The StartupYard team has liked Jaromir Dvoracek and Jan Mayer, co-founders of Trendlucid, since the day we all met. Infectiously energetic and passionate about their ideas, the Trendlucid team have also impressed our mentors with their vision for automating e-commerce business intelligence in the near future.

With their roots in data consultancy, Jan and Jaromir have branched out to develop their considerable combined experience by turning it into a tool for e-commerce, that they say will be able to predict the best sellers in any product category, up to two weeks before they reach number one.

I’ll let them tell you about all that, and more, below:

Most of our Startup co-founders are close, but you two often seem like twins. How did you start working together, and form Trendlucid?

Jaromir Dvoracek: Co-Founder of TrendLucid

Jaromir: We worked at the same company for a few years but actually never side by side every day. We’re trying it with the TrendLucid for the first time. And we’re twins definitely, but we’re quite different from each other, too.

TrendLucid lies on the top of our previous work of gathering and selling data for e-commerce price intelligence. It’s a logical next step in solving problems for e-shops. And Jan took this opportunity and crafted it into a side project, which became our main business opportunity.

Jan “Honza” Mayer, Co-Founder and CEO at TrendLucid

Jan: I don’t agree! Twins often look and behave more similarly. Our strength is that we are completely different. I keep track of things and focus on value, Jaromir on the other hand adds sparkle to the ideas and creates the buzz.

In a few words, what is Trendlucid, and what does it do?

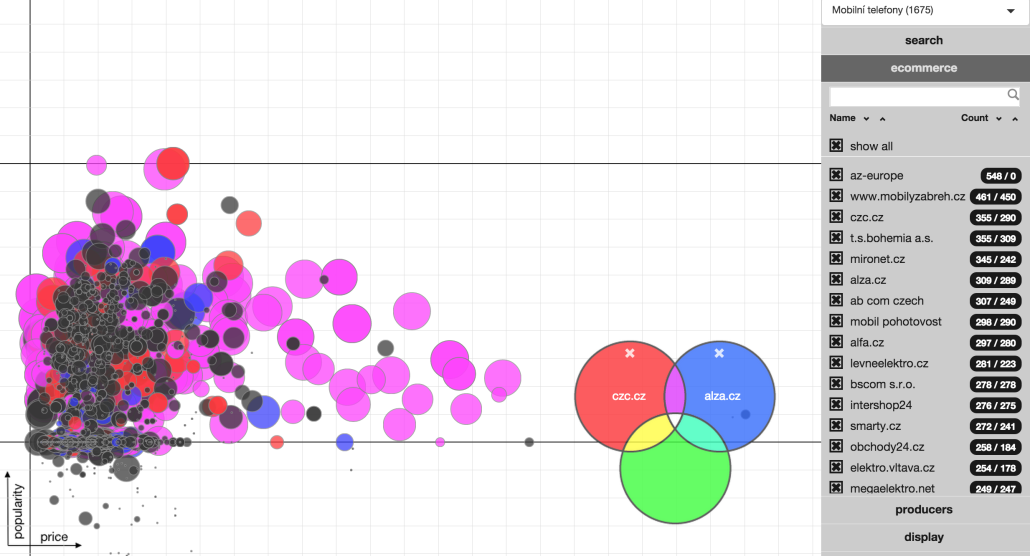

Jaromir: TrendLucid is a visual representation of the market giving you actionable insights about the product.

