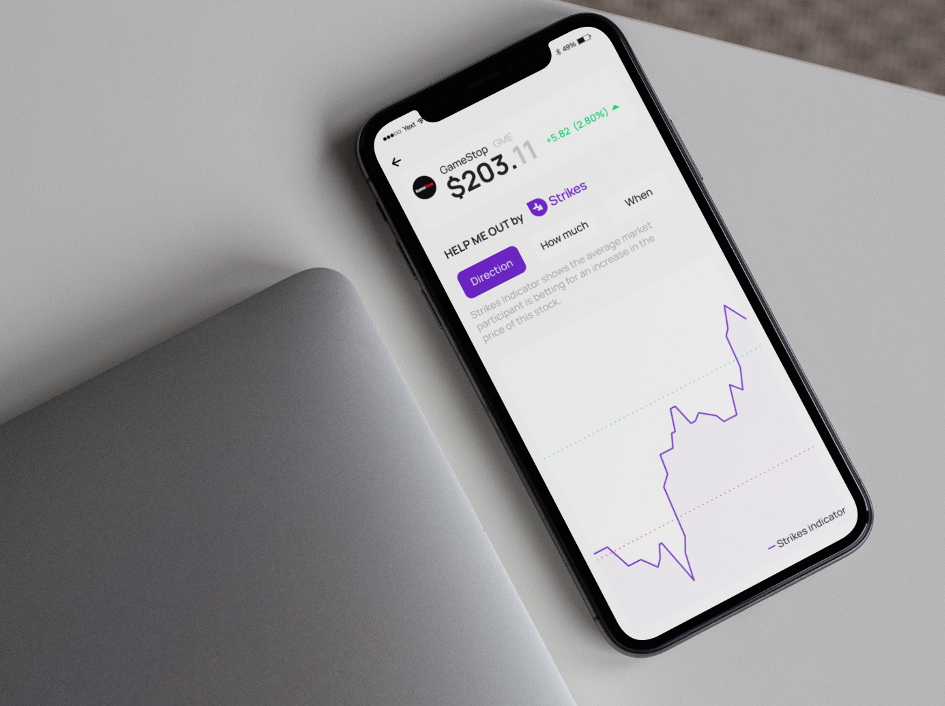

Strikes HELP ME OUT Screen with proprietary indicators built with AI.

Let’s talk more about the product. What would you say distinguishes Strikes from other options trading solutions? What is your “killer app?”

Grace: What we see is two main types of options trading apps:

- Low-cost, low-jargon, user-friendly apps, with a beautiful UI. Category leaders here are Robinhood and Webull. But, like we’ve said, they don’t offer any tools to help their users make better trading decisions and quite often users get bad prices on their option trades, known as execution or fill quality.

- Higher cost, jargon loaded apps aimed at professional option traders that already know their way around. Some do offer advanced analytical tools, but their mobile app versions sometimes don’t have most of the features. They’re also not exactly obsessed with having a beautiful UI and intuitive UX.

Strikes is more than just another trading app. We empower people to approach options trading the right way with an app that is:

- Intuitive. We keep the jargon to a minimum, we translate complex analysis into easy to interpret tools, and we dramatically reduce the learning curve to trade options.

- Opportunity-filled. Deciding where to get started doesn’t have to be intimidating, overwhelming, or confusing. Strikes filters all the information out there using AI, to show trading opportunities right there on the home page.

- Time-saving. Strikes users don’t need to spend hours monitoring data sources relevant to their trading positions. We monitor them, so they don’t have to.

- Insightful. We extract, transform, and translate data in the background. Strikes has proprietary indicators that let our users know what others think will happen to the stock price. And the probability of that outcome.

- Risk-mitigating. Those mistakes and dangers of options trading we were talking about? Unfortunately, you do have to have specialised knowledge to know when they’re coming and how to deal with them. But that’s what we have Andrii for! With his knowledge and our tech stack, we’ve built a notification system that lets Strikes users know when a threat is coming. And we let them know how the professionals deal with them.

Strikes simplified trading screen.

What have been your team’s biggest personal or professional challenges in making this project a reality?

Andrii: The key challenge for us was partnerships. Retail brokerage is a heavily regulated industry, and for a good reason. There are different actors within the options trading pipeline, and we needed to make sure we have all the necessary agreements in place. Thankfully, we have successfully overcome that challenge.

Another key challenge is translating options trading jargon, tools, and analytics into a plain language anyone can understand. For me, having spent years developing options strategies, financial lingo has become second nature. So, at times it can be quite challenging to not use it.

Is Strikes available now? What do people need to get started with your service?

Grace: Get on the waitlist! Just go to trystrikes.com and sign up. We are planning to release the paper-trading version of Strikes in September for early testers.

What do you hope that Strikes will be able to do for its users in the next few years that they can’t do now?

Grace: So many things! We have so many features and ideas on the backlog. From very technical, but extremely relevant features, like being able to guarantee our users the best trading price possible, to an AI trading Assistant.

“Hey Strikes! What’s the best options trade I can place today with $100?”

Has there been a major surprise for you since joining the StartupYard program? Did you learn something you weren’t expecting to?

Andrii: We were genuinely surprised of how tight and supportive the StartupYard community is. Whenever we need any assistance with design, marketing, SEO, or any other area, we can always find support from SY mentors and alumni.