Ramez Naam: 3 Ways We Fail At Predicting the Future

Last week in Prague, the famous inventor, sci-fi author and speaker Ramez Naam gave a talk about one of our favorite topics: Exponential Innovation, under the auspices of DirectPeople. Ramez Naam is not only an award winning author, he is also a veteran of Microsoft, the holder of 19 separate patents, and the founder of Apex Nanotechnologies, which is the first company to create software tools for molecular design.

The partnership is fitting, as DirectPeople works with companies and startups to realize innovative new projects, building teams around new ideas and executing them for banks, energy companies, and telcos, as well as smaller firms. (Full disclosure: Petr Sidlo, CEO at DirectPeople, is our mentor, and Phillip Staehelin their Innovation Evangelist is our mentor and investor.)

The talk centered around an introduction to exponential thinking, much like those we have written before. What really stood out from the talk however, was Naam’s particular attention to the reasoning that so often fails to predict radical changes in the business and technology landscapes. As important as the exponential innovation framework is, we must put it in context with the logic that has failed to match it over and over again.

The talk was a long one, so I’ve chosen to focus on 3 key errors that perpetually lead industries as well as individuals to dramatically underestimate the effects of innovation over long periods. As Naam pointed out in his talk,

3 Ways we Fail at Predicting the Future:

First: Disruptive Innovation Comes “Bottom Up”

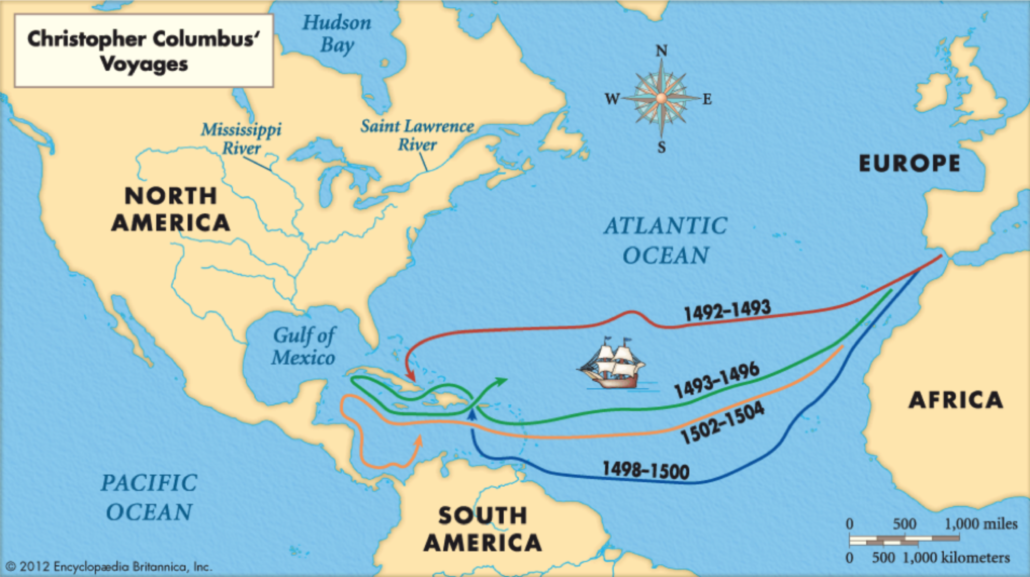

One of the key analogies Naam used was the broad history of world empires beginning around A.D. 1400-1500, with two key events: the European discovery of America by Columbus’s fleet, and the exploration of South Asia by Zheng He of China.

