StartupYard Startups Reflect on Mentoring month

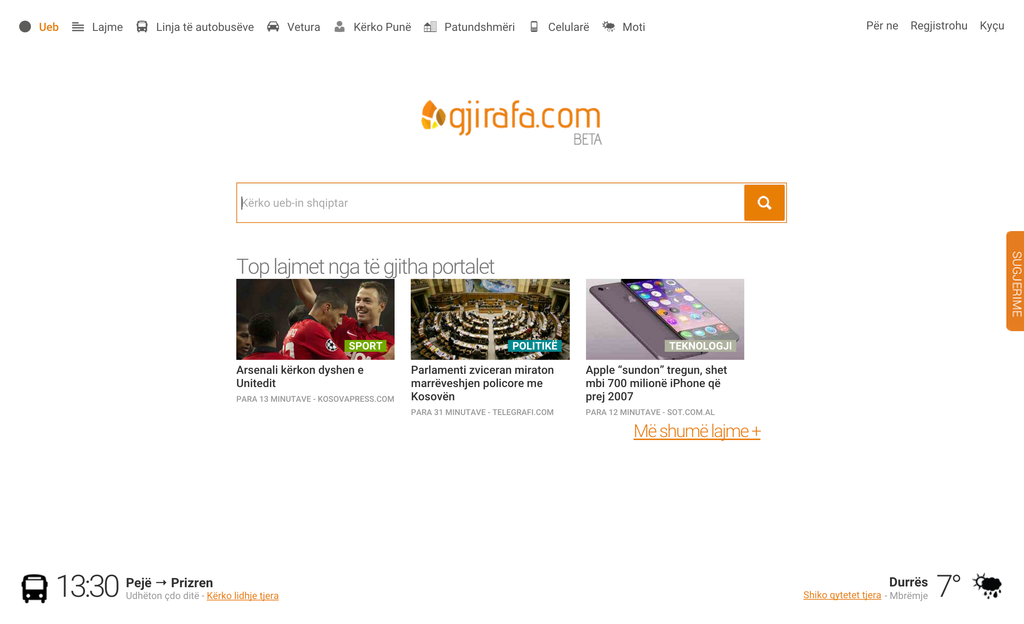

After a month booked solid with meetings between our startups and mentors, StartupYard 2015 participants have now met at least once, and often several times, with over 40 experts from a diverse range of industries.

These meetings are often a blur, so we insist that startup teams document their meetings every day, noting those mentors with whom they have agreed to speak again, or who may have promised new information or connections.

The Value of Mentoring

Mentoring at StartupYard is about more than networking. Of course, the value of networking with our mentors is inestimable. It’s certain for example, that the vast majority of the nearly $3 Million raised by StartupYard participants since 2011 came from connections made through mentors in our program.

But it’s important to keep in mind that our startups earn those investments themselves, by impressing and leveraging the mentors we give them access to. And just as important as money, mentoring sessions are real crash courses in the many hundreds of conversations that a startup is going to experience in its first year or two of operation.

It’s impossible for our startups to absorb and act upon every piece of advice they receive and every connection they make here. That’s sort of the point. On their own, startups in the early stages may find it very difficult to contextualize the various conversations they do have.

Reducing Sampling Error

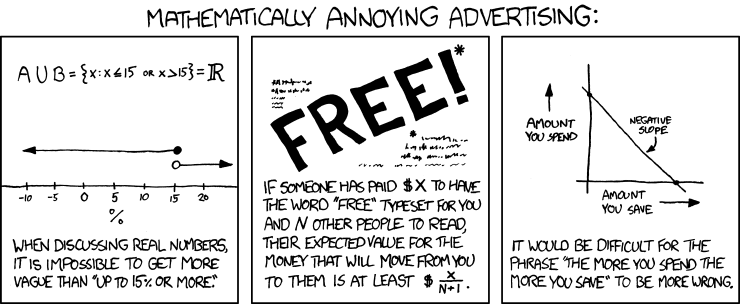

Outside an accelerator, a meeting with an investor or a potential partner may be the only meeting in a week, or a month. That meeting, however it plays out, might fester in the founders’ minds for a long time, causing them to overreact to criticisms, or to become fixated on a specific piece of advice.