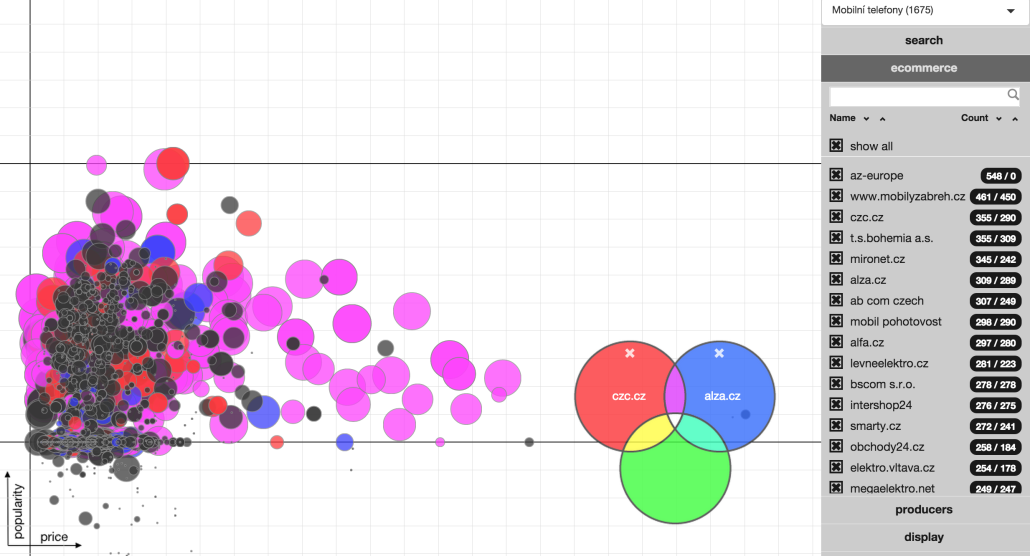

Suppose you’re a purchaser for an e-commerce site, and you need to know what to stock; what will be hot in the next few weeks. With Trendlucid, you can see a snapshot of all the products from a particular category (like smartwatches, or tvs, or washing machines), across the whole market at once. This includes pricing from other e-shops, and review information from as many sources as are available.

You’ll be able to quickly see how you can position yourself against competition in terms of price, but more importantly, which of the items on the market are actually reviewing really well, and being talked about most.

If there’s a winner with some room for a good profit margin, you can see that opportunity instantly. So if you’re using Trendlucid, you’ll be able to ensure that you’re offering the best prices, on the best products available.

What experience in data and e-commerce do you have that informs your work on Trendlucid?

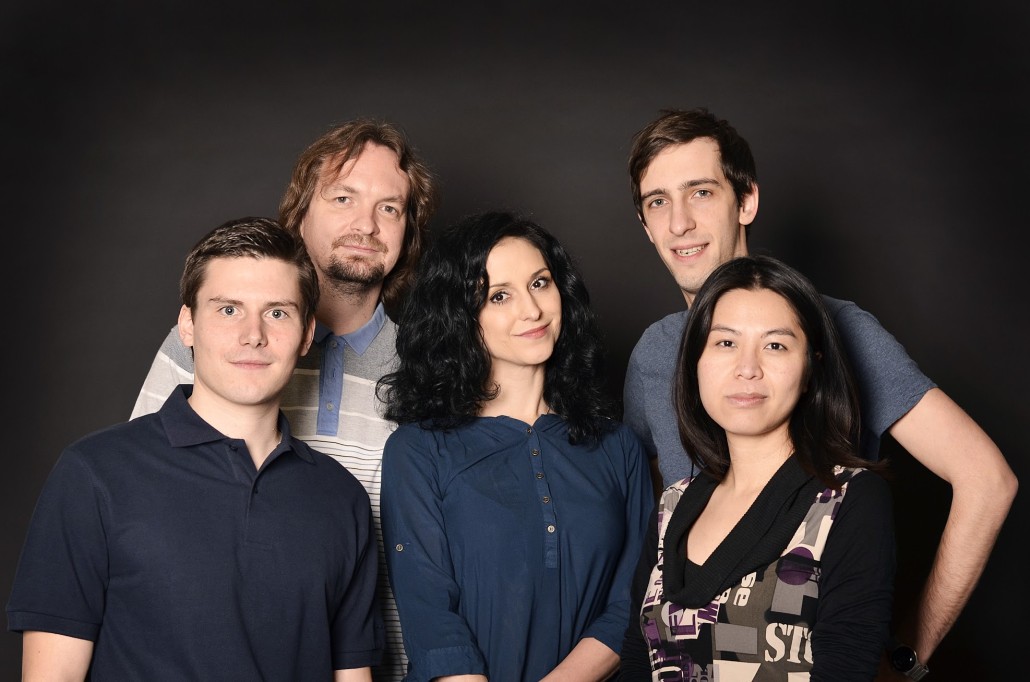

Jan and Jaromir at a StartupYard workshop with our director Cedric Maloux

Jaromir: We started 5 years ago as a consultancy for retailers of consumer electronics, as they need to know the prices of distributors. So we monitored the distributors for their prices and stock counts.

