In our continuing series, we are introducing the StartupYard 2014 teams in individual interviews with their founders and key members at the accelerator. Here we introduce Gjirafa, in the words of CEO and Founder Mergim Cahani, of Kosovo.

Mergim, how would you describe Gjirafa in a few words?

It’s an awesome animal with a long neck :laughs:.

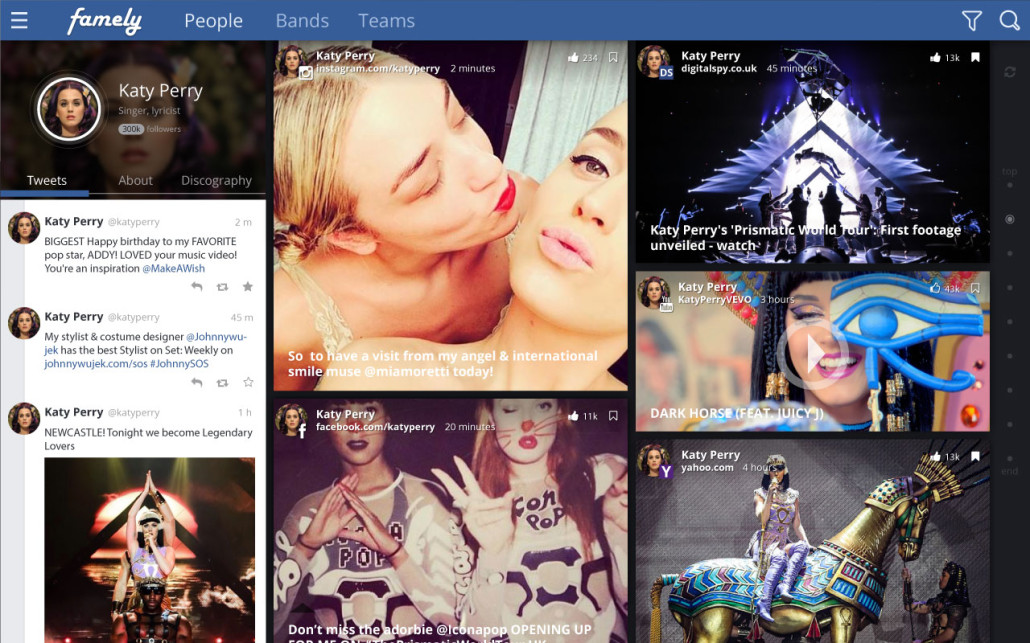

Gjirafa is a full-text web search engine and a news aggregator specialized in the Albanian language. Gjirafa will bring relevant information that will be easy accessible to over 12 million Albanian speaking people worldwide.

So it’s Google For Albanian Speakers. Isn’t That Job Already Taken (by Google)?

You could say the same thing about Seznam or Yandex (the Russian search giant), but they’ve thrived in competition with Google. That’s a great model for us moving forward. Competition between Seznam and Google have brought better results for consumers in the Czech Republic. Google doesn’t own the internet, and it shouldn’t.

And no, we aren’t Google. We have something that Google does not have. Gjirafa has access to local data, understands the market, and has been developing technology for full-text search in Albanian language. That’s something no one else has ever done, including Google.

