StartupYard’s 2016 Open Call: Visualized

StartupYard’s 2016 open call has now closed, and we’ve collected over 300 applications to StartupYard.

300 applications represents a 30% increase over the application rate for last year’s program, and a 200% increase over the number of applications for StartupYard 2014, the first cohort which was run by our current Managing Director, Cedric Maloux, and the first time that StartupYard began focusing on startups with global ambitions.

Where are Applications Coming From?

For that 2014 cohort, the vast majority of applications to StartupYard came from the Czech Republic. But over the last two years, as the number of applications have increased, so has the geographic diversity of startups interested in acceleration. As before, the majority of our applicants come from the Czech Republic. Here is a visualization:

Interestingly, last year the Czech Republic and Slovakia represented a supermajority of all applicant countries. This year, the Czech Republic remained the majority, but Slovakia was surpassed by several others, including Russia, Poland, Romania, Italy, and Ukraine, among others. This was a surprise, but highlights the trend towards startups looking outside of their own ecosystems for accelerators and investors alike.

Here are the applicants, without the Czech Republic:

For the first time, StartupYard had applications from Poland, Germany, Belgium, Spain, and France. We also saw applications from as far away as India and Hong Kong, as well as an increase in applicants from the East, including Russia, and Ukraine. Romania continued its trend of increasing applicants: we have taken Romanian startups in both of the previous two cohorts, and we have made three recruiting trips to Romania over the last year.

Which Country has the Biggest Appetite for Acceleration?

As with last year, StartupYard shared an application pool of over 700 startups with CEED Tech, a consortium of 5 accelerators in Central Europe. The syndicate garnered applications from every country in Central Europe and from most countries in Europe. Here is a visualization of the full application pool by country of origin:

Here, Slovakia does make a big appearance. Slovakia generated more applications for all the CEED Tech accelerators than any other country. But whereas last year, Slovak startups applying to StartupYard outnumbered all other countries combined, this year, the distribution was much more even.

Poland, Central Europe’s biggest country, did not account for many applications. Still, this is the first year that we have ever received applications from Poland at all. Our two trips to Poland this year to promote StartupYard supported the idea that the Polish ecosystem is somewhat insular, and startups in Poland are less likely to seek investment and acceleration elsewhere.

This is not necessarily surprising: Poland’s size as a market gives startups more local opportunities, and fewer reasons to launch startups globally, whereas smaller market startups like Estonia, the Czech Republic, and Slovakia are forced to be globally minded, because their home markets won’t support sustained growth.

What are Startups Interested In?

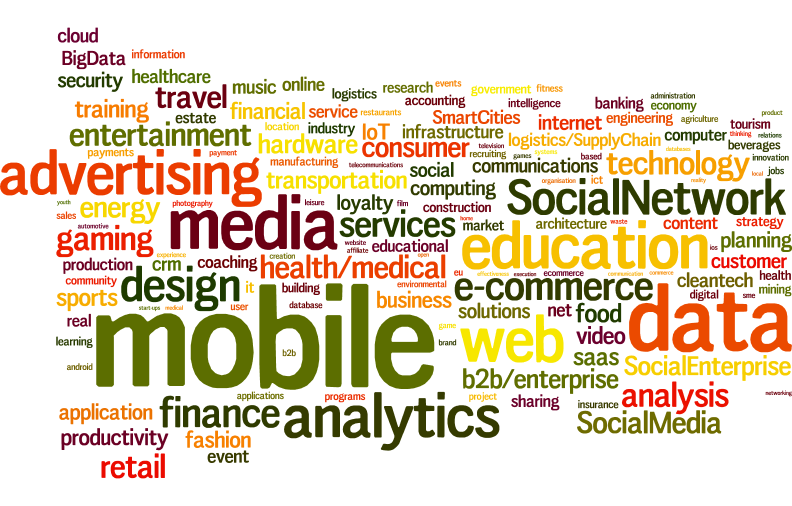

Our applications included a set of keywords for each startup, which represent their areas of interest generally. Here is a visualization of those keywords:

Mobile, data, education, media, and analytics make big impressions in this graphic. There is sustained interest among startups in pushing more use cases for mobile apps and smartphones, and this includes another big keyword: advertising.