That one person you met 6 weeks ago doesn’t like your company name. Or he told you that you’re behind the market. Or she told you that this market is too hard to break into. Or one of a thousand other things. Or something positive, but vague: “you could be Uber for X.” What to make of that?

If the meeting is with an investor, the founders may go too far, wasting their time and energy thinking about what that person says.

I see this quite often with the startups that I mentor and meet at various conferences. I ask: “have you considered an accelerator?” “Well,” the founder responds, “we’ve been talking to an investor, so we probably don’t need an accelerator.” That might be fine if the investor is serious, and his or her vision lines up perfectly with the startups. But that isn’t always the case.

As often as not, an early investor will delay commitment as long as possible, leading the startup down a path that is interesting for the investor, but not always right for the startup. If things don’t look promising after months of talking, the investor can just walk away- nothing gained, nothing lost. The startup can’t.

Strength in Numbers

That’s a classic case of sampling error, and it works as well when it comes to individual meetings, as it does for ad campaigns and landing pages. You need a lot of data to make anything but a gut decision.

Startups used to get that data the really hard way. They would collect over years of iterating the same mistakes, and going down dead-end roads, with investors, partners, and strategies. But that’s a process few startups can afford to go through, and it leaves a lot of great ideas on the table- dead only because the founders didn’t have the time to try that one last thing that might work.

Accelerators solve that problem, by condensing this string of dead ends, self-doubts, insights (and false insights), and breakthrough meetings into an intense, but survivable period.

Reflections

I polled our current startups with a few questions about their mentoring experiences this past month. Here are the questions, and a selection of the answers from all 7 of our startups:

What’s one piece of feedback you have heard most often from the mentors? How have you responded to this feedback so far?

Cindy Dam, Marketing: TeskaLabs

“We talk about security and protection, assuming that it is obvious what we’re protecting. However, many mentors asked us ‘what are protecting, and from what?’ They were still not convinced when we told them about potential security breaches and hacks.

Now we also mention the possibility for the customers to see reports of security-related events happening on the servers, as a way to back up our claims. Mentor Wallace Green from Cap Gemini gave us that idea and showed us how it could work. Mentors then started to consider and accept our arguments. With those changes, it started making sense as a product that can sell itself, and that’s something we hadn’t considered necessary.”

Elle Sidell, Copywriter: Testomato

“We’ve heard from a lot of mentors that we need to strengthen, or possibly change, our unique value proposition and simplify the way we introduce users to Testomato. These discussions have led our team to change our target group from developers to e-commerce companies.

So we’ve simplified the wording on our website, and provided clearer descriptions about what we offer and how we can help.

We’ve also cut down the amount of emails that we send to different users (i.e. different emails to different roles within each account), and we’ve created a new Application Dashboard to encourage customers to use more features when configuring tests or setting up website monitoring.”

Jaromir Dvoracek, Co-Founder: Trendlucid

“We started with a name that was really similar to another company in the same space. So much so, that some mentors thought we actually were the other company.So we really needed to define our brand.

After a lot of trial and error, and especially the help of mentor Liva Judic, we stumbled on TrendLucid. And that was it! We’re TrendLucid now.

Part of the learning process was discovering that the name didn’t have to be that appealing for the Czech market, which we worried about too much before. The Czech market isn’t the end of our long term plans, and we needed a name that makes sense globally. We have very good feedback for the TrendLucid brand so far. Especially from English native speakers. So it’s working!”

Jan Muller, Co-Founder: BudgetBakers

“A common question was: ‘do you have automatic data input?’ That’s something that is now available in some markets, like the US.

The mentoring process convinced us that this needs to be a main focus in the near future. We have already added an automatic bank statement importing/parsing tool, which reads users’ bank statements and adds them to the budget. We are starting conversations with Czech banks so we can eventually access user data through public APIs. In 2 years, all the European banks will have to make those APIs available, so we need to be ahead of the curve.”

