Introducing Turtle Rover: Your Raspberry Pi for Robotics

In a StartupYard batch full of unusual companies, Turtle Rover, led by CEO Szymon Dzwonczyk, has arguably turned the most heads so far. That’s because everywhere Szymon goes, a little robot follows him. Its name is Turtle, the brainchild of a global award winning robotics team from Wroclaw.

Turtle Rover, is like a Raspberry Pi for mobile robotics ideas. A robust, open-source platform on which makers, product designers, and creatives can build the robot of their dreams. Whether it’s photographing wildlife in South Africa, inspecting industrial pipelines, or performing on-site mobile video surveillance, Turtle can be adapted to almost any conceivable need. Fresh from a successful Kickstarter campaign, Turtle’s next move is an open-source platform where developers and others can share ideas and designs for new components and programs for the machine.

I sat down with Szymon this week to talk about the project, nearly 5 years in the making, and find out why prototyping mobile robots is his way of changing the world for the better.

Hi Szymon, first of all, everybody wants to know about the super cool award-winning robot you’ve designed and built. Can you start by telling us how it works, and how it was created?

Actually my first big robot success was Scorpio from Wrocław University of Technology. The robot was built to take part in University Rover Challenges ran by The Mars Society. As a team, we designed, manufactured and then operated a 50kg remotely controlled rover with a payload specialized for life and geology sciences related to space exploration. It was a prototype on which we could test new technology and the team skills with a real goal of preparing the concepts for future manned exploration of Mars.

Szymon Dzwoncyk, CEO and Co-Founder at Turtle Rover

In 2013 we won 2nd place in the World with Scorpio 3 and in 2014 we were first in European Rover Challenge with a team run by me. We won the challenge designing a robot that gave totally new direction to the topic, we were so ahead of the competing teams all over the World that they needed to raise the requirements of the Challenge in the following years.

The spiritual successor of Scorpio that our customers and mentors are seeing now is called Turtle. The technology is really different, but it comes from the same urge. He’s a little less aggressive, a lot more friendly, and much lighter and more agile. Turtle is built as the culmination of what we learned making Scorpio, and it serves as our base for future development of mobile robotics hardware and software.

Your team is from an academic background. What inspired you to turn to business to make Turtle a reality for consumers and businesses?

Academia is a wonderful environment for experimentation and ideation. However it just lacks the agility and ultimately freedom of business. When you sell something, it really has to work.

It really hurt me and the team that we couldn’t easily check all the ideas and concepts we had came up with for the rover. If you imagine, to change even the simplest interface feature, you needed to convince at least 2 engineers to spend their time and effort for the sake of checking your concept, that most probably won’t work anyway. This is all being funded by someone you have to justify everything to, and you sometimes don’t have that justification. You can’t always just “play,” and find things that work by accident.

After leaving the University I worked in a car brake manufacturing company where I coordinated a process of implementing new products and moving a BMW brake assembly line to China.

Maybe working outside of academia for awhile woke up my mind to the idea that I could take control of my own future, and I could do this on my own terms. That was a liberating realization, and we haven’t looked back! Last year we ran our first successful Kickstarter, which we are now delivering to customers. We sold about 100 rovers, mostly to makers and enthusiasts, but from all kinds of different backgrounds. Each has their own ideas about how to use the technology, and we’re learning a lot from that.

We have so much know-how that we, as a team, gathered during these years of working on the Rovers, that we could never just split ways and forget about it. The idea of allowing people to iterate and prototype with robotics was born then and part of the team reunited with Turtle.

Turtle is much more than a simple rover, isn’t it? Can you describe the ecosystem of products and customers you want to build? How will Turtle enable people to invent new use cases and grow new businesses?

Turtle Rover is a tough, resilient rover chassis that is suited to extreme environments, and is easy to combine with a huge variety of other components, so you can make a Turtle into anything you can imagine, as long as there is hardware and software to support it.

That’s what you can see on our site as a tangible product, but Turtle Rover is a lot more than that. What happens next – after you get it, is the main feature we offer.

We’re here to give you all the support needed during your prototyping process, so literally you don’t need to be a rocket engineer to build your own robotic solution. We’re addressing innovative people all over different industries: agriculture, cleaning, inspection, security, and much more. The idea is to provide you a place to become creative when thinking about concepts with no need of reinventing the basics that normally take the most of the time and effort.