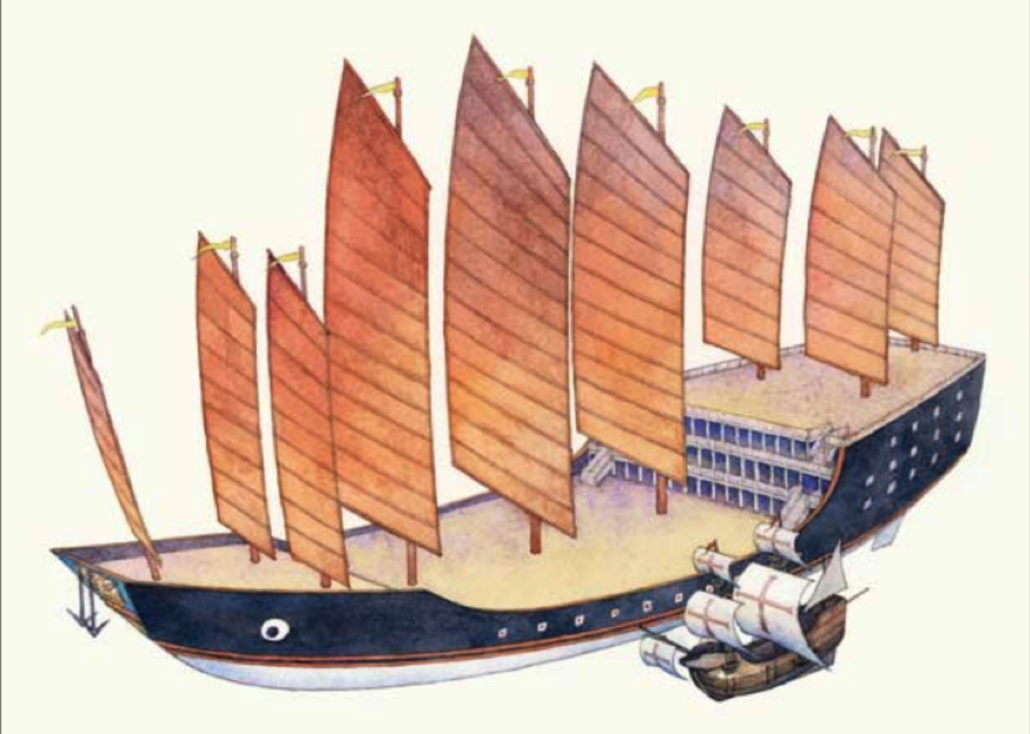

To scale: the flagship of the Chinese fleet of 1400 (larger), and the Santa Maria (smaller).

Though the two events bear remarkable similarity in their timing and boldness, there the similarities end. Columbus’s voyage was an accidental success. Attempting to circumnavigate the globe with too little food and resources, his fleet was saved by the accidental discovery of Cuba, a fraction of the total distance to his actual target, East Asia and India.

Zheng He, on the other hand, commanded the most technologically advanced navy in the world. His ships made Columbus’s tramp fleet of the Nina, Pinta, and Santa Maria look like bath toys in comparison. His expedition was well planned and financed, took much less risk, and made much more important near term discoveries for China in the form of large potential trading partners.

Yet, Columbus’s voyage set off an imperial age in Europe that lasted for nearly 5 centuries, and saw the colonization and Europeanization of most of the world. Zheng He’s 25 year exploration of South Asia and East Africa ended in the burning of his fleet, and the closing of China from the outside world for another 4 centuries.

Why these two vastly dissimilar outcomes? Moreover, why did the results of a well funded, professional, and government backed expedition (that of Zheng He), result in nothing of significance, when the poorly funded, badly planned expedition of Columbus ended in Spain’s domination of South America for hundreds of years, and Britain’s eventual domination of half the world?

Top Down V. Bottom Up:

There is one key differentiator: China’s exploration of the known world was a top-down affair, instigated by the emperor, and carried out on behalf of China’s leadership. It was essentially a government program/ Meanwhile, Columbus’s voyage was backed by Queen Isabella of Spain (after other monarchs turned it down), but she served as little more than a financier. The project was from the beginning a bottom-up effort by Columbus, and would have been doomed to failure and the death of the entire fleet, if not for America conveniently sitting between Europe and Asia. Columbus lucked into a discovery that eventually made him rich and famous. He took the key risk (with his life), and so he also owned his share of the rewards.

Again, Naam directs our attention to the effects that leadership structure had on the resulting discoveries. While Zheng He returned to China a hero, his discoveries and fleet were the property of the Emperor, who chose simply to dismantle them, rather than to take the risk of engaging with foreign trade and potentially coming into conflict with foreign powers. To China, the fleet represented a cost and risk that was evaluated based on the status quo. Since the voyage proved that China was the most powerful nation on Earth, the Chinese saw no more reason to engage with the outside world and risk their already safe position.

Stability Becomes a Liability

Columbus was in a weaker position from the beginning. So why did he win? Naam argues that it is because of the inherently competitive nature of European politics at the time. While China was unified under the Ming Dynasty for 3 centuries (from 1368-1644), Europe’s political landscape was inherently unstable, and composed of hundreds of individual state-like entities, with nobles fighting for position and consolidating control of their regions.

It was that instability which made it difficult for any one government to back Columbus, and it was the need for a competitive advantage that drove Isabella, who had only just united Spain under one ruler, to fund him. The price of not having state control of the expedition was that Columbus himself (along with the explorers and conquistadors who followed), personally profited from their efforts. A traditional of entrepreneurial exploration was established because Europe could not afford to publicly fund it.