What is the single best piece of advice you have received so far, and why? What did you do about it?

Ales Teska, Founder: TeskaLabs

“If I have to pick only one most valuable piece of advice, it has to be a ‘marketing crash course’ from Jan Habich. He explained how we should introduce our product in our materials. He actually completely reversed our point of view.

It is simple as this: 1) “What is it?” (simple statement), 2) “Is it for me?” 3) “Why should I trust you?”. Our new website follows this and works very well (on test subjects) and all our new marketing communication is built around this.

We now start talking about the pain/experience of our customers and only after that do we go into feature walkthroughs if needed.”

Máthé Zsolt-László, Co-Founder: Shoptsie

“The best advice we have received is that, at the start, we should focus more on customer acquisition to get the critical mass of customers with which we can test our assumptions, and not to bother with the pricing module. Rumen Iliev, Andrej Kiska, and Wallace Green especially advocated this approach.

After we do this, we can test multiple pricing models and choose the most suitable to our customers and also for our business. Also, when we have achieved the growth of our customer base, we can easily create planned marketplaces from which we also can make income.

One another good advice was that in time we should focus on other industries, like digital goods, lifestyle coaches. Advices given by Liva Judic and Daniel Hastik“

Ondra Cervinka, Co-Founder: Myia

“Concentrate on building the user base. If you have big user base, then the business model becomes obvious. We are looking for cases where the owner of Wi-Fi will suggest or require that people install and use Myia.

We plan to add affinity functions that will influence the users to keep using the app.”

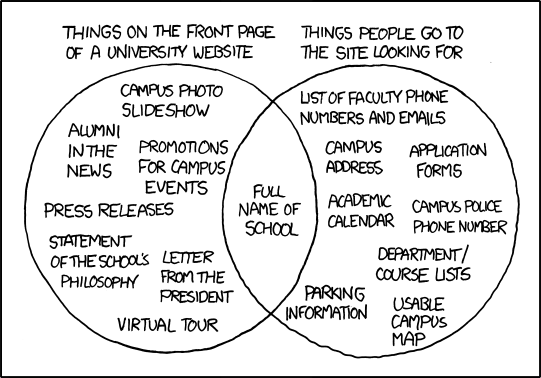

The positioning statement frames that “window into the mind,” by establishing the company’s (and therefore the product’s), place among other products and in the market as a whole. It establishes, in broad terms, how the startup will go from a killer feature, to a product people will buy, to a company that people will trust, so we make sure that our startups spend quite a bit of time hammering out, refining, going over, and rehearsing their position statements, listening to what the mentors say in response, and paying attention also to what they don’t say in response. The objections that mentors raise will be about basic concerns, many of which the startups have not previously considered. Are there legal complications? Do they understand the market well enough? Is the business plan workable? Do the costs make sense? Do they have the right branding? Would the mentor buy from or invest in the company? These are all objections that add value in experience for the startups- they will have to work to answer all of them, and more that they haven’t even begun to think about. Eventually, these problems will begin to find their solutions, and the startups will be able to incorporate the answers into their pitches, their marketing, and their business plans.

The positioning statement frames that “window into the mind,” by establishing the company’s (and therefore the product’s), place among other products and in the market as a whole. It establishes, in broad terms, how the startup will go from a killer feature, to a product people will buy, to a company that people will trust, so we make sure that our startups spend quite a bit of time hammering out, refining, going over, and rehearsing their position statements, listening to what the mentors say in response, and paying attention also to what they don’t say in response. The objections that mentors raise will be about basic concerns, many of which the startups have not previously considered. Are there legal complications? Do they understand the market well enough? Is the business plan workable? Do the costs make sense? Do they have the right branding? Would the mentor buy from or invest in the company? These are all objections that add value in experience for the startups- they will have to work to answer all of them, and more that they haven’t even begun to think about. Eventually, these problems will begin to find their solutions, and the startups will be able to incorporate the answers into their pitches, their marketing, and their business plans.