In a way Turtle is like an accelerator for your robot. With Turtle you can do 2 years of prototyping and testing in 2 months, and in 3 months, have a product ready to go into production that works. Imagine how many great ideas are lost in the development process when there is no simple way to test and iterate them.

Turtle as a product provides you a simple plug & play robot capable of working outdoors, but moreover as a community and platform, it provides you access to all the developers and businesses eagerly developing this new techology for their own purposes.

Instead of having a bunch of robot projects all solving the same problems independently, we want to solve these problems collectively, and enable companies and individuals to create advanced functional robots fast and reliably.

You launched a successful KickStarter campaign last year. Can you tell us something about the people who pledged, and even about some of the live use cases you’ve already seen for the rover?

We found great supporters on Kickstarter. We’re really greatful to them for believing in us and our vision.

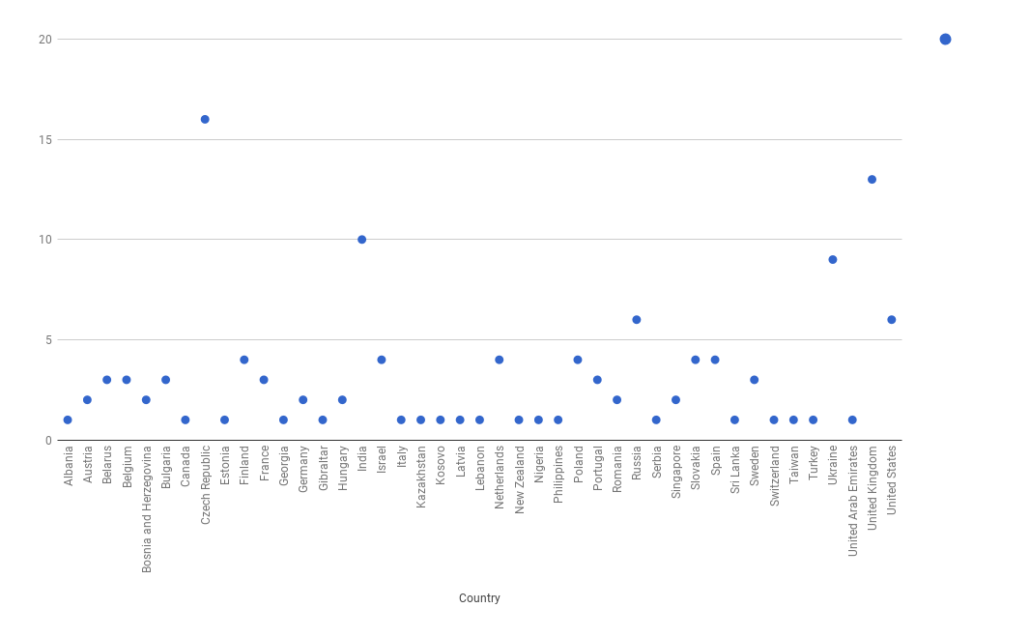

The platform really surprised us with all the help and attention we’ve been given during the crowdfunding campaign. We have 96 backers, mostly individuals who plan to experiment in their own areas: gardening, cave exploration, photography and education.

On top of that we have several universities researchers who ordered the rover. They see the idea of accelerating their work convincing enough that they bought the rovers even from their own wallets. Then, the thing that really shows Turtle is not only about ideas and concepts – a couple of the rovers will be used in businesses: pipeline inspection, wildlife photography in South Africa, or even the European Space Agency research.

The amazing variety of uses surprised us, and helped us realize that we were not just building our own dream, but helping others to build theirs as well.

There are plenty of robots like Turtle on the market today. What makes your core technology unique and special? What can Turtle do that nothing else can?

Turtle is the first affordable robot on the market that allows you, as an individual or even startup, to prototype in your environment. No other platform offers this flexibility and speed, at any price.

Keeping software and hardware open-source is really important to us. The rover is designed to be sturdy, waterproof and to be used in outdoor activities and tough environments. Turtle doesn’t end there though, we address your ideas all the way from concept-proofing, prototyping and getting to the market. And with that, we’re open and transparent so you can rely on us all the time.