We continued as an e-shop scraping platform – clients sent us the products and we returned the list enriched with prices from competitors.

Today, we’re making that ability to view the market as a single map available as an on-demand tool, with even more market insights included in the graph that we are able to generate.

We’ve made the market something that retailers can explore, rather than something we have to investigate for them individually.

Jan: We had started with mining social media platforms, discussion and forum mentions from the whole Czech internet, and we’d sell that information to partners like Socialbakers.

One day a very “lucid” idea came to us – Why don’t we merge these two data sets to see not only what products people talk about, but what they eventually buy, and how that data correlates?

And the results were pretty interesting. We confirmed that the number of mentions and ratings strongly correlates with total sales of any given product. Moreover, we were able to use our market intelligence tools to determine that a lot of e-shops don’t have enough interesting products in their portfolios. Worse- they don’t know they have a problem!

What can you do that an e-shop or e-commerce company can’t do on its own?

Jan: We actually solve one of the biggest problems for e-shops: having the right products at the right time. If you stock a product that people won’t buy at the price point you anticipate, it’ll cost you a fortune to move the products- you’ll have to cut prices to move the stock, and that eats into your margins. On the other hand, if you can stock products that aren’t popular yet, but will be popular in a few weeks, you’ll be ahead of your competitors. You won’t have to cut your prices to get rid of stock no one wants to buy.

Jaromir: Every successful e-commerce works intensively with data nowadays. TrendLucid enriches and validates internal data from e-shops so purchasing managers and marketers can see if they’re behind the market. Every e-shop has internal data about sales. But they don’t have comprehensive overviews of market data. And that’s what we are fixing. Our vision of TrendLucid is to fully understand what people want to buy and automate purchasing management based on this information.