Thus, Columbus’s voyages were highly disruptive to the established order because Europeans were desperate to gain competitive advantages over neighbors. Meanwhile China, the strongest nation in the world at the time, had no such need. In fact, quite the opposite, as opening itself to trade only served to destabilize China when it eventually did realize it could no longer afford to remain closed. It was finally Britain that forced the opening of China and established Hong Kong as its trading colony in the late 19th century.

One does not have to look too hard here to recognize the tech startup and the modern corporation. Stability for its own sake can turn to a liability over time, as hungry younger competitors adapt too quickly and are too numerous to be stopped.

Second: Exponential Innovation is Deceptive

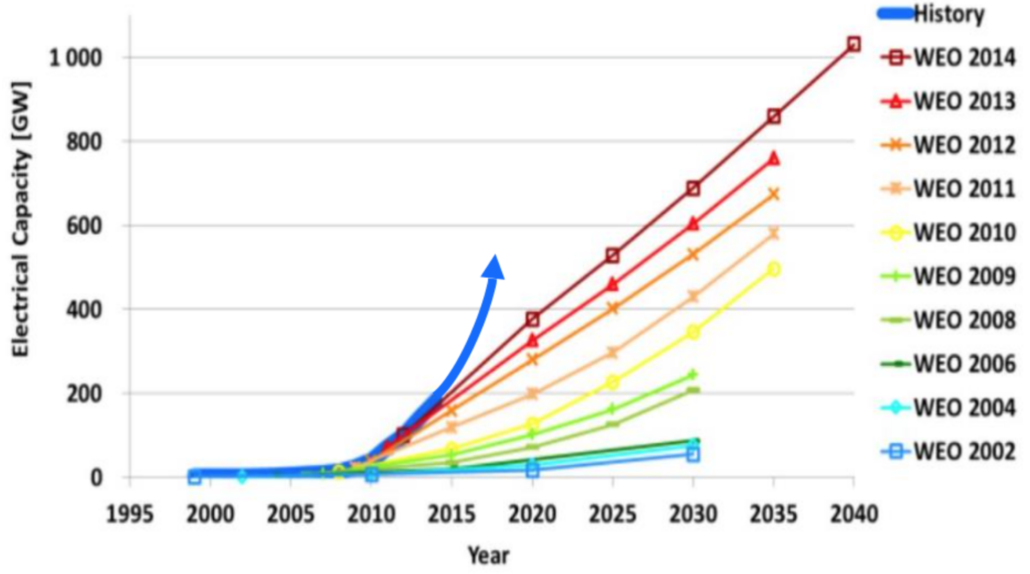

Naam spent a lot of time covering the ways in which exponential innovations deceive people into seeing them as always just about to slow down. This is because the fundamental drivers of innovation are often mistaken as being the same as they were before the exponential growth curve took effect. He shared this graph, for example:

The graph shows a classic exponential curve in the electrical capacity of solar power from roughly 1998 to 2014, along with the World Energy Organization predictions of future growth. As is plain to see, every single prediction over 12 years shows static growth, but realigned from the new actual baseline in any given year. Every prediction is not only wrong, it’s wrong in exactly the same way.

Why would that continue to happen for 16+ years in a row? Surely someone at the WEO might notice it happening and try to figure out why?

Exponential Innovations are on a broad front:

Naam provides a partial answer in this blog post on the topic. He points out that predictions typically take a snapshot of the industry at the present moment, and extrapolate expected advances based on what appear to be limitations to growth that are non-surmountable without a step change in the technology or the underlying economy.

This works most of the time, because most of the time the specific conditions for exponential innovation aren’t met. Namely: that advances in different aspects of a technology produce feedback to affect growth in other areas. Innovation is happening on a “broad front.”

In this particular case, the reason the predictions are wrong is not because their underlying assumptions are inaccurate, but because they are about the wrong things.

For example, predictions of the slowed growth of solar energy may point to theoretical limitations in the materials being used to make solar panels. Indeed, solar panel efficiency is not growing as fast as it did in the past. Instead, as Naam points out in his post, the manufacturing methods are improving faster instead, which is compensating for the diminishing returns of material science advances.

This effect repeats itself over and over again. If it isn’t manufacturing, it’s software. If it isn’t software, it’s infrastructure changes. If it isn’t that, it’s changes in the consumer business model that accelerate growth. The growth in total wattage keeps going up exponentially because all these advances are driving each other forward at once.

Third: Exponential Innovation is Democratizing

On the last point about innovation around the economic models of new technologies, Ramez Naam took special care. He argues that exponentiality of innovation depends on the technology’s ability to be democratized over time.