Imagine being able to go from the drawing board of a new robot project, right into prototyping without having to look for engineers, without having to solve any of the problems that a mobile robot base requires you to solve. You just get it, and a huge range of modules that can be attached and software to make it work.

Our job is to help our customers create the perfect robot for them. That’s what we love to do, and building a community to help them do that is a big part of our vision.

Tell us more about who Turtle is for, in the near term, and then later on when you have a working platform with a range of add-ons and options. Who will buy it in the future, and how will it be used?

At first we will continue to focus on makers and developers, essential people who will help us designing new add-ons depending on their ideas. We plan to open a marketplace for add-ons giving you the possibility to not only buy the rover, but also buy functionalities of your choice. Robot arms, cameras, sensors, even delivery boxes for example. Anything that can be integrated onto the rover can be an add-on, software or hardware.

Just as smartphones have their appstores, robotics needs marketplaces that are set up with interoperability as a priority, with open source software so that you can plug and play, or dig in and design something custom for yourself.

For makers – we’ll open Turtle to be as 3d-printable as possible, so it will be you, who will be able to manufacture the robot. The ultimate goal is to accelerate the process of implementing robotics in real-life use-cases and business uses, meaning that finally individuals and SMEs won’t need teams of genius engineers to autonomize outdoor tasks in their work. See a need for a robot? Design it, prototype it, and deploy it in no time. No engineers needed.

You mentioned that you want to pursue distributed manufacturing and open source the project. How will this be accomplished? What will Turtle be as a business when most of the manufacturing is open sourced?

Most people see robots as hardware products, but in reality – rovers are more about software and implementation, the actual machine is just the tool that the software uses, the way you program it. So in that sense, we look forward to a future where we don’t have to directly supply the machines, but can focus on maintaining a wide range of interoperable and complimentary add-ons and software packages that enable people to get their robots to actually do things.

This is the thing. Right now robots are “cool,” and like any new technology, they will only be cool, and not really necessary, unless there is an ecosystem in place that makes them an easy and even an obvious choice for implementing new ideas. A robot to perform road maintainance or cleanup, or nature photography, or even farming sounds nice, but it has to be built by somebody, and programmed by somebody.

Those barriers keep these ideas from being tested and adopted more widely. You see that the majority of robotics projects always remain in the testing phase. That’s where we don’t want robots to live anymore. Now they should live in implementation.

It’s the community we build around this technology, who will find the best use cases and customize the robot add-ons for the job to be done. Turtle will act as a provider of the prototyping platform and a marketplace where you, as a developer, will be able to show your work and monetize it in the real use-cases. The distributed manufacturing method will allow us to focus more on the functionalities that matter and not the basics – being the manufacturing and assembly.

That’s the exact mindset we want to show the people within robotics. Stop testing! Start building.

You’re the first pure robotics company to join StartupYard. What led you to that decision, and how has the program lined up with your expectations?

After a successful Kickstarter campaign and Indiegogo sales, we lost focus on what the product is really about.

To be honest, we’ve never had the focus as we didn’t have any experience in business building. Funny enough, we fell victim to the same mentality we are trying to solve with Turtle. Endless tests, endless ideas and prototypes.

We assumed that if it’s us who have the prototyping issue, then most certainly – there’s more us in the world, so in that sense I guess we thought the idea would sell itself. But it did not, as you might have guessed.

But it’s not that easy. We joined StartupYard to gain that business focus and to formulate a real comprehensive vision for what we’re doing. In that respect the move has been a real success for us.

How can people get their hands on the Turtle Rover now? How can developers and idea makers start working on the Turtle Rover platform?

The robot is available on the Turtle Shop, where you can get your rover with a 2-3 month delivery time.

We still need to catch up with the orders from Kickstarter and then will stock up to be able to deploy the robots faster. Developers can meet us on GitHub and, I’m revealing a little secret, will be able to join Turtle Challenges – hackathons that we’ll start in the next months. On top of that, as a developer you’ll be able to get 3D-printed parts and build within the Turtle Community right away with minimal upfront costs.

Our aim in the next year or so is to make getting a rover into anyone’s hands a lot easier, and start to become a real marketplace of ideas for makers and business-minded technologists who have an idea they haven’t been able to prototype yet, because of cost or a lack of the right knowledge and experience.

If you can imagine a use for a tough, sturdy rover with flexible programming and extensibility, then we’ve got just the thing for you.