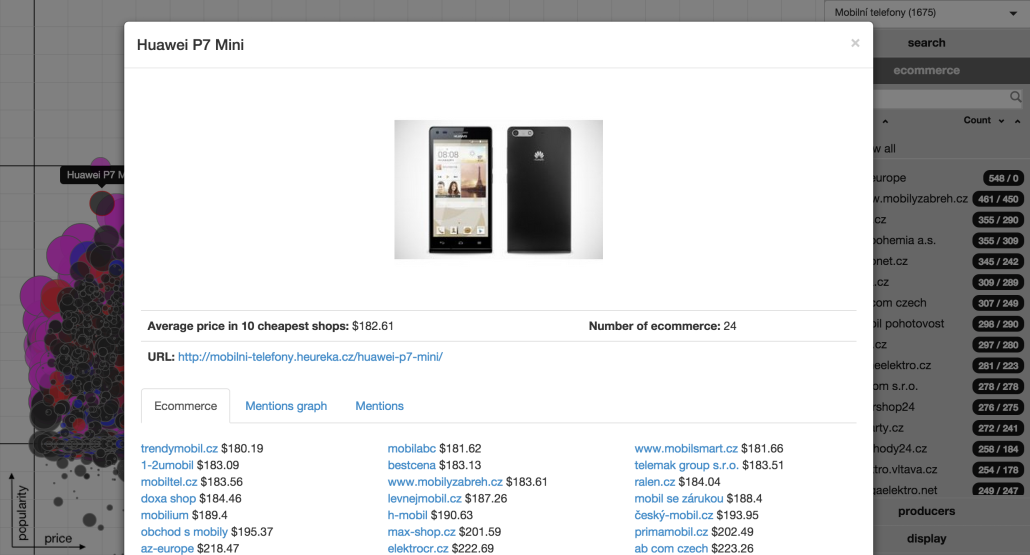

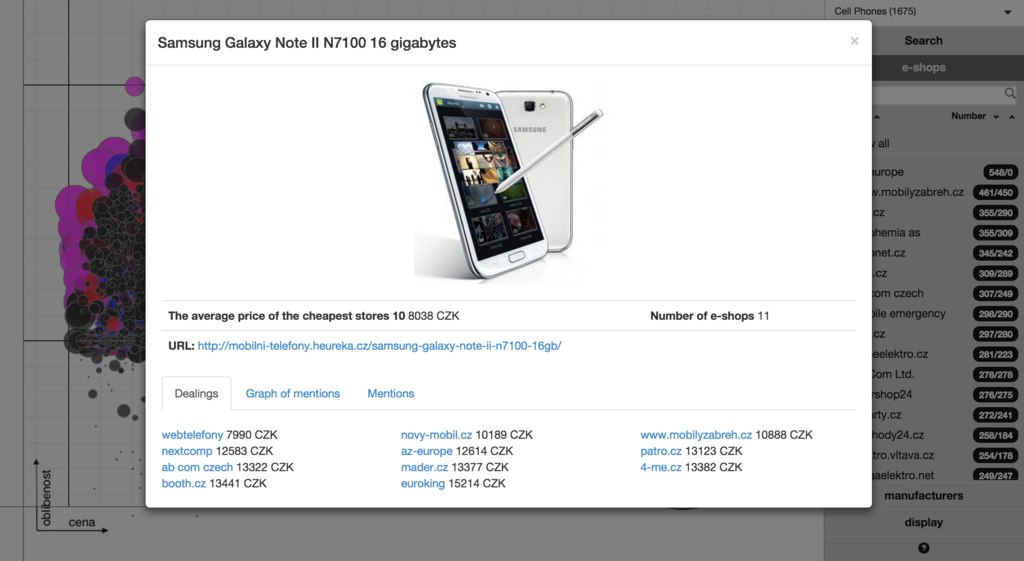

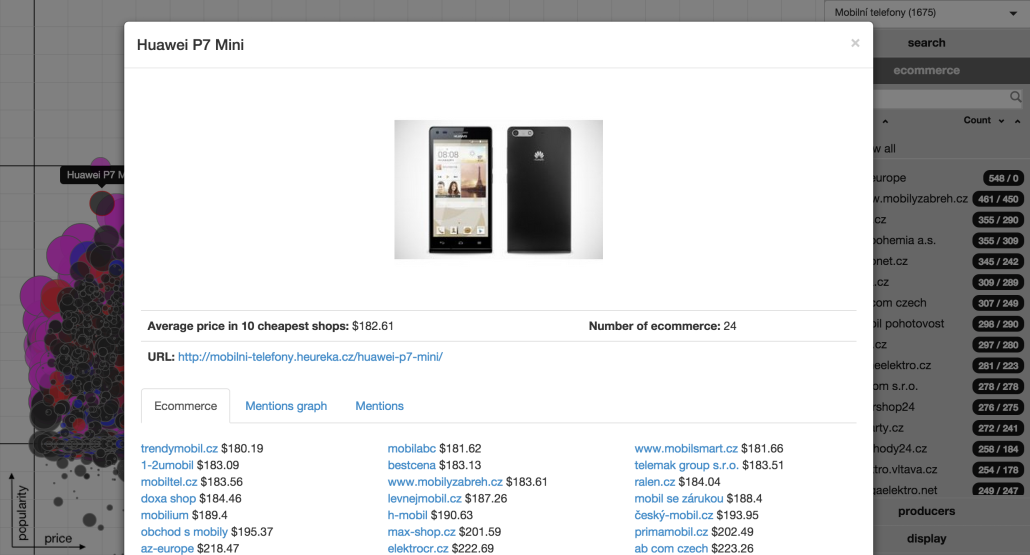

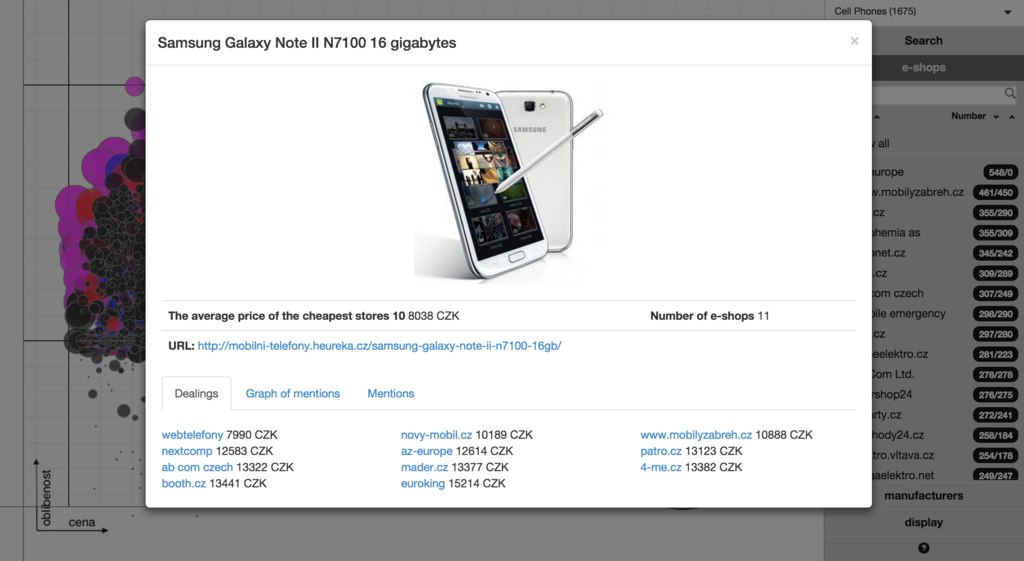

Trendlucid provides a market overview for specific product categories, showing the popularity and prices of products on each market. Users can zoom in to examine specific products and see a market overview for each one.

Through the mentoring process, you got a lot of conflicting advice- lots of big ideas. How did you get to your current vision?

Jaromir: Surprisingly we’ve received only two big contradicting pieces of advices so far. And it was “go big very quickly with a huge investment” vs. “your conservative approach to grow the business makes sense”. Our vision has been refined after hundreds of questions from our mentors at StartupYard. But business strategy was a much more oft-discussed topic.

Jan: We started with very simple idea: “Let’s show to e-shops what products they miss”. But they were so excited they wanted to know more. While we could show them very detailed and clear overviews of the current market, what they really wanted to see was the future- what will sell best 2 weeks from now? That’s a harder questions. We knew that the future of a product and the phase of it’s lifecycle can also be revealed in data, but the mentoring process really helped us to see that those insights were where the real value was for us, as a business.

We thought initially that the most important users of our engine would be purchasing managers for eshops. But one of our mentors, Wallace Green, who has a lot of experience with marketing, showed us the necessity of data to e-commerce marketing. He introduced us to the concept of the “smart marketer” who makes his decisions based on data, not on instinct.

This helped us to see that TrendLucid could also have a future as an insight tool for marketers, as well. As marketing becomes more data focused, there is an ever-increasing need for more granular and precise data on what people are talking about, and how that correlates with their buying decisions.

What will be your initial approach to the market? How will you make your first dollar? Where will you launch the service first?

Trendlucid also provides in-depth pricing data on specific products across a whole market.

Jaromir: We’ve already made our first dollar! We’ve been selling e-commerce data for 5 years now. So in a sense, TrendLucid is simply evolving into something more visible on the market- less a consultancy, and more a product for marketers and e-shop owners. We’ve taken our internal tools for visualizing the market, and made that available to more potential clients to try for themselves.