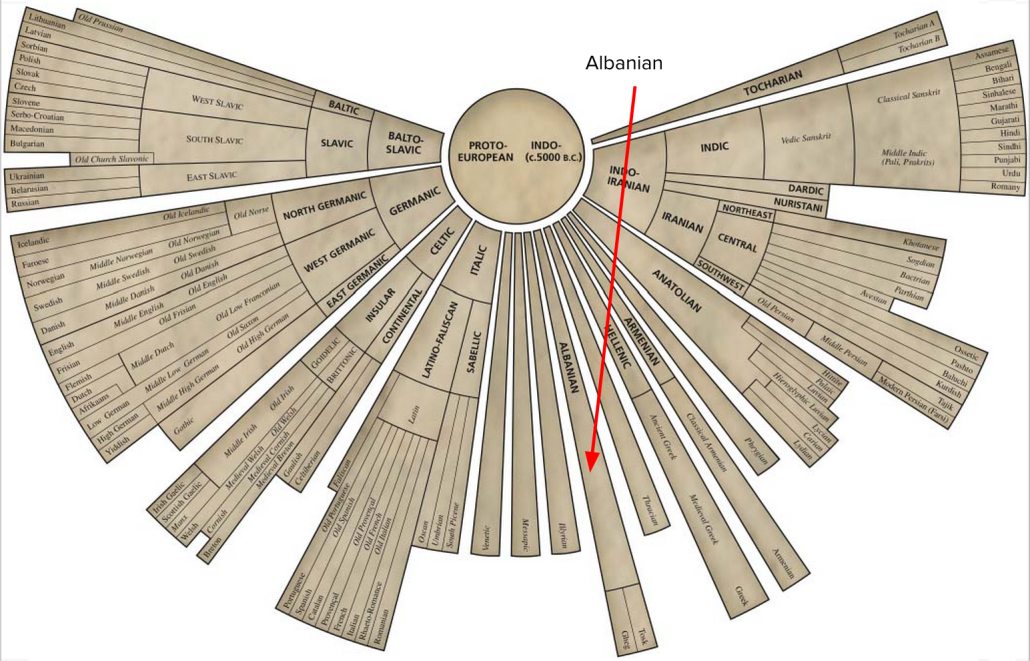

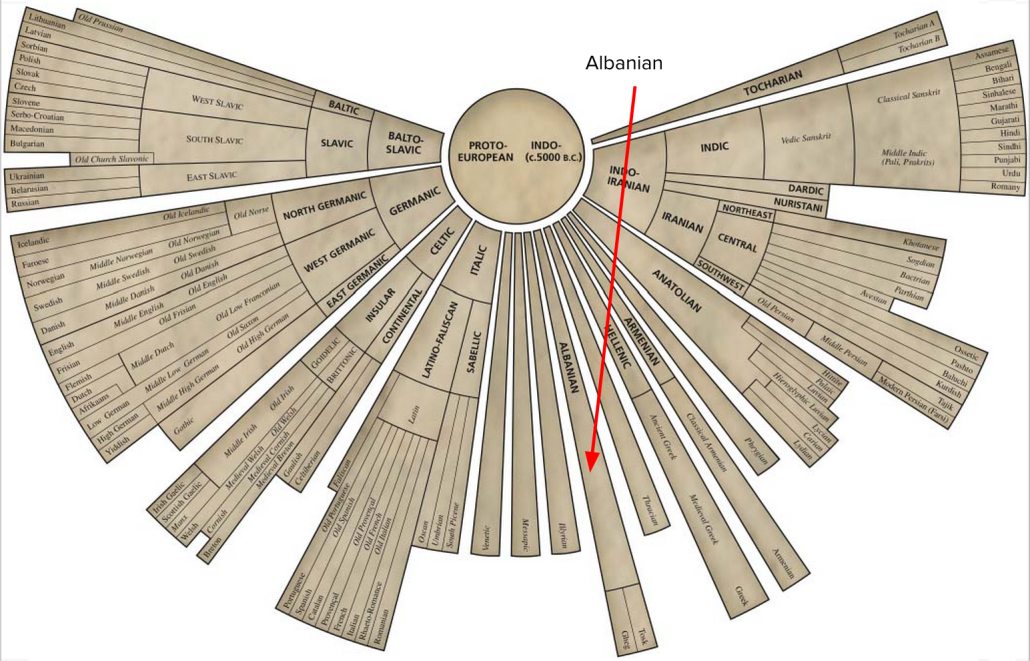

Albanian stands alone as a language with no relatives.

Gjirafa is turning quite a few heads with our mentors at StartupYard. Why do you think that is?

Our team is built to impress, with a very strong business and academic background. Three founders have a combined 30+ years of experience, one previous successful startup, four masters degrees and one PhD. The advisory board features prominent figures in web search and management, Prof. Torsten Suel and Prof. Jay Nathan respectively.

We are very happy to be getting so much positive attention, but important to note is that mentors’ inputs and constructive feedback is shaping our product and company further. From day one at StartupYard our value proposition started to get better and better thanks to mentors’ feedback. The reason why most mentors and investors are interested, we think, is that our project has the prerequisites to make it promising: a strong team, an excellent market potential, and the technology – specifically our differentiating product features.

Mergim Cahani: Founder and CEO of Gjirafa

What brought you to StartupYard? What have been the benefits for you, so far?

I am certain that StartupYard is de facto the best accelerator that our team and project could have picked. In fact it is the only accelerator that we wanted to be part of (within the context of this project). It has just about all the ingredients of other accelerators, including the ones from Silicon Valley, and then some – that directly gives us better opportunities and increases our chances of success.

Mentors, investors, angels and VC’s, involved with StartupYard can more easily comprehend the potential of our project at our targeted market than other investors from other geographic areas. There are great similar success stories in the Czech Republic, and some of these investors are involved directly in those projects (www.seznam.cz is one example). They understand our product, they recognize its potential, and have a clear idea what it takes to reach our goal. This way, they can provide feedback that is so vital to company success, and some have already shown interest to be part of this journey.

Where to start with benefits of StartupYard :laughs: We love Prague, StartupYard at TechSquare has an amazing working environment, great people, a lot of events, and, can’t forget, great Czech beer. As far as accelerating our project growth, we have meet some industry leaders, Chairpersons, CEOs, and investors from world leading corporations, who really helped shape our product and increase our value proposition immensely. Also there are a lot of perks, to mentioned one: we are en route to becoming a BizSpark plus company (that is around $60,000 in azure credit that we were planning to spend). Last but not least, people who run StartupYard know their business- they have a proven track record and experience that was evident from day one.

left: Cedric Maloux, Director Startup Yard. Right: Mergim Cahani, Founder CEO, Gjirafa

What are your near-term goals for Gjirafa? What products and services will be part of the ecosystem at launch?