In fact, in reference to solar power, he used Nuclear energy as a counter-example. Despite the enormous efficiency and effectiveness of modern nuclear power, it is failing to keep up with solar energy in the growth of its footprint. In fact it is declining. Predictions by Isaac Asimov and many others about a nuclear future in which atomic cores power watches and handheld computers, or even body implants, are now severely dated.

Why is that? Naam argues that it is because Nuclear power is difficult or impossible to democratize. Simply because of how it works, and its ability to be weaponized, atomic power must remain under the control of governments. This means that the core technologies involved with nuclear power have fewer chances to influence other areas of technology growth, and vice versa. Nuclear grows in a kind of parallel, where advances don’t greatly benefit other technology areas, and so other technologies don’t arise to create demand for new innovations.

Nuclear is not doomed because the technology doesn’t work, but rather because it can’t be enmeshed with other businesses and technologies. Like China’s great navy in 1400, nuclear is a state operation: it can’t be democratized because it is too dangerous.

If we go back to the previous example of Columbus and Zheng He, we see that a classical prediction would state that the Chinese technical superiority would allow them to predominate or to catch up quickly with the west. But what actually ended up happening was that the west innovated around the business model of exploration first, and the attractive monetary incentives led a revolution in technology that profited from the scalable finance model that colonization had created.

Consider the fate of nuclear vs. solar power in that context. Nuclear is far and away more complex technology. The only problem is that might not matter. The innovation that advances on a broad front and permeates society will win out.

By the time the British Empire came into direct conflict with China, it was the English who had developed the use of colonies as markets for their own goods, rather than a source of resources for the use of their own governments or ruling classes. Thus the English could afford conflict with China, because colonization was immediately profitable to those involved, rather than to established players only.

Indeed, this innovation is what made the American revolution the opposite of a disaster for England. Because England had repurposed itself as the workshop of the world, the growth of American power and economic strength helped the British empire to finance itself through trade with America. Britain had innovated away from the old definition of an Empire through mercantilism and trade. The state did not have to directly fund exploration and colonization because it shared the profits with the colonies themselves.

The English democratized economics itself. That was the innovation. It was one China still struggles to match.

So too with solar energy: solar power can afford to compete directly with traditional sources because it brings the benefits of the new technology closer to those who will profit from it. Even when solar was not at cost-parity with traditional fossil fuels (which is no longer true), it was cost effective for those who adopted it, because they saw the benefits personally, and over the long term. The risk of adoption had an appropriate reward.

Unlike with nuclear power or coal, which require long-term up-front investments far from view of those who pay for them, solar is a source of energy consumers and businesses can own themselves. This means they’re increasingly likely to invest in it, and to see less risk in doing so. The technology is thus democratized, and suddenly it can be the basis for knew, previously unimagined products or businesses.

The innovation can be in the business model this makes possible: not always in the technologies that underwrite the growth. Exponential Innovation shifts streams and goes around obstacles, rather than charting a straight line in one area. Thus predictions from the WEO may accurately represent technological limitations, but still fail to predict growth because they are using an outdated economic model.

Is There a Better Way to Predict the Future?

On the one hand, if predicting the future were as easy as a new mental framework, then everyone would be doing it already. Yet on the other, we can avoid making the same wrong predictions over and over by paying attention to what causes an exponential growth cycle in a particular industry or technology.

One of the key takeaways for me from Ramez Naam’s talk was that exponential change occurs primarily where there are multiple axes of advance being explored at once. If one hits a wall, another can cause the technology’s adoption to grow any way. What is inherent in an exponential growth model is that growth never depends on one particular characteristic of a technology, but rather on the overwhelming incentives it creates. People want it to grow, and so it does. That was the fundamental insight of Moore’s Law decades ago. Limitations we recognize as crucial today can become meaningless tomorrow, because the incentive structure for innovation is self-feeding.

Singularity University uses a framework called the 6 “D”s (also used by Ramez Naam), namely: Digitized, Deceptive, Disruptive, Demonetized, Dematerialized, and Democratized. In broad strokes, they argue that an organization or industry becomes exponential when the following conditions occur:

- Advances are based on an already exponentially scaleable platform (ie: computing, or energy generation)

- Advances appear to be insignificant or even slow at first, although capabilities are doubling and redoubling on small scales.

- Advances begin to outperform existing solutions at sub-scale (eg: Solar vs. Coal)

- Cost falls as demand rises.

- Advances become commoditized and ubiquitous.

- The underlying technology becomes commonly achievable and can be applied anywhere.

Given these conditions, a technology may reach an exponential growth curve, and if we recognize a technology that begins to fall into this particular virtuous cycle, we must closely examine whether or not traditional predictive frameworks of the future remain useful.