While StartupYard doesn’t consider startups that are built on an advertising model (meaning ad-supported business models), we do see many applications for mobile optimization of advertising and marketing processes. As pressure has grown on media and communication companies to monetize their mobile users, ad-tech has become of increasing interest for startups.

There was also an increase in applications around the fields of health and wellness, as well as medicine, over previous years. We are seeing more startups who are interested in leveraging IOT devices and mobile interfaces to improve health and fitness, and promote wellness generally. While these companies have diverse approaches, they typically are being made possible by the pervasive nature of mobile computing and internet access now available.

Also, somewhat surprisingly to me, we saw a sharp decrease in the number of consumer SaaS products and social platforms coming from startups. Is there a feeling that the booming consumer app market has become saturated over the past few years? Certainly, the number of speculative social networking and dating apps decreased significantly in comparison with previous rounds. We received only a handful of such applications this year.

What Startups are Working On

This is not to say that startups are not still working on platforms and apps. The vast majority are still focusing their development on mobile solutions, but with a noticeably broader set of approaches to different markets. Startups are finding value propositions in supporting an already complex array of platforms and services currently available. Here is a breakdown of the words that appeared most often across all applications:

Clearly social, mobile, and apps remain important topics. But “platforms” now represent the most common piece of jargon for today’s startups. This is not surprising, and it’s a trend we’ve been observing over the past few years as well.

While talk was always about apps a few years ago, as cloud services and consumer access to smartphones and tablets has become nearly universal, startups generally have begun to see themselves as selling something more than software.

When app stores first premiered, the interest was in leveraging the technology that people had in their hands. What could a smartphone do? There were many exciting new applications.

But today, 8 years after the premier of the iPhone, leveraging a smartphone’s hardware is much less of a focus. In order to engage users and continue to provide them with value, startups are focusing on building platforms on which services can be integrated and extended to meet consumer needs continuously. Companies like Uber, AirBnb, WhatsApp, Dropbox and Facebook leverage mobile technology by building connections between people and services, people and information, and people to people. The value of smartphones has become their ubiquity, not their internal computing power.

Gone are the days in which startups thought of getting a million downloads, and serving ads to make money. Today, consumers are looking for a continuous value proposition from mobile products, and are more prepared to try different solutions. As markets have become more crowded, unintegrated one-off products have become less viable. Consumers are less willing to pay just for software, but want a product that will evolve with their own needs.

At What Stage are Startups Applying?

It’s quite difficult to precisely pin down a startup’s stage of development in a written application. Many are great at talking about their ambitions, but have little work actually done. Others have executed a lot of development, but are not very clear on the direction they will take as businesses.

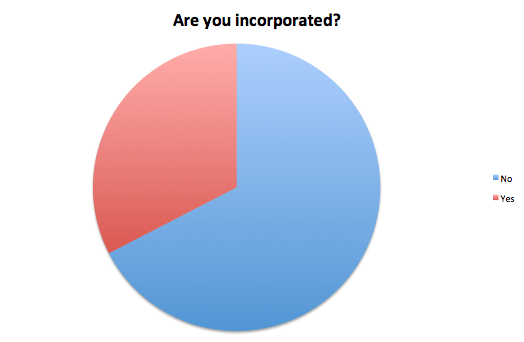

We asked a simple question to try and gauge startups in terms of their general development:

What we found was that the majority of startups applying are not incorporated. This really demonstrates the value that accelerators can bring to young companies.

We don’t generate ideas or inspiration: we accelerate them. We help startups make themselves into real businesses, so it’s not a surprise that many who apply are not yet thinking of themselves as businesses at all. Making the leap from an idea, or a prototype, to a business is one you have to take with a running start- exactly what startups will get with StartupYard.