Our near-term goal is to launch within two months. We are planning to include a few “elect” services at the beginning. That means a full text search, news aggregation, a transport scheduler for Kosovo, Albania and Macedonia, weather widget, and Albanian web facts. All these services are one of a kind, as they currently do not exist anywhere. The obvious exception is text search, where Google is a player, but we think we can do a better job, as we are focused only on one language and one specific segment of the web. That’s worked for Seznam, and we think they’ve shown us the way to success against the Google Goliath.

How about your long term goals?

Our long term goal is to become the front page of the Albanian speaking web. To be synonymous with “Internet” in the Albanian mind. If you speak Albanian, when you open a browser, it will open on www.gjirafa.com. We will provide highly relevant services and ease of access to information that is geographically localized and based on the Albanian language. Gjirafa will be more than just a useful search engine, it will be everywhere for everything. I will not speak to specific services that we plan, but I can tell you that there is a full list on queue that we are prioritizing; each one of them more valuable than the next.

As a sneak peak, enabling e-commerce in Albania and Kosovo, at this moment, tops the list of our long-term goals. Replicating the platform to other Balkan peninsula countries, is also a viable option.

You’ve mentioned developing a unique search engine for the Albanian language. Can you tell us about the development process?

It was fun! :laughs: That may sound extremely nerdy, but I don’t mind. It was really fun.

Working on this from Kosovo was a different experience than the time I spent in the United States; where in my last job I worked in a typical corporate environment. Previous to that I was in Academia, and being able to work full time on a project that I loved, what can I say? It was thrilling.

I turned one bedroom of the house into an office (this startup was luxurious; no office garage)! I used a bit of my prior experience with developing large-scale full search engines, from my Masters program at NYU Poly School of Engineering, and the very valuable help of my mentor Prof. Torsten Suel, to create all the pieces needed for the Gjirafa engine; multi-threaded crawler, indexer, query processor, and a few things in between. I developed a prototype that was not the best out there, but it was good enough and I was happy with the outcome.

The biggest limitations at the beginning were hardware and bandwidth, plus latency, and occasionally an algorithmic problem that kept me up at night. Later, two friends joined me as co-founders, and now we are working on making the engine even bigger and better. One co-founder Ercan Canhasi, PhD, is working on the search engine, while the other co-founder, Diogjen Elshani, MS, is working on the business development side.

Why do you think competitors like Google haven’t focused on Albanian speakers,

Google hasn’t ignored the market completely. I think they’ll regret their absence.

The scalability of Google allows it to fit almost any market given enough data. But there are two problems here (1) currently there is not enough data for the Albanian language on the web, and (2) the Albanian language is one of the most lexically unique language in the world. Google can’t search something it doesn’t have; it can’t index information that currently does not exists on the web. As far as the language goes, Albanian is one of the a few languages that does not derive from another language; it is a branch on its own. Processing a language (intelligently), means some knowledge is needed for that language. Linguistic research in English, and for a lot of other languages, exists. There is almost no linguistic research for Albanian that applies in this context. We are currently researching and developing Albanian grammar and syntax for NLP. We have done the groundbreaking work that will tie Albanian speakers together online, through their language.

Kosovo’s political situation has undoubtedly held back business development in the region. Do you see the situation as improved enough for the region to compete on a level with the rest of Europe?

It is true that the political situation in the region has set back development. But things have started to take a turn, and Kosovo and Albania are becoming emerging markets especially in technology development. Based on our web mining data, the Albanian web is still in the early stages of development, but it has doubled in the past year and it is continuing its growth rapidly. That might sound like not much, considering that the whole size of the web increases at the same rate, but the difference is that the Albanian web has been expanding its core economic value at a much greater rate than the average. It is developing, and that means there are enormous positive gains to be made across a huge range. The rest of Europe will not see its web experience improves by 200% in the next 2 years. Albania and Kosovo will see that kind of improvement. This web infancy is one of the reasons why the market is not penetrated by global companies, which makes it a logical reason why our project represents a great opportunity right now.

What’s your general strategy for marketing Gjirafa? Google has name recognition in search all over Europe. How can you compete with that position?

Our position is with the unique services that we provide for users that Google, and other competition, do not. People need information, and currently can not get it online, and we feel that this market has been left behind – but they will be able to find it on www.gjirafa.com. Also, we will provide a targeted platform for merchants that will enable them to reach their customers. That aspect of the online economy is completely absent in Albania/Kosovo. Can you imagine that? It’s 1999 in online advertising there. Imagine what that means for the future. Our marketing strategy is diverse and a combination of several channels. Without going into specifics, we have a few marketing strategies planned for direct and indirect marketing.

Gjirafa is planning to launch its full text search engine in July of this year.

You can connect with Mergim via Linkedin.

[ssba]