Jan: As part of making TrendLucid more of a “product,” than just a data consultancy, we contacted czech e-shops and offered to them trials of TrendLucid’s new market mapping software for a month in exchange for their valuable feedback. It’s working nicely so far. We want to follow Dan Hastík’s strategy, which he used with Futurelytics – integration with big e-commerce platforms (like Shopify).

Variations in price can be quite wide on higher margin items.

We also found out that TrendLucid has many valuable metrics for manufacturers. They can measure brand awareness in many ways already. But they’ve not yet been able to measure product awareness for all their products on each market. That’s a game changer. With TrendLucid, they finally can.

Electronics, particularly online, are a generally low-margin business. What makes electronics e-commerce interesting for Trendlucid?

Jan: Social media has become important to understanding how consumers behave, and important in selling to them. And personal electronics have enabled and accelerated this trend as well. Electronics have become an element of personal fashion.

People want to buy a new smartphone every few months now – like new socks. We’ll see that even more with the rise of wearables in the near future. So consequently people talk a lot about electronics on social media and elsewhere. And that makes our insights into the market even more granular and valuable.

Whereas 30 years ago, consumer electronics was divided into just a few categories: personal, appliance, entertainment, they now represent a huge diversity of categories, with more choice than ever before. So purchasing decisions for e-shops become increasingly more difficult, even as margins are dropping.

This market segment has low margins and the fights for market share are pretty bloody. But at the same time, many e-shops miss out on big winners all the time. That’s actually why e-shops need TrendLucid to get ahead.

Jaromir: It’s hard to monitor this market manually. You can’t store all the information you need about phones, tablets and notebooks in your head, much less predict what features and individual products will be most popular. You can watch manually what is popular on the market and what you should try to sell. But no one person can have a complete handle on this market anymore.

It might be easy to pick the next big winner, if you’re comparing two or three competing products. But try it with thousands of washing machines, microwaves and televisions which are not so interesting for most purchasing officers. Try it with the ever-expanding list of wearables that are entering the market- all targeting a different market segment.

The problem with electronics is that the products change so fast. You can predict which type of socks will be popular for a sustained period, because our needs don’t change that fast. But electronics don’t follow these old patterns anymore. Now our needs change too fast for any individual to keep up.

That’s what our first client in Czech Republic found out: we automatically identified the next best selling washing machine 14 days before it happened. Most of the e-shops stock best sellers 6 weeks after they’re already popular. That’s 8 weeks of margins they’re missing because they aren’t using TrendLucid.

What do you see the Trendlucid platform being capable of in a few years? Who will be your customers at that point?

Jaromir: We’ll be able to see trends worldwide. What’s popular on the American market today will be popular in central Europe 4 years later. What’s popular in Germany today will be popular in Slovakia 2 years later. What’s popular in South Korea now will be popular in the US a few months later. With TrendLucid you’ll be able to look back in time to see what you can sell successfully next month. You can prepare for changing market trends based on statistics. You’ll never miss the train again. This kind of information would be critical for big e-commerces, brands even for big retail players. We haven’t gotten to the level of understanding and complexity we need to be able to make those types of global, multi-year projections with real accuracy and speed. Nobody is really there yet, even if they claim to be. But that’s where we want to be.

Jan: Yep, that’s our first target. The second target is brands. We can tell LG, or Samsung, or any big brand with lots of products, which of their products people are talking about, in which countries- and what they’re saying. They’re working on “brand awareness” now. We can give them “product awareness”, which is one level more precise.

Right now we’re like Klout for products on the Czech Market. We’d like to apply that capability globally in the future.

Michael Jackson, a Mangrove Partner, is a celebrated seed investor and former Chief Operating Officer of Skype. In his over 25 year career in telecom, he has worked for, grown or started a dozen businesses.

Michael Jackson, a Mangrove Partner, is a celebrated seed investor and former Chief Operating Officer of Skype. In his over 25 year career in telecom, he has worked for, grown or started a dozen businesses.

I sat down with Ales this week to get more of the TeskaLabs backstory. Here’s what he had to say.

I sat down with Ales this week to get more of the TeskaLabs backstory. Here’s what he had to say.